ESOP & RSU: How Employee Stock Ownership Plans Should Be Implemented

- 1.9K views

- 20 minute read

Employee ownership plans (ESOW) are a cornerstone of motivation and compensation, yet their complexity often presents a significant challenge. Two forms co-exist: Employee Stock Option Plans (ESOP) and Restricted Stock Units (RSU), each with intricate rules governing distribution, taxation, and vesting. I implemented over two dozen plans both as an Investor and advisor over the years, and I share here best practices on crucial parameters that can make or break the effectiveness of equity compensation.

In this post, I offer a foundational overview of ESOP benefits and their pivotal role in employee compensation. I then contrast ESOP with RSU, shedding light on RSU meaning and its implications for both startups and mature companies. A deep dive into ESOP distribution, taxation, and vesting follows. The discussion encompasses best practices for managing ESOP when employees transition out, addressing both good and bad leaver scenarios and their impact on equity plans.

In This Post

Accelerate Your Learning: Watch Our Webinar!

Don’t just read about it, immerse yourself in the content through our companion webinar for this post! Engage with a multimedia presentation, discover all the referenced sources, and have your questions answered live! Click the “Watch Now” button to access the webinar. (Members: click here).

Why ESOP Exist

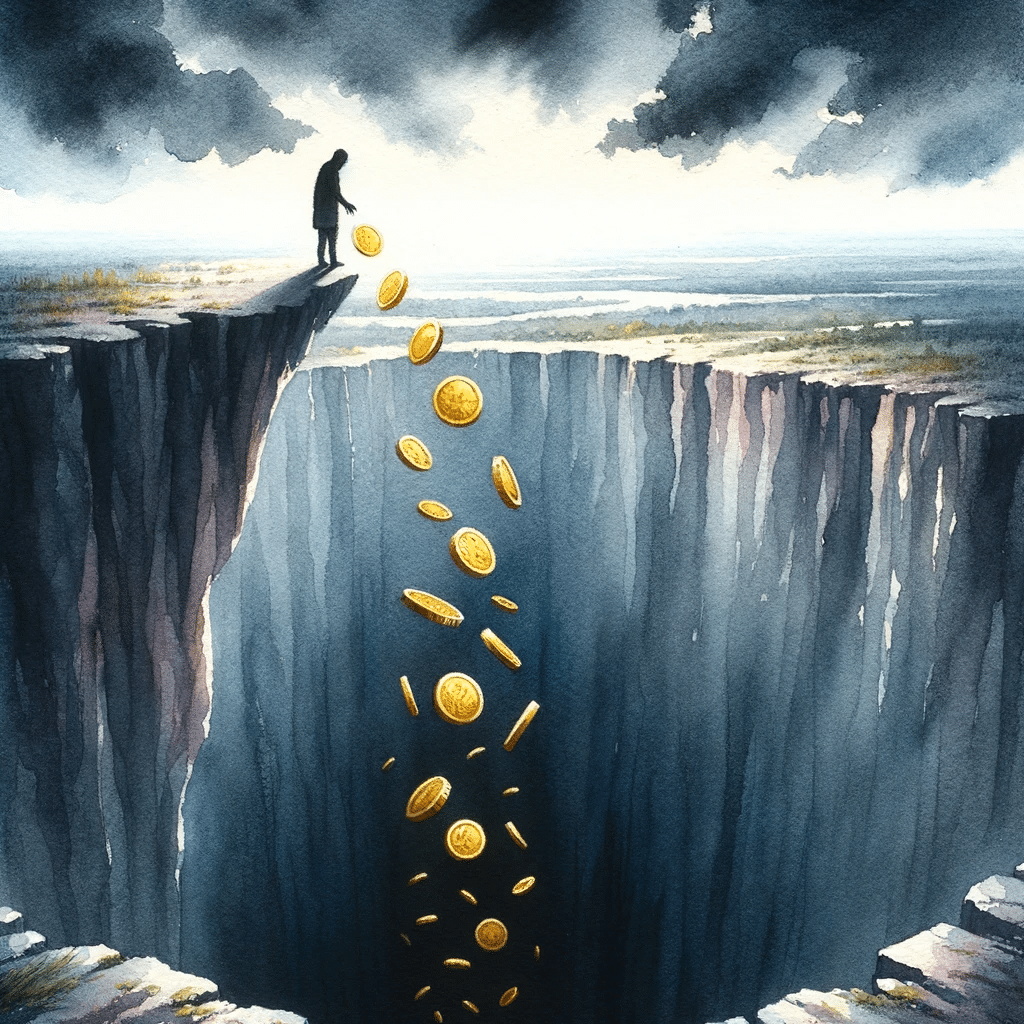

ESOP are strategic tools aligning employee goals with company success. These plans offer a pathway to wealth, drive motivation, and ensure retention.

Attraction - ESOP as a Pathway to Wealth

Employee Stock Ownership Plans allow employees to become shareholders of their company. The allure of ESOP lies in the promise of sharing in future success. Such schemes are particularly attractive in the tech sector, where startups sometimes become behemoths.

ESOP are formidable attractors in the competitive hunt for talent in startups. They represent a potential for significant financial gain, appealing to talented professionals considering roles in startups where base salaries might be lower than in established firms.

At least 2,200 of the 11,000 people who worked at Microsoft headquarters became millionaires. As many as a third of them were worth more than $3 million.

Michael Kwatinetz - Sanford bernstein (Source: New york Times)

For instance, early employees at tech giants like Microsoft reaped substantial rewards from their stock options. While these are extreme examples, the potential for wealth creation is not just theoretical. A series of studies by the National Center for Employee Ownership (NCEO) showed that employee-owners have significantly higher median household wealth than non-employee-owners.

