With close to 900 million users worldwide, of which 40% are active daily, LinkedIn has become the platform of choice for generating business leads. If you're a startup Founder, chances are LinkedIn already helps you get in touch with prospective clients, and you'd like to do the same with Venture Capitalists. If you're aiming at breaking into Venture Capital, you're probably already trying to connect with Investors through LinkedIn.

The problem is, you're not the only one.

People on the right side of the checkbook (i.e., holding the pen) are besieged with so many requests they barely respond anymore. Investors, in particular, are known to dislike LinkedIn messaging. So how are you supposed to get through to them?

There are currently 14,000 connections and followers in my LinkedIn network, of which 4,000+ are listed as Investors. I thought I'd share some best practices I've learned about and implemented over the years to get in touch with them.

Here are four tested steps to use LinkedIn effectively to connect with Investors and meet with them.

In This Post

- Step #1 - Don't Use Linkedin Messaging To Connect With Investors

- Step #2 - Find 15 to 20 Investors Who Are Likely To Invest In Your Startup

- Step #3 - Engage Effectively With Your Target Investors

- Step #4 - Optimize Your LinkedIn Profile for VCs

- Connect With Investors On LinkedIn (And Social Media In General): How Much Work Is Required?

Step #1 - Don't Use Linkedin Messaging To Connect With Investors

Many Angel Investors and Venture Capitalists are vocal about not liking LinkedIn requests and InMail. Early-stage VC firm M8 Ventures even published a Medium post titled "Do VCs Mind You Pitching Them On LinkedIn?"

The answer: Yes, they do mind—a lot.

I don't know anyone in venture who welcomes LinkedIn pitches. There might be some, but I don't know them. (Holla if that's you).

Alan Jones (@bigyahu) - @M8ventures

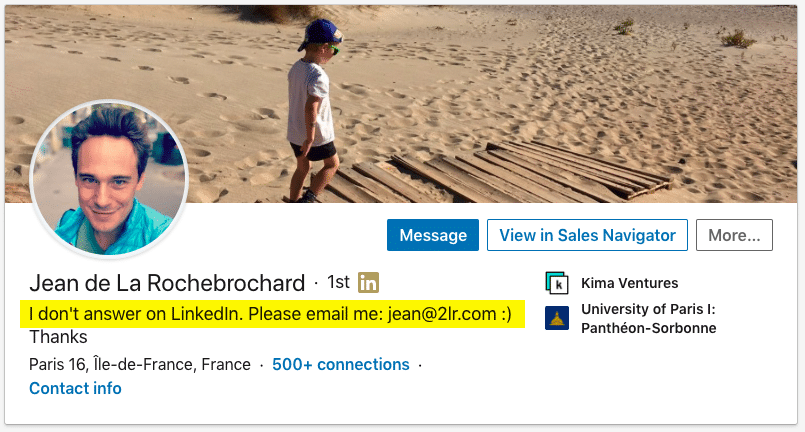

Some VCs mention on their LinkedIn profile that they don't reply to requests there. They usually indicate an email address where founders should send their pitch decks.

Why do so? They probably built an efficient funnel to (dis)qualify deal flow opportunities and want you to enter it through the same end as everyone else.

You're Wasting Your Time

I get at least a dozen LinkedIn requests a week from startup Founders looking for money. I don't invest professionally anymore, highlighting how bad these Founders are at targeting potential Investors. That being said, I try to reply to most of these messages and always ask the entrepreneurs how successful they have been at getting in touch with Investors.

I have yet to hear back from even one account confirming that this method works.

During a talk he gave at Harvard, Flybridge Venture's Jeff Bussgang mentioned that only 1 out of 60 deals they had made came from a cold introduction. (For context, Bussgang's book, Mastering the VC Game, appeared on the AppleTV+ show WeCrashed. Respect). That's a 1.6% hit rate. I know what you'll say: it's not bad, all things considered. Since most Founders send over 500 messages over LinkedIn, they're bound to find at least a sympathetic Investor. Plus, that stat was from ten years ago.

Now consider the following:

- On average, VCs invest in 1% of the opportunities they look at. That means Flybridge looked at 6,000 opportunities over the years to realize 60 deals

- That number is heavily skewed toward warm introductions. Assuming that 80% of their deal flow comes from cold intros, it'd mean that Flybridge received approximately 5,000 opportunities to close just one of them. That's an effective 0.02% hit rate

You can do the maths with different numbers, but the result is the same: trying to connect with an Investor through unsolicited, no-context LinkedIn messaging is like throwing a bottle in a vast ocean. Some potential targets may answer, but most won't.

Are Venture Capitalists horrible people for not answering? I don't think so. Contacting hundreds of people on LinkedIn has become so easy that most Founders have abused the system, and VCs just stopped replying. Some of them will accept the connexion but ghost Founders afterward. Others put a restriction in place that requires you to know their email address before requesting a connexion, which is telling in an industry where network serendipity plays such a role.

Let's face it: LinkedIn messaging has become almost as bad as email spam.

You're Also Hurting Your Mental Health

It doesn't mean that our beloved professional network is the wrong place to meet with Investors, quite the opposite. The issue resides in how LinkedIn is currently being used.

Founders and Aspiring VCs typically use the following methodology to connect with Investors on LinkedIn:

- Run a basic search on terms like "Investor", "Venture Capitalist", or "Angel Investor"

- Send the same message to a few hundred LinkedIn members at a time (due to current limitations)

- Wait for an answer

- Chase up after a week

- Start again at Step 1

As mentioned above, this spray-and-pray strategy rarely produces results—otherwise, you would not be reading this post.

