Startup Valuation: How Venture Capitalists Value Early-Stage Companies

- 4.1K views

- 17 minute read

Startup valuation, often seen as more art than science—and sometimes even as black magic—is a process fraught with ambiguity. Unlike mature businesses with years of historical data and steady cash flows, early-stage startups often lack substantial track records and have uncertain future prospects. This makes valuation more of an informed speculation rather than a precise calculation, as traditional valuation methodologies often fall short (nobody uses DCF in VC). Venture Capitalists have to rely on a mix of metrics, market trends, intuition, and experience, making the craft of startup valuation a delicate balance between analytical rigor and speculative judgment.

In this post and the companion webinar, I discuss the key dynamics in VC valuation, the two methods VCs use, and the internal, external, and human-related factors impacting startup valuation. I also provide data on the current market's valuation, updated regularly. Having taught startup valuation for years to VC professionals and finance students, I developed a novel method to help them apply these techniques effectively.

In This Article

Accelerate Your Learning: Watch Our Webinar!

Don’t just read about it, immerse yourself in the content through our companion webinar for this post! Engage with a multimedia presentation, discover all the referenced sources, and have your questions answered live! Get a sneak peek with the short extract below, then click the “Watch Now” button to access the webinar.

Key Dynamics in Venture Capital Valuation

Venture Capital valuation is a complex, often subjective process that relies on a multitude of factors. Let's explore some of the crucial dynamics that define this process, from the dualistic approaches of VC investing to the unique rules that govern startup valuation.

Two Approaches: Fundamental-Driven vs. Land Grabbers

Two distinct approaches have prevailed in the last two decades:

- Fundamental-driven VCs focus on performance and market fundamentals, taking into account a startup's potential for profitability, market size, and growth rates. They are meticulous, preferring to invest when they can clearly see a path to substantial returns.

- Land Grabbers, on the other hand, recognize that there will be a limited number of unicorns every year and focus on getting "unicorn real estate", regardless of valuation.

While some VC firms pride themselves on valuation discipline, others point to missing outlier outcomes due to too much emphasis on the price.

The influence of each group over startup Founders fluctuates with market cycles, especially during periods of market bubbles and bursts. Haystack Founder Semil Shah suggested in March 2021, in a frothy VC market, that the dichotomy between fundamental-driven and land-grabbing VCs created a market dislocation. He used different terms, but I believe these ones are clearer.

According to Shah, fundamental-driven Investors are willing to pay a premium, but only within the framework of public and exit comparables. Their aim is to back startups whose unit economics show promising growth.

FOMO around limited real estate for VC ownership in those earliest rounds is very real and warranted.

Semil Shah - Haystack (Source: website)

On the other hand, Land Grabbers are opportunists who quickly adapted to the rapidly evolving startup funding cycle. Tiger Global and other crossover funds exemplify this land-grabbing trend. They view early-stage investments as finite, highly coveted pieces of real estate.

The stakes are high, as they often only get limited chances to secure an ownership stake in a startup. Their approach is less about valuation metrics and more about securing a stake in potentially game-changing companies at the earliest stages. For them, the fear of missing out on the next Snowflake, Zoom, or Airbnb can be a powerful motivator, overriding traditional valuation metrics.

This approach is especially prevalent among billion-dollar funds that require high-value outcomes to significantly impact their portfolio. They need to "move the needle," meaning that only investments returning their fund at least once are worth considering. Read the article below to better understand this fundamental criterion in VC investing.

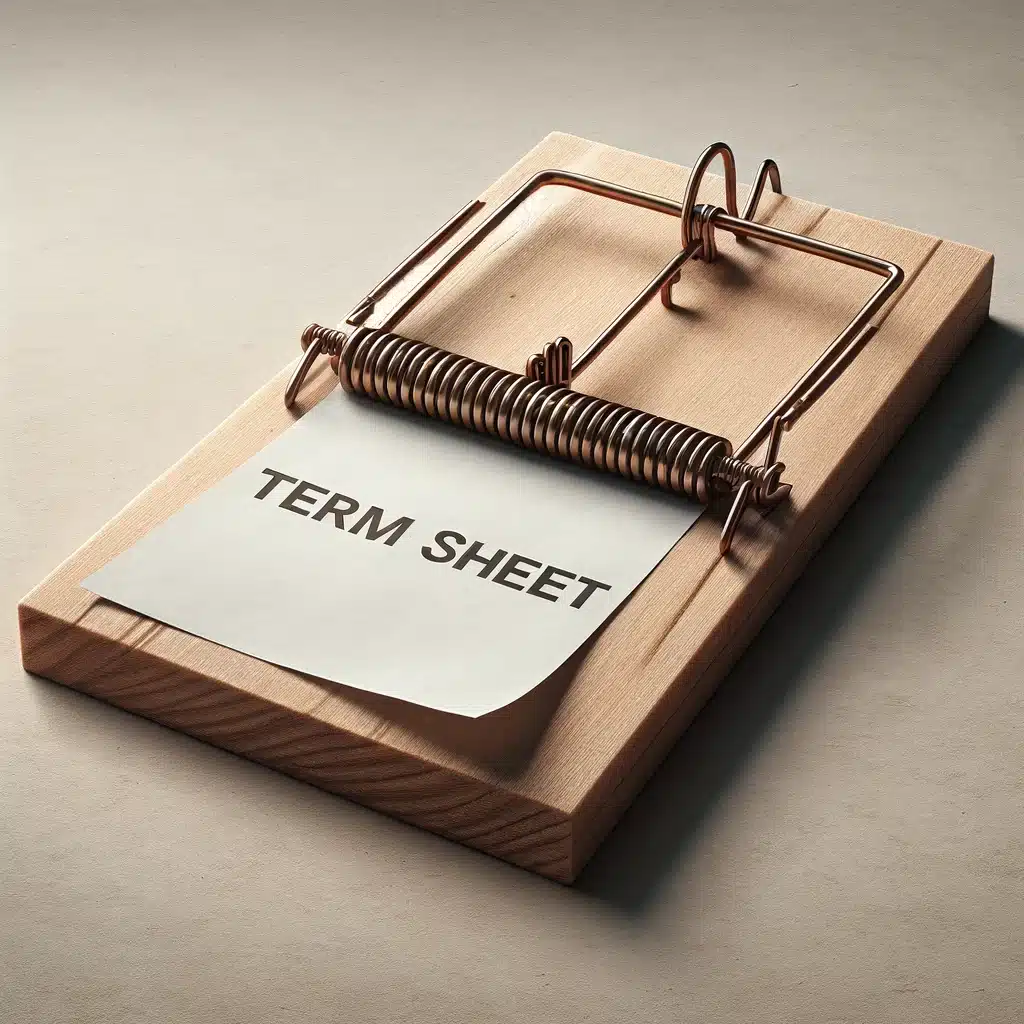

The Only Rule That Matters in Startup Valuation

In traditional investment theory, as popularized by Investors like Oaktree Capital's Howard Marks, the age-old mantra is "Buy Low, Sell High." This strategy is a tried-and-true method for generating alpha in the public markets. It entails holding on to the stock when it made more sense, instead of selling due to "the fear of making mistakes, experiencing regret and looking bad."

However, in Venture Capital, this principle loses relevance due to the power law dynamics and the potential for extraordinary returns. Venture Capitalists invest in startups with the hope of massive growth, which could result in exponential returns. This approach is different from traditional investing because the primary focus is not on buying at a low price, but on identifying potential unicorns that could provide outsized returns.

Valuation is a mental trap.

Peter Fenton - Benchmark (Source: 20VC)

Peter Fenton, a general partner at Benchmark, and an early Investor in huge successes such as Twitter, Yelp, and Elasticsearch, stresses that valuation is just one factor to consider when investing in a startup. The team, the market, and the product are all more important. If a VC firm identifies a startup as a potential winner in its market due to its fundamentals, it should be willing to pay a premium even if the valuation seems high.

The high risk, high return rule is a better guiding principle in Venture Capital than buy low, sell high. Startups, particularly in their early stages, are highly risky ventures. They operate in uncertain markets, often with unproven business models, untested products, and inexperienced teams. They may face stiff competition, regulatory challenges, or technical hurdles. Many of them fail. Even the best VC firms have failure rates as high as 50%.

However, the potential returns on successful startups can be extraordinary. When a startup succeeds, it can generate returns many multiples higher than the initial investment. These "home run" investments can more than compensate for the many losses in a VC's portfolio. For instance, a single successful investment in a company like Facebook, Uber, or Airbnb can cover the losses from numerous failed investments and still provide a substantial overall return to the VC fund.

I’m often wrong. But when I’m right, I’m f*cking right.

CHRIS SACCA – LOWERCARBON CAPITAL (read more here)

This potential for outsized returns in the face of high risk is what makes the Venture Capital asset class appealing to certain types of investors. These investors, typically institutional ones like endowments and pension funds, or high net worth individuals, are willing to accept the high risk associated with Venture Capital investing because of the chance of achieving high returns.

Read the article below for more data on the power law and an analysis of how elite VCs like Chris Sacca drive outlier returns fund after fund.

State of The Startup Valuation Market (Update: June 2024)

I regularly update this section with fresh data, as valuation cycles change rapidly in VC. I keep historical numbers below to provide some background.

Startup Valuation Market for Q1 2024

The startup valuation landscape has undergone significant shifts in 2023 and 2024, driven by a confluence of market dynamics, investor sentiment, and economic factors. After a tumultuous period marked by dramatic declines, valuations have shown signs of recovery and stabilization, albeit with varying impacts across different funding stages.