A June 2023 survey of over 100 U.S. "S Corps," a legal entity common for small and medium-sized businesses, reported that employees in these ESOPs experience substantial wealth building. The median ESOP account balance was $80,500, significantly higher than American workers' median savings overall. This not only enhances their financial security but also likely contributes to a more invested and motivated workforce.

While tech startups tend to use C Corp and LLC structures, results are typically similar.

Motivation - Equity Compensation Drives Performance

Beyond financial incentives, ESOPs are instrumental in building a robust company culture. Equity compensation is more than just a number on a paycheck—it's a vote of confidence in the employees, an investment in their potential, and a sign of trust that they are considered integral to the company's future. This fosters a sense of ownership among team members, creating an environment where everyone works toward a common goal: the company's success.

The underlying factors and paradigms behind Employee Stock Ownership Plans and employee incentivization are rooted in several key economic and psychological theories. Here are the main concepts:

- Agency Theory: This theory suggests a natural divergence in interests between company owners (shareholders) and employees (agents). ESOW align these interests by making employees part-owners, thus motivating them to work towards increasing the company's value.

- Human Capital Theory: This posits that investing in employees' skills and knowledge leads to greater productivity. ESOW can be seen as an investment in human capital, as they increase employee commitment and motivation, leading to better performance.

- Behavioral Economics: ESOW tap into several behavioral economics principles. For example, the concept of "loss aversion" suggests people work harder to avoid losing something of value (like stock options) than to gain something of equivalent value.

In essence, ESOW exist not merely as a benefit but as a cornerstone of a strategic partnership between a company and its employees. Their objectives are clear: to drive performance and instill a cohesive culture geared toward shared success.

I wrote on loss aversion, a critical notion in Venture Capital, in the context of VC reinvesting in portfolio companies. This cognitive bias is a potent one in startup investing.

Retention - ESOP Reduce Turnover

Recent studies underscore the significant role of ESOPs in enhancing employee retention. The 2023 NCEO study revealed that ESOP companies experienced voluntary quit rates significantly lower than the national average—approximately one-third. This finding suggests that ESOPs are a potent tool for retaining talent, as employees with a stake in the company are likelier to stay.