Worse still, it has a debilitating impact on entrepreneurial morale.

I'm writing a doctoral thesis on entrepreneurs' psychological traits, worked with and trained hundreds of them for over a decade. I'm well aware that perseverance is a Founder's superpower.

However, there is something inherently disheartening about having VCs not acknowledging you. After all, replying to Founders raising funds is part of their job description. Entrepreneurs being passed without notice also tend to feel they miss it on the "Gold Rush Bingo" in VC-land.

All this time, energy, and psychological capital devoted to sending umpteen LinkedIn requests to hundreds of unknown Investors would be better spent another way.

In the remainder of this post, I will detail a better method of getting to the desired results: effectively connecting with Investors and getting a meeting with them.

Step #2 - Find 15 to 20 Investors Who Are Likely To Invest In Your Startup

The approach I've been using and recommending to dozens of fundraising Founders who successfully connected with Investors on LinkedIn requires doing more work upfront.

Target The Right Investor For Your Startup

You need to target Angels and VCs actively looking for opportunities in your industry, geography, development stage, and so on. Investors are generally focused on a particular niche of the fundraising market.

To dig this point further, you should watch the webinar "The 3 Reasons Why VCs Will NOT Invest In Your Startup".

Aspiring VCs should also understand it because a VC firm's investment strategy conditions the skills it looks for in candidates.

Make Sure Your Target Investors Are Active on LinkedIn

While most Investors have a LinkedIn profile, not many use it actively.

Foundry Group co-founder and VC legend Brad Feld is one of them. At the time of writing, Feld had over 300,000 LinkedIn followers, which is a lot. But if you read his activity, you'll realize he's almost only "curating": either sharing posts and articles from others, or about his books, or Techstars news.

It would be useless to contact him on LinkedIn or even engage him by commenting on his posts. He doesn't go there often.

It's easy to find out how active the Investor is:

- Go to their activity feed (click on See all activity at the bottom of their Activity section)

- Click on Posts

- Browse the history to see both what they write about and how often they do it

- One other helpful indication is how many followers have liked and commented on the post

A person's LinkedIn activity will teach you much about what they care about and how they interact on the platform: write vs. share vs. comment on other people's posts.

Step #3 - Engage Effectively With Your Target Investors

Now that you've found a group of 15 to 20 active Investors on LinkedIn who may show interest in your startup, you need to make them aware of your existence.

Engaging people on LinkedIn is an art I find not many individuals master. Most people commit one or several of the following mistakes:

- Only hit the Like button (influencers writing posts with many reactions rarely browse who liked them)

- Write "Great post" and not offer more value

- Comment on all the Investor's posts with long messages

- Comment on a few posts, then disappear

To be effective, you need to write posts that are meaningful, engaging, and frequent.

Let's illustrate these points one by one with concrete examples.

Be Meaningful

When you comment on a target investor's post, you must add something to the table. It means you share knowledge or viewpoint relevant to the content the VC is sharing.

It could take the form of an anecdote from your professional life, a quote from a piece of research your startup published, a conference you attended, a YouTube video that illustrates the point, a case study you analyzed in business school, and so on.

Your comment needs to be authentic. Avoid not-so-subtle sales pitches.

The objective is to make you noticed by the author. The acknowledgment could take the form of a Like to your comment, then gradually become a dialogue. In the example below, I replied to a post by Jason Lemkin, a SaaS-focused VC I've long admired. His LinkedIn article tackled startup Founders' need to carefully select their lead investors.

As you can see, my short comment shows that I am competent (I use VC lingo appropriately) and have industry experience (I mention working in private equity).

This comment attracted a Like from the author, which is what I was trying to achieve.

There are several lessons learned from this example:

- Focus on posts with a low number of comments. Authors of LinkedIn posts are anxious to receive comments early, as the algorithm will share them more widely. You're more likely to be noticed if you write one of the first five to ten comments

- Favor posts with many Likes. Don’t forget that other VCs are probably reading these posts, too. Your comment will be shown to them if they interact with the original post. Double Whammy

- Some VCs are more “social-media generous” than others. They like or reply to comments more often, therefore giving you more visibility

- Write in a high-context manner. Your comment will be shown to your networks, who may not have seen the original post you are answering to. Make sure your response can be understood on a stand-alone basis.

A lot of thought goes into a comment to make it meaningful.

Be Engaging

Adding meaningful content to posts written by Venture Capitalists may prove difficult because you may not understand the ins and outs of the topic discussed. Besides, many Investors are often cryptic or write for specialists in their craft.

Don’t shy away from asking a question, formulating a hypothesis, or sharing doubts.

What matters is to keep an open mind, especially if you are not an expert on the issue. In the example below, Nidhi Prabhu replied to Dr. Aniruddha Malpani, a prolific and thought-provoking Angel Investor based in India.

Prabhu's comment caught the author's eye. She was one of the first three individuals to engage him.

Note how framing the comment as a question diffused the tension on what could be a contentious argument.

Be Frequent

You've reached a Members-only area.

Unlock Full Access

Discover exclusive content curated for Venture Capital professionals and enthusiasts. Join our community and gain unlimited access to in-depth articles, expert guest interviews, MBA-level webinars, and networking opportunities.

Register for our 7-Day Free Trial: Click Here

Already a member? Please Log In Below: