Into the Hell of VC Job Applications

With the allure of big deals, influential networks, and the chance to shape the next big thing, it’s easy to see why Venture Capital careers are coveted. However, as one VC job candidate recently discovered, the path to landing a role in VC can be fraught with unexpected challenges, lengthy processes, and a frustrating lack of transparency. Despite her impressive background and a rigorous preparation process, “Valeria” (not her real name) found herself caught in an endless loop of interviews with little to show for it. Valeria’s experience is far from unique. I trained dozens of VC job applicants over the years, with a few now working at elite VC firms worldwide—but the story of those who fail to break into VC is rarely told. This article dives into the ordeal and explores why applying to VC job listings might be more of a mirage than a real opportunity.

In This Article

Applying to VC Job Postings Is a Waste of Time

The sad reality of the VC job market is twofold: they are few and far between, and way too many people apply. Consequently, applying for open roles on LinkedIn or VC firms’ websites seldom translates into job opportunities.

VC Jobs Are Scarce

The VC industry’s growth over the last decade and a half has not translated into a comparable job increase.

This assertion may seem delirious, as thousands of emerging managers have launched new firms over the last fifteen years. Let’s look at several pieces of data to understand what’s happening in the VC job market.

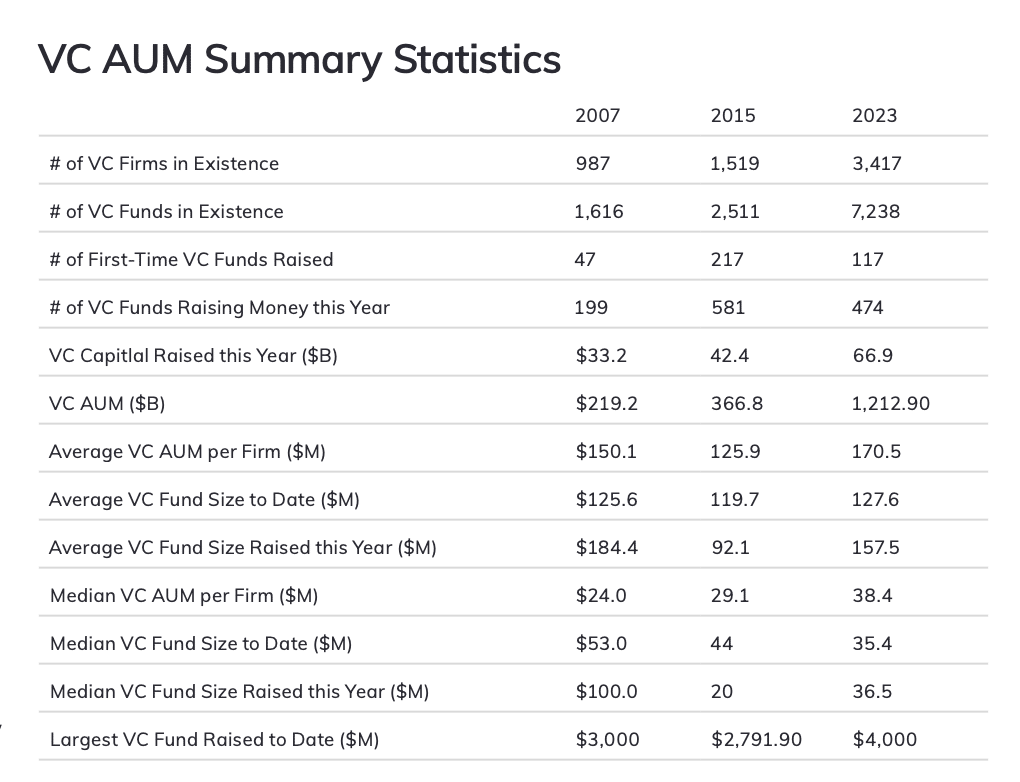

First, while the assets under management (AUM) in Venture capital have grown fivefold in the last fifteen years, the number of active VC firms only grew threefold (see table below). VC firms manage more money on average, but don’t necessarily employ more investment staff. A comparable number of Investors deploy more money per deal.

But how about the new firms, you say?

The problem is that many VC firms are abysmally small and will probably never hire anyone in the investment team beyond the founding partner(s).