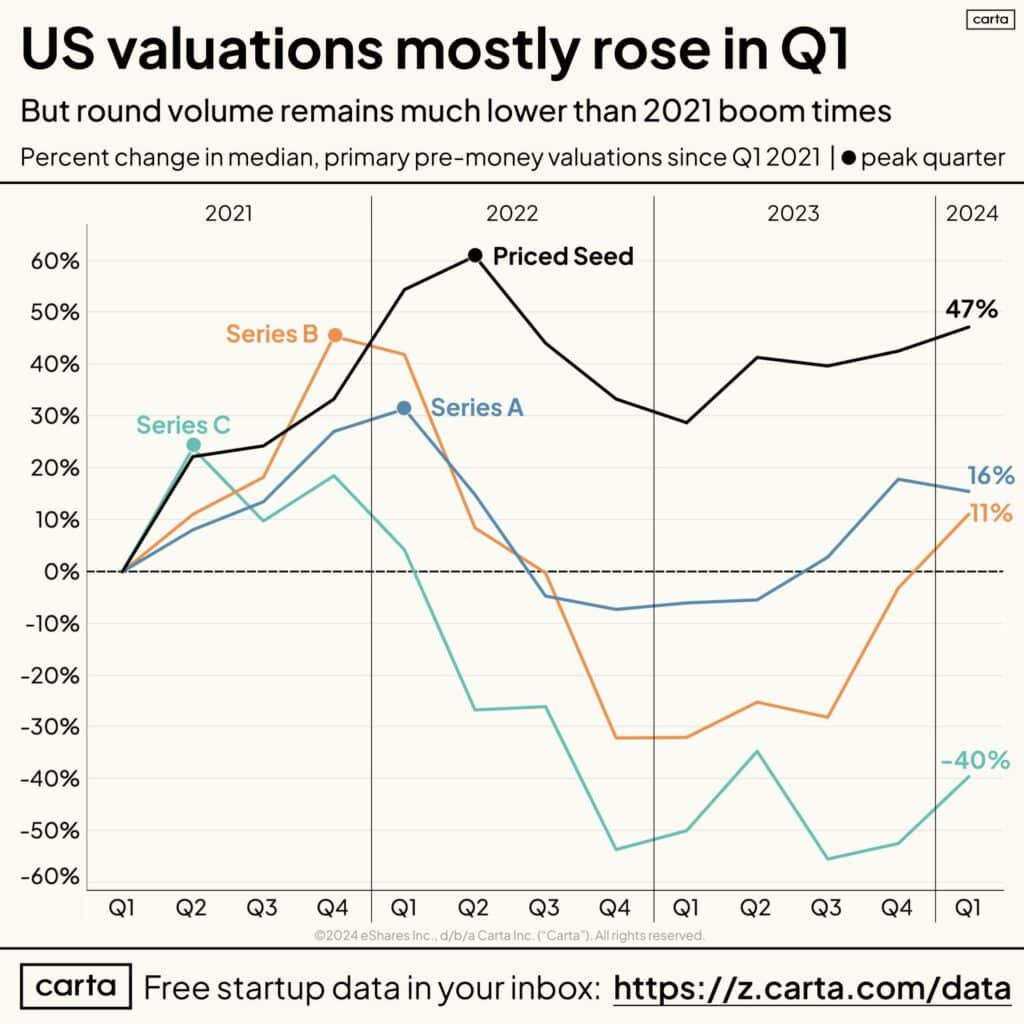

All funding stages except Series C are up compared to their Q1 2021 levels. (Source: Carta)

Data from Carta shows that Priced Seed (excluding SAFEs), Series A, and Series B valuations have exceeded their respective levels in Q1 2021, but remain significantly below their 2021 peak (2022 for seed, which always shows a lag as it's further removed from exit valuations).

Median valuations for Series C remained well below 2021.

Here's a round-by-round analysis based on Carta's data. As it seems skewed towards “VC super users”—companies raising lots of equity—it’s worth recouping with other sources.

Seed Valuations

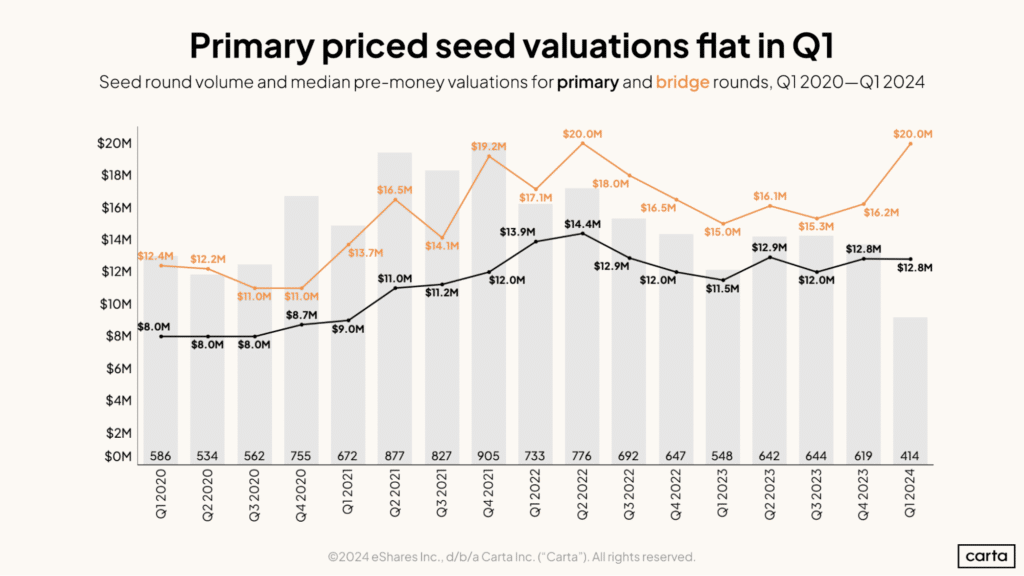

At the seed stage, while the median pre-money valuation remained flat in Q1 2024 vs. Q4 2023 at $13 million (people remember round numbers better), the deal count plummeted by over 30% compared to the average in 2023. This indicates that fewer startups are receiving funding, but those that do are maintaining strong valuations. The typical "flight-to-quality" scenario is frequent in market rebounds.

The trend towards bridge rounds at this stage is significant, with 40%+ of all seed-stage deals being bridge rounds. These valuations do not always reflect market valuations because other considerations are at play, which explains why Carta isolated the data.

It is also worth noting that priced rounds occur much less than SAFEs at seed under $2 million.

Series A Valuations

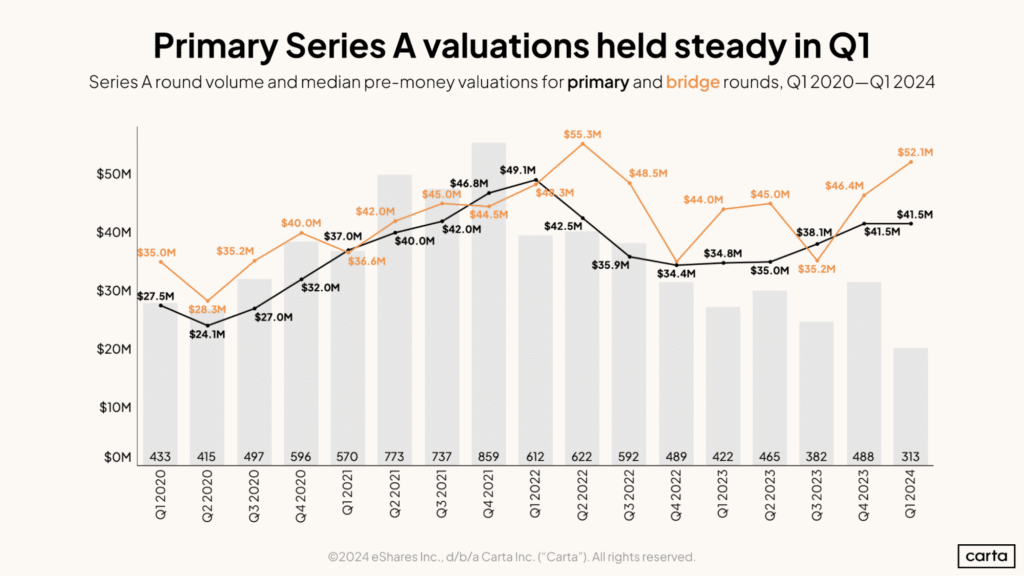

Series A valuations have held steady in Q1 2024 compared to Q4 2023 at $40 million, but also report a sharp drop in the number of investments (-35%). Additionally, bridge rounds at Series A saw significant increases, with the median valuation reaching $50 million.

The Series A data reflects a more selective investment environment where only startups with strong fundamentals and growth potential are securing funding. The transition from Seed to Series A funding has become notably more challenging in recent years.

