“70-80% of Venture Capitalists Add Negative Value To Startups.” – Vinod Khosla

Vinod Khosla, the eponymous Founder of Silicon Valley VC firm Khosla Ventures, is known for his no-nonsense approach and frank delivery. In a quote that is a decade old but often repeated by himself and others, Khosla affirmed that most Venture Capitalists destroyed value in the companies they invested in. 95% failed to bring any value, he added. The question of whether VCs have a positive impact beyond money on the startups they back has been debated for two decades, as the wave of company-building Venture Capitalists made way to money managers devoid of operational experience. In this post, I examine both sides of the argument, provide concrete examples of VC value add, and share data on this hotly debated question.

In This Article

Who Did Vinod Khosla Target With His VC Value Add Comment?

Retracing the history of the Vinod Khosla quote adds nuance to the sound bite so often repeated in the media.

The opinion, first published in a 2013 Techcrunch article, was given in the context of advice delivered to startups in difficult times. Vinod Khosla fumed against Venture Capitalists who had no prior entrepreneurial or even operational experience but dished copious advice to Founders nonetheless.

“Most VCs haven’t done shit to know what to tell startups going through difficult times.”

Vinod Khosla – Khosla Ventures (Source: Techcrunch)

Refusing to name names, he offered instead that not only do most VCs (“some percentage substantially larger than 95 percent”) don’t add any value, many add negative value—their advice hurts the companies who follow them.

The comment did not infatuate Khosla with his peers. He doubled down on several occasions in the last few years, clarifying his point of view.

In his Stanford GSB address in 2015 (see below), Vinod Khosla put his statement into perspective, contrasting the skills and experiences of VCs today with those who grew the industry in the 1970s, such as Sequoia’s Don Valentine or KP’s Eugene Kleiner and Tom Perkins. “These guys earned the right to advise an entrepreneur,” said Khosla, because they fought the same battles in the trenches.

Vinod Khosla has a point. I made a similar argument in my article explaining why VCs funded social media instead of financing flying cars. With the growth of the VC asset class, troves of glorified money managers lacking operational experience flocked in.

In contrast with the maverick company-builders of old, many of these new VCs are more concerned with what other Investors think, and are unable to make investment decisions from first-principle thinking.

Vinod Khosla is one of the mavericks, which I call “promotion-focused Venture Capitalists.” After making a fortune out of his Sun Microsystems adventure and working many years with Kleiner Perkins, he’s now investing in projects most VCs would not look at due to the extreme odds and long-term view. Read the post below for more analysis on how elite VCs generate superior performance.

Do VCs add value to the startups they invest in?

If you ask most Venture Capitalists, they will tell you they add a lot of value beyond the money.

They help, during and between Board meetings, by:

- Sharing their extensive networks

- Recruiting top talent

- Making acquisitions

- Bringing strategic expertise

Such VC value add justifies the hefty profit share, called carry or carried interest, they charge their Investors (Limited Partners or LPs) on the funds they managed on their behalf. Read the article below for more details on how VCs make money.

Founders have long acknowledged and praised the assistance they received from top VCs—such as John Doerr, Marc Andreessen, Bill Gurley, and Peter Fenton. Part of what makes them great is the value they bring to the table.

How about middle-of-the-range Venture Capitalists, which are far more common?

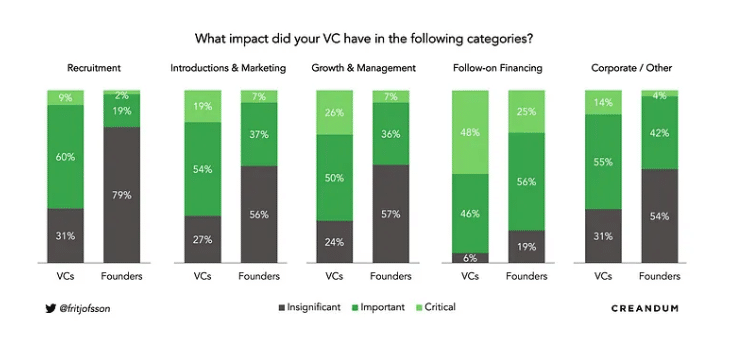

I found several Founders surveys suggesting that VCs overestimate their value add. For example, a study led by three VCs for the Kauffman Foundation found that VCs score their impact 32% higher than entrepreneurs score their own VCs.

When asked where they thought their impact was higher, VCs mentioned recruitment, introductions & marketing, growth & management, and follow-on financing. When the researchers asked Founders the same question, a stark contrast emerged. Founders rated their own VCs much lower on these dimensions, except for the follow-on financing category.

The 2020-2021 wave of crossover funds, led by Tiger Global, taking over a large segment of the Venture Capital market is a testament to how little some Founders think of VC value add.

These players promised money with minimum strings attached, including no Board seat.

Is Vinod Khosla Wrong? How Do Non-Entrepreneurial VCs Perform?

Despite Vinod Khosla’s stance, the notion that entrepreneurs who became VCs perform better is not supported by the data.

A few years ago, I analyzed the background of Forbes’s 2019 Midas List—the top 100 VCs worldwide that year, ranked by the investments they made. The findings did not support the idea that former entrepreneurs make better VCs:

- Only 25% of the top 100 VCs in 2019 had a prior entrepreneurial experience

- A whopping 37% did not have any operational experience at all

These results are backed by other research I mentioned in the article below. In particular, a recent study claimed that VCs who have had successful runs as entrepreneurs perform only marginally better than those without such experience.

Go Further: 7 Steps To Land A Venture Capital Job

Bill Gurley, one of the most visible Venture Capitalists at elite VC firm Benchmark Capital, doesn’t fit Khosla’s description of a former entrepreneur who has gone through the tranches.

Gurley famously has a background in Wall Street, which has undoubtedly helped him bring a long list of tech startups to IPO in recent years. Like 37% of star VCs ranked in Forbes’s 2019 Midas List, Gurley has no operational experience. Has it impacted his ability to create VC value add?

In a recent interview with the 20VC podcast, another VC Hall of Famer, Chris Sacca, describes how he witnessed Bill Gurley add value to Uber, where they were both Board members (listen at 55’15).

Sacca recalls an Uber Board where the need for a CFO sprung up. As he was starting to think about candidates in his network for the job, Gurley took a dossier out of his bag, laid it open on the table, and pulled out the CVs of six vetted CFO candidates who wanted the Uber position.

Conclusion: tl;dr

As the Venture Capital asset class grew over the last two decades, new VCs lacking entrepreneurial expertise flocked to the industry. Can they add value to Founders going through troubled times without having been to the trenches? Vinod Khosla famously answered a resounding “No!”

While I don’t dispute his stance, I offer two arguments to nuance it. First, data shows that entrepreneurs who became VCs outperform only marginally. Second, anecdotal evidence shows that many entrepreneurs lack the empathy required to distinguish what they went through from the situation at hand. They tend to project their own solutions to a problem that often requires fresh thinking.

VC value add is real but, like returns in this asset class, strongly skewed towards a small number of players.