Surveys conducted by the US National Venture Capital Association (NVCA) and Deloitte show that, on average, VC firms in the sample employ twenty employees (investment professionals and support roles such as finance and HR). However, the median is seven employees, suggesting that most firms employ just a few people.

Deloitte reported that 39% of their sample of 314 VC firms employed less than five people, while only 21% had more than twenty-one staff. Since only firms where GPs have time and resources participated in the survey, one can safely assume that most VC firms are tiny indeed.

The data confirms the assertion often made that VC firms are typically “top heavy.” They are managed by a few partners who work with limited resources. It’s common to see VC firms that employ a couple of MBA interns and no analysts or associates. Read this article to better understand why VC funds under $100 million have a hard time employing investment professionals.

I couldn’t find recent data on the seniority split of active VC roles. A VC claimed in 2016 that there were 8,000 partners and only 5,000 junior investment professionals among VC professionals registered with the US NVCA. However, I couldn’t verify her claim in the report she referenced.

The 2022 Deloitte report has a 55/45 split in favor of investment partners among their sample, close to the 60/40 ventilation mentioned before.

Let it sink for a moment.

There are more partners in VC than non-partners. It is a notable exception to other similar industries such as consulting (where the typical team structure is one partner, one associate partner, one engagement manager, one associate, and one analyst), private equity (one partner, one director, one associate, one analyst), or investment banking (one managing director, one director, and a dozen junior members).

Venture Capital is one of the only transaction-based asset classes that does not have a pyramidal hierarchical structure.

Too Many People Apply to VC Job Postings

As a result, few VC firms recruit new hires (partners rarely change firms due to vesting on their carry), and when they do, they tend to go for junior roles.

Deloitte reported that only 43% of the firms in their sample seek senior investment professionals for vacant positions, whereas 71% look for junior investment roles. Again, the sample bias may suggest that the first percentage is overestimated.

Anecdotally, I train many more junior VCs than partners in my VC Career Accelerator. Professionals with 15 to 25 years of work experience I train fall into one of three categories:

- Industry expert recruited ahead of new fundraising to “sell the strategy” to LPs, without prior VC experience and who must quickly learn the ropes

- Head of a CVC unit who wants to learn “the VC way”

- Senior executive with a peripheral role (e.g., Investment Committee member) who wants to better understand what the investment arm does and how to interact with them

The problem is, many, many graduating students and young professionals want to break into VC.

While efforts by the likes of John Gannon and Harlem Capital’s Nicole DeTommaso are commendable, so many applicants send in their CVs that it is nearly impossible to get an interview slot. (By the way, check their VC job postings if you decide to apply to a VC job listing after all. Just don’t say I didn’t warn you!).

Most hiring VCs will confirm to anyone who asks that they receive hundreds of applications for every open role they post on LinkedIn or their website. One example is Wischoff Venture’s eponymous Founder, Nichole Wischoff, who xeeted (yes, it’s a thing) that she had received 450 applications for her open associate role and had prioritized candidates who replied to her within 24 hours.

450+ applicants applied for our open Associate role. I have taken the 25 first calls.

Nichole WiSchoff – Wischoff Ventures

GPs are busy people with little time to go through applications. They prioritize candidates with prior VC experience or those with substantial experience with famous startup names.

But even such top 1% profiles are not guaranteed to get the job.

For example, most students of the #1 Finance Master in the world, where I teach the “Advanced Venture Capital” course, have stellar pedigrees, including internships with tier 1 VC firms. They often get into the interview rounds with top firms, and some land VC roles—but many fail and take a job with a lesser-known firm.

Candidates without VC experience looking for entry-level roles stand almost no chance of reaching the interview rounds.

From Hell: A VC Job Candidate’s Testimony

Valeria, the candidate I interviewed for this article, applied at a dozen different VC firms and was invited for interviews in most cases. While she didn’t have prior VC experience, she had a few years under her belt working in the tech team of a prestigious investment bank and was, at the time she applied, the number one employee and chief of staff of a post-seed round startup. (She later changed jobs, but more on it later).

She confirmed that Venture Capital firms are notoriously selective, and the number of available roles is minuscule compared to the pool of eager applicants. “I went through processes in eight firms,” she shared, “and of those, I think maybe one company hired eventually. The rest, they just didn’t recruit anyone.” Valeria felt that with so few positions genuinely available, the odds were stacked against candidates from the start.