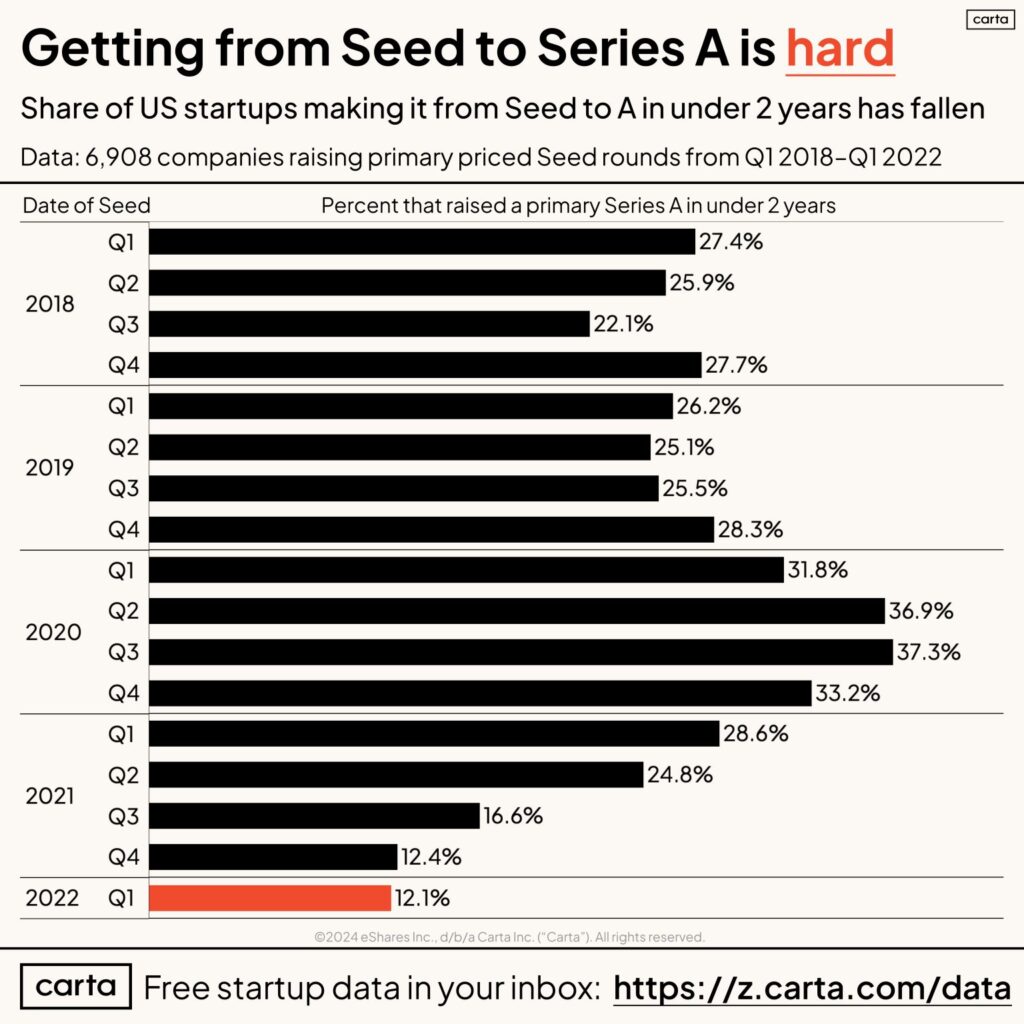

The "graduation rate," or the percentage of startups that advance from Seed to Series A within two years, has seen significant fluctuations. During the boom period of 2020, over a third of startups raising seed rounds successfully completed a Series A round. This was driven by a favorable funding environment and aggressive investment strategies.

The end of excesses and taking longer to raise the A? (Source: Peter Walker)

However, with changing economic conditions and rising interest rates, the rate has dramatically declined. For startups that raised seed rounds in Q1 2022, only 12 % secured Series A funding within two years, marking a substantial drop below the historical average.