These findings align with broader research trends indicating that ESOP contribute to higher job stability and longer tenure, as employees are incentivized to remain with the company due to their financial and psychological ownership. This evidence collectively highlights ESOP as a financial mechanism and an essential strategic approach to foster long-term employee commitment and reduce turnover.

While financial incentives play a significant role in reducing employee turnover, many factors influence retention. Aspects such as company culture, career development opportunities, and work-life balance are pivotal in an employee's decision to stay. As I'll explore later in this blog post, the vesting mechanisms inherent in ESOP and RSU also contribute to retention. Vesting schedules reward long-term commitment, aligning incentives with the company's growth milestones.

Are ESOP for Everyone?

For all the stated benefits of ESOW, Founders and their VCs sometimes overestimate the interest of such incentive plans for some employees. After helping to structure a new plan, I often present it to beneficiaries. I've had big surprises over the years.

For some, the allure of potential future rewards does not offset the present risks associated with equity in a startup or growing company. These employees might prefer more immediate and guaranteed forms of compensation, such as higher salaries or bonuses.

Others may have different plans for their financial investments (such as buying their home) or may not be interested in part-owning their company. Tying a portion of their financial future to the company's success can be daunting for those who prefer more predictable and stable investment avenues.

We also interview to understand if the individual would have an "ownership" mindset. Are they the type of person that would take initiative and accountability?

ESOP Leader - NCEO Survey

Some employees may not find the idea of ownership as a motivating factor in their job satisfaction or career goals. Therefore, while ESOP are a powerful tool for many, they are not a one-size-fits-all solution and should be considered part of a broader, diversified approach to employee compensation and motivation.

Who Pays For The ESOP?

One crucial aspect of implementing an ESOP is determining who bears the cost. Venture Capitalists often advocate for Founders to finance the ESOP and structure their investment to avoid dilution from the future allocation of options.

However, this perspective overlooks ESOP's broader value to all stakeholders, including the VCs. When ESOP successfully drive employee attraction, motivation, and retention, they contribute to value creation, benefiting all shareholders.

Watch the webinar for numerical examples of ESOP dilution (Members: Click here)

I often insist in negotiations that it is more equitable for the cost of the ESOP to be borne by all shareholders, dilution VCs as well as Founders.

ESOP vs. RSU: Key Differences

The terms ESOP (Employee Stock Option Plan) and RSU (Restricted Stock Units) are often used interchangeably but represent distinct forms of equity compensation. It’s more accurate to refer to ESOP under the broader category of ESOW (Employee Stock Ownership Plans), encompassing various types of employee stock ownership. However, except in this section, I'll use ESOP to mean ESOW, which aligns with market practice.

Share Ownership in ESOP and RSU

ESOP: An ESOP grants employees the option to purchase company shares at a predetermined price after a certain period. This form of equity compensation hinges on the company’s performance and the employee’s decision to exercise their option. For example, in a startup experiencing rapid growth, employees with an ESOP can buy shares at a lower, predetermined price, potentially reaping significant gains. However, if the company’s value declines, the ESOP may yield little or no financial benefits due to its dependence on stock price appreciation.

RSU: RSU, in contrast, involves direct share ownership upon vesting. Employees are awarded a specific number of shares they own outright after meeting certain conditions, typically linked to their tenure or performance. RSUs provide a more direct and less conditional ownership path than ESOP. RSU can offer a more secure form of equity compensation for employees in stable or steadily growing companies. However, immediate ownership also exposes employees to the risk of stock value fluctuations, which can impact the perceived value of their compensation.