Assuming you’re still inclined to apply for a VC job posting, the next obstacle is to prepare for the interview process.

Preparing for VC Job Interviews is Time-Consuming

Applying for VC jobs involves an exhaustive preparation process that includes detailed case studies, financial analysis, and in-depth market research.

VC firms don’t have time to train new hires and will favor those who are ready to hit the road running. After a few initial interviews on motivation and numerical literacy, most VC firms test candidates’ ability to evaluate startups through a case study. There is no winging it; preparation is essential.

Step 1. The Resume

Valeria began her application process by explicitly tailoring her résumé for Venture Capital roles, leveraging her background in banking and startup experience. “I prepared my CV, so it was interesting for venture capital companies. I think with my background, it was not too hard because I worked at a startup before, and I also worked at a bank in M&A.”

She didn’t have to make drastic changes but focused on highlighting the most relevant aspects of her experience. Her CV emphasized her analytical skills, deal experience, and familiarity with startup dynamics—key qualities VCs look for.

She then had to apply to the right firms and VC roles for her experience levels, and at the right moment. Read my thorough guide below for more pro tips on all these aspects.

Go Further: 7 Steps To Land A Venture Capital Job

Step 2. The Application Screening Questions

Valeria’s preparation for VC job applications started long before the first interview. She had to write about three startups she would invest in to make it past the initial screening. Valeria described her preparation: “I spent a lot of time preparing for the startup analysis part. Usually, when you apply, you have to already send a written note about three startups you would invest in, and explain what you like or don’t like about them.”

She used a structured format for these short answers, analyzing financials and team dynamics, which she found manageable, especially with the help she received from the VC Job Accelerator. “You helped us with the overview of the market, the fit, and the team. I always did this pitch analysis with the criteria you usually look for as a VC.”

I advise VC job applicants to use a rigorous structure when they evaluate startups, benchmarking VC screening deal opportunities. Read this article to better understand the criteria used.

Valeria’s efforts paid off, as her well-prepared answers often led to the first interview invitation.

Step 3. The Fit and Behavioral Interviews

As in any other job, fit and behavioral interviews help the hiring Venture Capitalists assess a candidate’s alignment with the VC firm’s culture, values, and work environment, as well as their interpersonal skills and past behavior in various situations.

While HR professionals often conduct these interviews in other companies, few VC firms have a human resource function. The partners themselves conduct these interviews.

Behavioral interviews typically involve questions that prompt candidates to share examples from their past experiences, focusing on how they handled challenges, worked with others, or demonstrated key traits like leadership and adaptability.

Fit interviews, on the other hand, explore whether a candidate’s values, work style, and personality align with the company’s ethos and team dynamics.

To succeed in these interviews, candidates must spend much time reflecting on their past experiences, understanding the company culture, and articulating their motivations and values clearly. Read this detailed guide to prepare best.

Once she moved past the application screening stage, Valeria found the first interviews were often straightforward. “It was often easygoing, they just wanted to know about my background, my interest in the venture capital market, and why I wanted to make a move.”

Step 4. The Case Study

Case studies are a critical component of the VC interview process, designed to test a candidate’s analytical skills, investment judgment, and ability to think like an Investor under pressure.

The format varies widely, from take-home assignments to timed, live analyses requiring on-the-spot thinking.

Valeria encountered both types throughout her interview journey. “Sometimes I got case studies which I needed to prepare at home, which was easy as I used your Startup Analysis Grid.” These take-home case studies allowed her to showcase her understanding of financials, team dynamics, and market positioning without the immediate time constraints of a live setting.

In live case studies, however, the pressure was significantly higher. “I think it was live two times, and they were kind of hard.” Valeria described one particularly challenging scenario with a later-stage VC firm: “I got a big Excel, and I think a pitch deck with 40 pages, and a web document with three pages, and I needed to analyze those things within one hour.” The case was intentionally overwhelming to test her analytical ability and composure under pressure.

Despite the stress, Valeria noted that her case study performances were well-received: “I never had a problem, I always got in the next stage, they always told me the case studies were good.”

Valeria’s experience highlights why I put so much emphasis, during 1-to-1 mentoring sessions of the VC Job Accelerator, on “building the muscle” for VC evaluation.

Over the years, I built a thorough library of resources, including 30+ real-life pitch decks testing every aspect of the assessment VC make before investing.

Head over to the VC Job Accelerator for more details on how to join the program.

Valeria took over 30 interviews (including case studies) with the eight VC firms she applied to. While she didn’t get to the last round at all, she said there were about four or five interviews for each VC role.

Why VC Job Postings May Be Fake

The dirty little secret of VC job hiring is that many VC firms keep their hiring doors open even when they’re not actively looking to fill a role, often driven by performative motives or hopes of future funding that may never materialize.

Valeria’s experience sheds light on several reasons why job openings in Venture Capital can often feel like mirages.

Venture Capitalists Want To Look Busy

During periods when deal flow slows down, some VCs maintain hiring processes to keep busy or to show activity to their senior partners.

“A lot of VCs who are not busy look for people to have a task to do, or even to tell their directors or managing directors, ‘Oh, we interviewed x people.’’ This performative hiring creates an illusion of activity, giving candidates the impression that the firm is expanding or actively seeking new talent, when in reality, they are simply passing time.

The VC Firm Does Not Raise The Fund

A significant driver of these illusory VC job openings is the uncertainty around fundraising. Many VC firms keep positions open in anticipation of closing a new fund, hoping they will soon have the capital to justify new hires.

“They have the application open, so people apply, and they hope they close the next fund.” However, if the fundraising efforts fall through or take longer than expected, these roles often go unfilled.

Valeria frequently encountered this scenario, noting that firms would be “super optimistic” about their fundraising prospects, but in reality, they had not secured the new capital yet: “They were all like, yeah, yeah, we are raising, we are super optimistic—but no one said they had succeeded to raise the fund.”

Moreover, Valeria pointed out that VCs often avoid disclosing these dependencies upfront. “You have to ask the question. They’re not open about their process and will never tell you the fundraising is not going well. Never, never.” This lack of transparency is driven by a desire not to reveal struggles or delays in fundraising, as VC firms want to maintain an image of success and confidence. “I think they didn’t want to let the market know they were struggling. VCs always feel optimistic, claiming that their performance is great. Several managers told me their limited partners already told them they’d get money for sure, but then nothing happened.”

The Hiring VC Has A Specific Profile or Person In Mind But Must Run A Process

Another common issue Valeria faced was that some VC firms seemed to already have a specific candidate profile in mind, but still ran full interview processes for appearances. “For instance, I applied for [Redacted] Capital, and I think all the people who worked there usually worked at McKinsey before.”

These firms often maintain a formal hiring process to demonstrate fairness or to meet diversity expectations. Still, their true intent might be to hire someone who fits a narrowly defined profile. “They often looked for the same people… At one firm, it already seemed before I had the first meeting that the hiring manager wasn’t really interested in interviewing me.”

VC Firms’ Plans Changes—But They Don’t Always Communicate To VC Job Candidates

One of the recurring issues Valeria faced during her Venture Capital job search was the lack of clear communication from VC firms regarding changes to their hiring plans. She was often left in the dark about the actual state of the opportunity she was pursuing.

For instance, Valeria described her experience with a large VC firm that had initially expressed ambitious plans to expand into the country she lives in. “They told me they want to increase the team here. They had only two investment professionals and were looking for more hires. But a few months later, I read that of two people, only one was left, the other one left to the VC firm’s base country.” Despite the firm’s earlier promises to grow, the reality was that they scaled back their plans significantly without informing candidates, creating a false impression of potential opportunities that did not materialize.

Similarly, Valeria encountered firms that indicated a need to hire for more senior roles but ultimately did not follow through. “Two of them told me they decided to hire a more junior profile, but in the end, they didn’t hire anyone. They took an intern, but that’s it, that’s not a hire, you know, it’s an intern.”

Hiring VCs would often tell me I’m through to the next round, then they would ghost me.

Valeria – VC Job candidate

Valeria encountered multiple instances where firms promised quick hiring timelines but then delayed without warning. “They were telling me, ‘We are really fast, we want to get this process done within the next 3-4 weeks,’ and then they don’t come back to you for 10 days, and after 10 days they’re like, ‘oh, you’re in the next stage, let’s get you a meeting in 2-3 weeks, because now we’re busy.’” This happened repeatedly, and sometimes the process would stop without Valeria knowing about it.