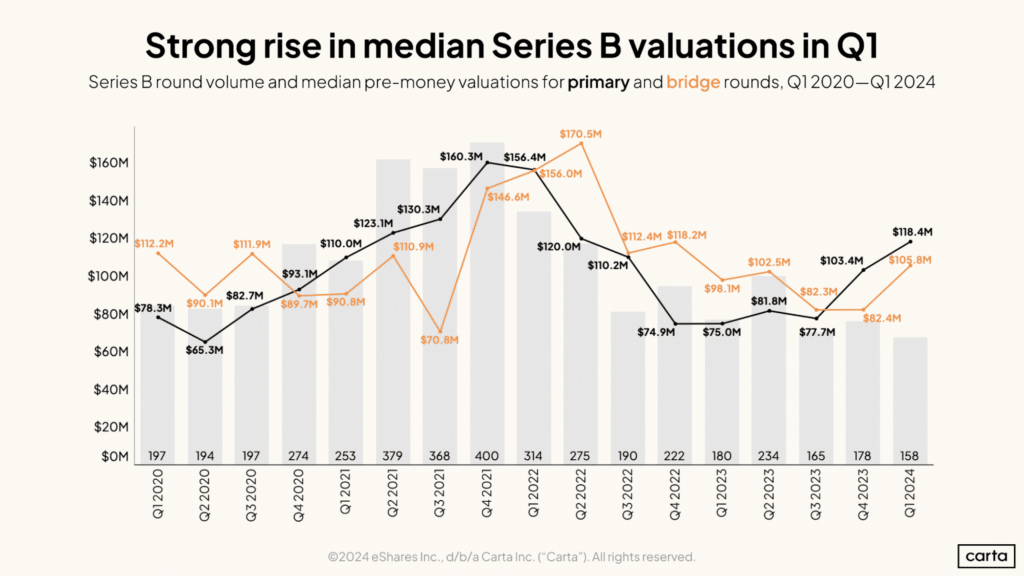

Series B Valuations

Series B valuations have shown a strong rebound over the past two quarters. The median valuation for primary Series B rounds surged by 33% between Q3 and Q4 2023, followed by an additional 15% rise in Q1 2024, bringing the median valuation to $120 million. The number of rounds was roughly stable over the period.

Interestingly, the median bridge valuation for Series B rounds is below the primary valuation, indicating that companies opting for bridge rounds may be doing so to extend their runway until they can raise a full funding round.

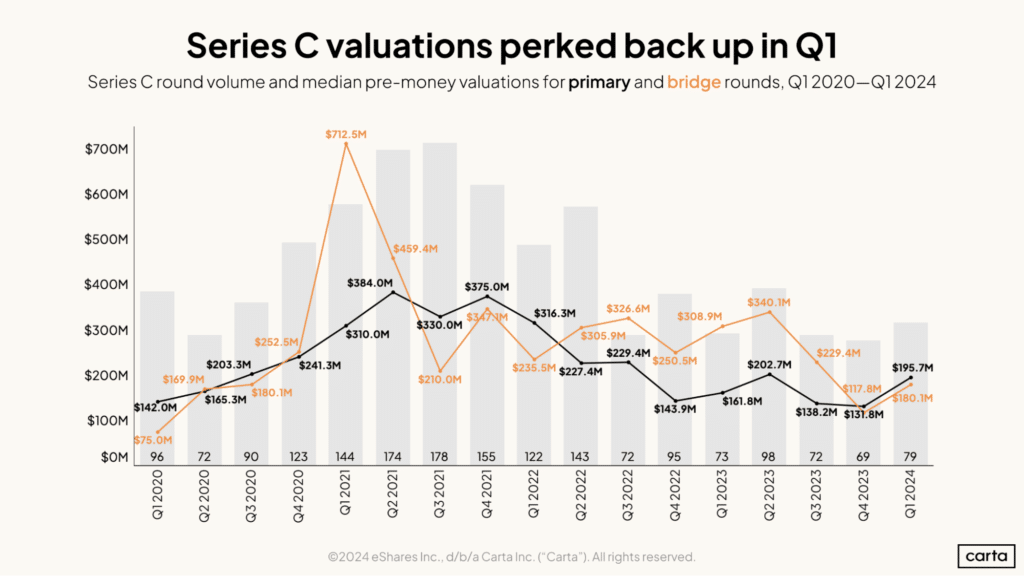

Series C Valuations

Series C valuations experienced a notable rebound in Q1 2024. The median valuation for primary Series C rounds rose to $200 million, marking a 50% increase from the previous quarter. Deal count rose by 45%.

Despite the recent uptick, the Series C market remains cautious, reflecting ongoing adjustments in investor strategies and a more selective funding environment.