Taxation of ESOP and RSU

ESOP: One of the most significant advantages of an ESOP is its favorable taxation treatment. Employees are not taxed when the option is granted or even when it vests. Taxation occurs only when the employee exercises the option. In most scenarios, beneficiaries do it just before selling their shares, allowing them to pay the taxes. Employees may benefit from lower capital gains taxes (not income tax) if the shares are held for a longer period. This deferred and potentially lower tax rate is a strategic advantage for employees, especially in high-growth companies where the stock's value can significantly appreciate over time.

The taxation issue is the reason most companies issue options instead of restricted stock.

Fred Wilson - Union Square Ventures (Source: AVC.COM)

RSU: RSU, however, is taxed differently. When RSUs vest, they are considered income and are taxed accordingly. This immediate taxation can lead to a substantial tax burden for the employee, particularly if the vested shares have a high market value. While RSU provides more straightforward ownership, the taxation at the time of vesting can be a drawback, especially if the employee cannot or does not wish to sell some of the shares immediately to cover the tax liability.

Vesting of ESOP and RSU

ESOP: The vesting schedule of an ESOP is typically subject to a "cliff" period (typically one year), after which the options gradually vest over a predetermined timeframe. This structure encourages long-term commitment, as employees must remain with the company for a certain period before they can benefit from the option. The vesting of ESOP is often strategically aligned with the company's growth objectives, incentivizing employees to contribute to long-term success.

RSU: RSU usually comes with a more straightforward vesting schedule. Employees are granted a certain number of shares, which vest over time without the complexities of a cliff period. Once vested, the RSU provides immediate ownership of the shares. This approach can be particularly appealing in more established companies or scenarios where predictable, steady growth is expected. Most RSU have "dual triggers": On top of the time-based trigger, another condition must be met for the units to vest. The second trigger is typically performance-based, depending on a milestone such as an IPO or a sale. Sometimes, a sale restriction (such as a right of first refusal) limits the beneficiary's ability to sell vested shares.

I cover vesting in more detail below, in the context of departure.

Which Firms Should Implement ESOP vs. RSU?

The choice between these two forms of employee ownership is often influenced by the company's stage, growth trajectory, and financial stability.

ESOP in High-Growth and Early-Stage Companies: ESOP is particularly well-suited for early-stage or high-growth companies, where the potential for significant stock appreciation exists. In these environments, ESOP serves as a powerful tool to attract and retain talent who are willing to share the risks and rewards associated with the growth potential of the company. For employees, the attractiveness of ESOP lies in the possibility of purchasing stock at a lower price, which could be worth significantly more in the future as the company grows.

RSU in More Established and Stable Companies: RSU tends to be more appropriate for established companies that have a more predictable and stable growth rate. In these firms, the immediate value and less risky nature of RSU make it an attractive form of compensation. Employees in these companies often prefer the certainty of owning shares upon vesting, as opposed to the potential high-reward but higher-risk nature of ESOP. RSUs are also beneficial for companies that wish to avoid the complexities and administrative burden of managing stock options.

Many companies change incentives plans over time. As they grow, they go from ESOP to RSU. Carta reported that on average, startups switch to RSU after 5.5 years and a post-money valuation of $1 billion.

ESOP Distribution: How To Strategically Allocate Equity

Capital is scarce in a startup that will raise several rounds of funding to get to an exit point. Therefore, the strategic allocation of equity, including ESOP and RSU, is a critical decision. It can significantly impact the company’s ability to attract, motivate, and retain top talent. This section explores the best practices in deciding equity percentages and compares two distinct approaches to equity distribution.

You've reached a Members-only area.

Unlock Full Access

Discover exclusive content curated for Venture Capital professionals and enthusiasts. Join our community and gain unlimited access to in-depth articles, expert guest interviews, MBA-level webinars, and networking opportunities.

Register for our 7-Day Free Trial: Click Here

Already a member? Please Log In Below:

Subscribe to our Newsletter

Join 12,000+ VCs & Founders globally who enjoy our weekly digest on Venture Capital. We keep your information confidential and you can unsubscribe at any time. Sweet!