In one case, Valeria interacted with a family office that enthusiastically praised her fit for the role during the interview. “They were always over-exaggerating, they were always saying, ‘I can really imagine you working in our team, I think you would be such a good fit,’ and then after 10 days they said, ‘Sorry that we didn’t come back earlier, you’re in the next round, but we still need to hire a VP first before we hire an associate.’” Despite assurances, the position was eventually closed without any further communication, and Valeria never heard from them again. “I never saw the position open anymore,” she recalled.

Tips To Manage The VC Job Hiring Process

The hiring process for VC roles can be grueling. It takes six to nine months for even successful VC job candidates to land a role at a VC firm. With long timelines, vague communication, and intense competition, candidates often feel worn down. Here are a few tips to make sure you don’t drown halfway through the chase.

Have A Hard Stop To Preserve Your Mental Health

For Valeria, coping with the ups and downs of the VC hiring process became a “rational game” that she approached with persistence and a realistic mindset. “I felt like if I had already gotten so far with so many companies, there was a good probability of finally getting a job. I often reached the fifth or sixth interview round,” she explained.

Despite reaching advanced stages in numerous interviews, the repetition of near-misses was frustrating. However, Valeria believed that success was a matter of persistence and probability. “I felt like I was always so, so close. I felt like maybe one time it works out, that this is just a numbers game. If I apply to more and more job postings, it will work out in the end.”

Valeria’s hopes were up; she almost always passed the initial rounds and the case study. “If I always got declined at the beginning, after the case study, I would have probably said, ‘Okay, maybe I need to prepare much more for the case study or maybe I need to do a finance course.’”

However, over time, Valeria had to recognize the emotional toll of the process. “It was really demotivating, so I decided to stop applying if it didn’t work out by the end of the year. And that’s what I did.” Giving herself a defined timeline helped Valeria maintain her motivation while protecting her mental well-being from the prolonged uncertainty of the job search.

Don’t Apply If You Don’t Have Prior VC or Startup Experience

Valeria emphasized that the feasibility of landing a VC role depends, for a large part, on the candidate’s prior experience. “I think it probably depends on what experience the candidate has. Someone who doesn’t have any VC experience, or any startup experience… I don’t know. I think that’s not even possible.”

For those without any direct VC or startup experience, the path is significantly steeper, with few exceptions for those with relevant backgrounds, like M&A. “If somebody has no startup experience and no VC experience, internships might be the only viable entry point, although they are often competitive and underpaid.”

Valeria also highlighted that in the current market conditions, now may not be the ideal time to pursue a career in VC. “People who work in the VC industry told me that it was not a very good environment to apply for jobs” With the downturn in fundraising and many firms scaling back their hiring efforts, the environment is challenging for newcomers.

She recounted speaking with others who had similar experiences, including a startup founder who ultimately gave up on the VC hiring process due to prolonged and fruitless efforts. “I even talked to another guy who founded his own startup. He was in the process and it never worked out. Then he stopped applying because he got so annoyed.”

Warning: Pay Is Low

Even for those who make it through the gauntlet of VC interviews and receive an offer, the compensation may not be what they hoped for. “The salaries were really low… You’re an associate with four or five years of experience, and they propose like 60k,” she mentioned, comparing the offers to what she earned in her first job years ago.

In some cases, internships or entry-level roles offer salaries that are even below unemployment benefits, making the financial proposition of entering VC less attractive. “One firm offered me an internship with a lower pay than my unemployment benefits,” she said, underscoring the stark reality that even landing a coveted role doesn’t always equate to financial success.

I reviewed the total VC compensation structure (salary, bonus, and carried interest) in the US and Europe in the article and webinar below.

Forget VC Job Postings. Here’s The Best Way to Get Into VC

Given the daunting challenges of applying through conventional VC job ads, aspiring VCs should consider alternative routes.

Patiently Build A Mousetrap To Attract VC Job Opportunities

Building a “mousetrap” that puts you top of mind when a VC job opens is a much more effective way than VC job listings to get into VC.