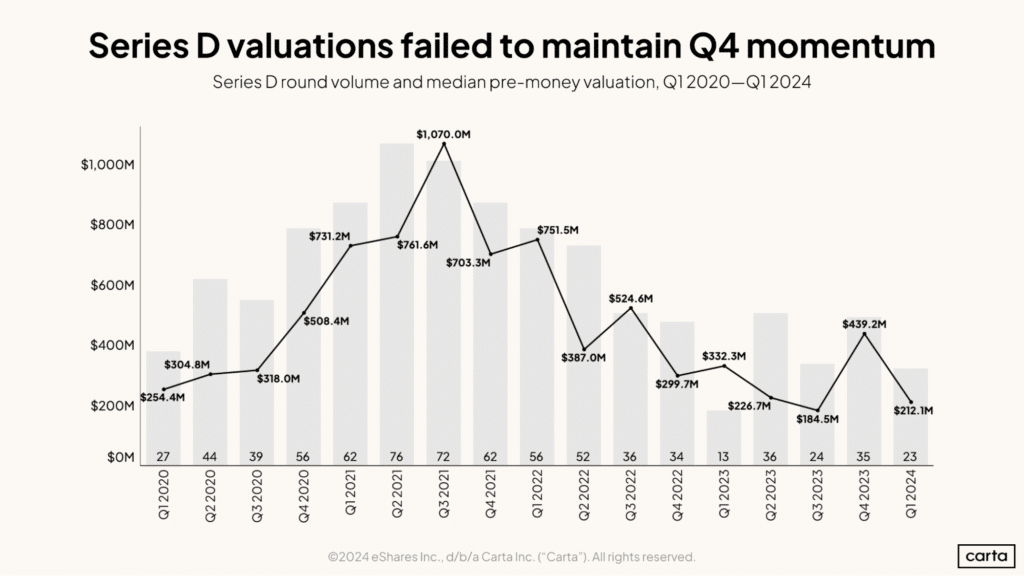

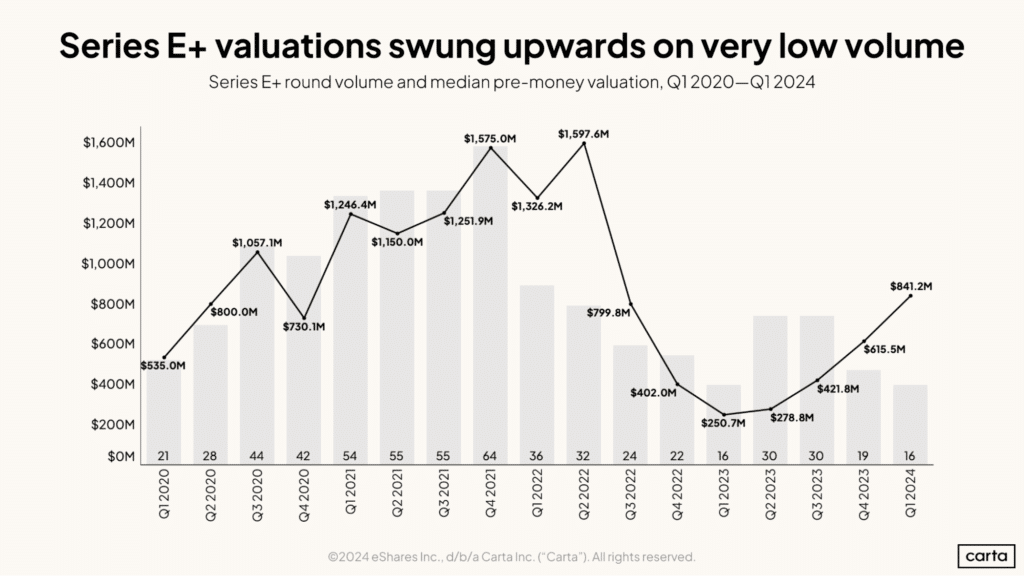

Series D+ Valuations

Series D and E valuations present contrasting performance, the former down 50% to $210 million while the latter continued the upward trend started in Q1 2023 to reach 840 million (+40% quarter-over-quarter and 2.3x year-over-year).

However, the low number of deals (23 for Series D and 16 for Series E+) on Carta makes these data points less representative of the overall market trend.

Higher median valuations in various stages hide a wide disparity in individual price settings, bubbling under the surface through down rounds.

Down Rounds Abound

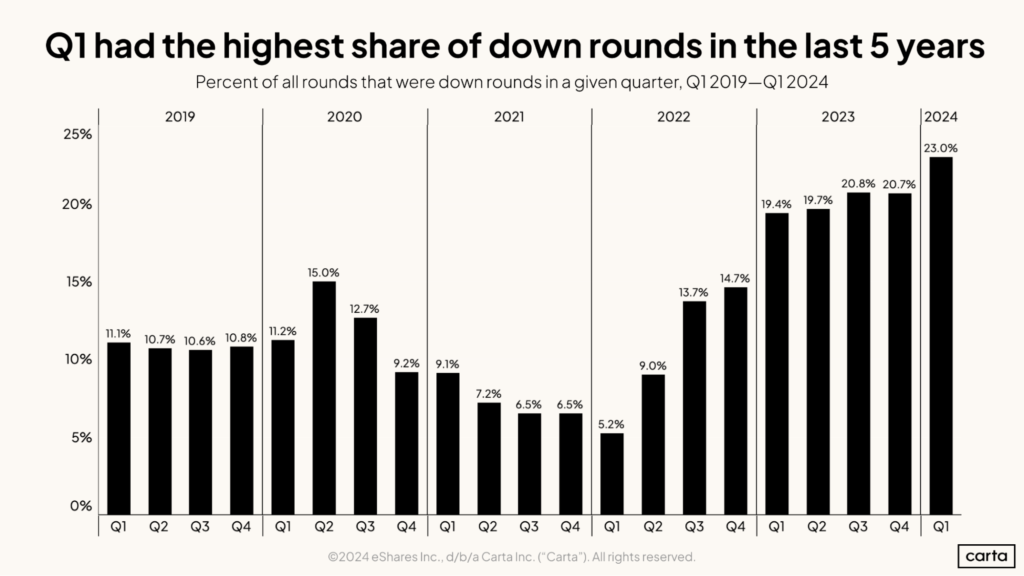

The prevalence of down rounds reached a ten-year high in Q1 2024, with a quarter of all funding rounds occurring at flat or reduced valuations compared to the previous round.