How to do that? There are several parallel tracks: developing a unique skill set, gaining insights that are valuable to VC firms, and creating something that showcases your expertise—a blog, a podcast, or a monthly report analyzing data. You need to demonstrate your value long before a role opens.

Networking and building relationships within the industry can also open doors that aren’t accessible through public job postings. Start networking years in advance by attending industry events, engaging on social media, and finding ways to connect with VCs informally.

The objective is that GPs at your dream VC firm know and remember you, so you’re already on their radar when a firm is ready to hire.

In my ultimate guide on how to land a VC job, I described seven steps to break into VC with this method.

- Step 1. Make The Most Of The Opportunity: Leverage every chance to connect with VCs and make a strong impression.

- Step 2. Know What You Will Do On The Job: Understand the daily tasks and responsibilities of a VC role.

- Step 3. Sell Your Past Experience Adequately: Highlight relevant skills and achievements that align with VC needs.

- Step 4. Build Competencies Needed For A Venture Capital Job: Develop skills like market analysis, financial modeling, and deal sourcing.

- Step 5. Apply At the Right Time: Timing is crucial; apply when firms are actively looking to hire.

- Step 6. Get An Interview For A Venture Capital Job: Use networking and targeted outreach to secure interviews.

- Step 7. Prepare For The Interview(s): Thoroughly prepare for VC interviews with knowledge of the firm and relevant market insights

I’ll offer one last piece of advice for VC job candidates: don’t be open to taking a detour, or even considering other jobs in tech.

Consider Alternative Routes

When asked about the best prior job to break into VC, many Investors say “entrepreneur.” I disagree. The odds of success in entrepreneurship are even lower than getting a VC job, and the pain and suffering are incommensurably higher.

Instead, one effective approach is gaining operational experience at a startup, which can provide the necessary insights and skills that VCs value. An analysis of the careers of early employees at successful startups such as AirBnB, Spotify, Facebook and Palantir showed that they easily transitioned into VC roles. While the money they made may have played a role, a career in tech has many advantages for the job of Venture Capitalist.

I summarized them in this X post, where you can also see the data mentioned above:

VCs love former employees of successful startups.

— Aram Attar (@TheVCFactory) September 17, 2024

1/ Value-add: They went through the 0-100 scale-up and can share knowledge with their younger protégés. + They possess a rich network of tech execs they can tap to hire for the startups they invested in

2/Deal flow: Employees…

Follow my account for more VC-related research and data!

Another route into VC is joining accelerator programs or other initiatives that provide exposure to the VC ecosystem, where you can demonstrate your value in a practical context, better understand what startups stuggle with and how to help them, and build a valuable reference network of Founders who will either introduce you to VCs or act a reference points during the interview process.

Finally, there are other jobs in VC than in the investment team. Venture partners and operating partners provide hands-on operational support for portfolio companies. Andreessen Horowitz exemplifies this approach by employing operating partners who are industry veterans, providing portfolio companies with expertise in scaling, business development, and other strategic areas.

These roles are great alternative routes into VC because they leverage specific operational skills rather than traditional finance backgrounds, offering a direct impact on company growth while providing valuable VC exposure. This makes them ideal for individuals looking to enter the VC space without a conventional Investor track.

What happened to Valeria? She decided to stop her VC job search when she was approached by a promising startup that offered her a compelling opportunity. She felt it was unfair to apply to other roles once they made her a good offer. Valeria was impressed by the company’s rapid growth and numerous validation points, stating, “I never saw a company that grew so much in such a short time.” This new role provided her with a sense of stability and excitement that she hadn’t found in her VC job search, leading her to pivot away from pursuing VC roles.

Conclusion: tl;dr

Breaking into Venture Capital is more challenging than it appears on the surface, and the traditional application process often leads to a dead end. With few roles available, messy and protracted interview processes, and firms that are not always transparent about their hiring intentions, aspiring VCs can find themselves wasting significant time and energy. Even when offers come through, compensation might not meet expectations.

Instead of getting caught in the conventional application trap, consider alternative paths like gaining relevant experience, building a strong network, or joining programs that offer a closer connection to the industry. Ultimately, navigating the path to VC success requires patience, perseverance, and creating opportunities. Not a polished CV sent via LinkedIn.