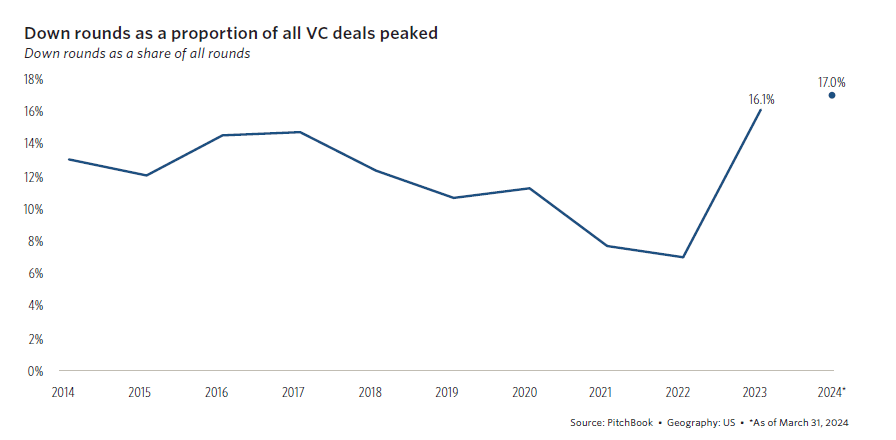

23% of all Carta startup rounds were down rounds, increasing markedly following a plateau in 2023. Pitchbook has slightly different data, with down rounds as a share of all VC deals peaking at 16% in 2023 and expected to increase again to 17% in early 2024 (27% including flat rounds).

Given a median time between funding rounds of two to three years, many companies seeking new funding in early 2024 last raised capital in 2021, a time when valuations were exceptionally high due to a bullish VC environment. As market conditions have since corrected and valuations have declined, many startups are now raising new rounds at lower valuations than before, resulting in a higher incidence of down rounds.

Down rounds are particularly challenging as they often involve highly dilutive terms, impacting both common stockholders (primarily Founders) and early-stage Investors. Pichbooks also reports more pay-to-play rounds, where existing Investors face significant dilution if they do not participate with additional capital.

Founders also find these stringent terms difficult, leading to a reduced alignment of incentives between top management and Investors—all the more so since ratchets are often attached to down rounds. Read the article below about ratchets for detailed explanations and calculations.

Another confounding factor may skew the data presented here: the impact of Artificial Intelligence (AI).

A Tale of Two Cities: AI vs. The Rest

AI startups have clearly distinguished themselves from other sectors in terms of valuations in the last few quarters. As VC Hall of Famer Bill Gurley noted on the BG2 Pod, the AI hype cycle has permitted a soft landing in the Venture Capital market.

There was a mini correction in VC in 2022-2023. Then the AI wave came, and that segment is almost behaving like it was prior to the mini correction.

Bill gurley - Benchmark (Source: B2G Pod)

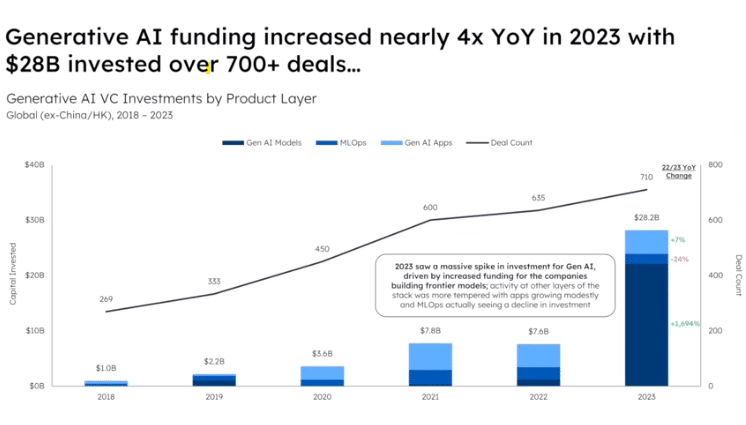

His co-podcaster Brad Gernster shared a graph highlighting a dramatic surge in AI investment in 2023, with $28 billion funneled into over 700 deals in 2023, representing a nearly fourfold increase year-over-year. This spike is primarily driven by heightened interest in companies developing models. Data from Sapphire Ventures showed that the top 5 deals in 2023 represented almost two-thirds of invested capital in AI.

AI has also distinguished itself in terms of valuation.

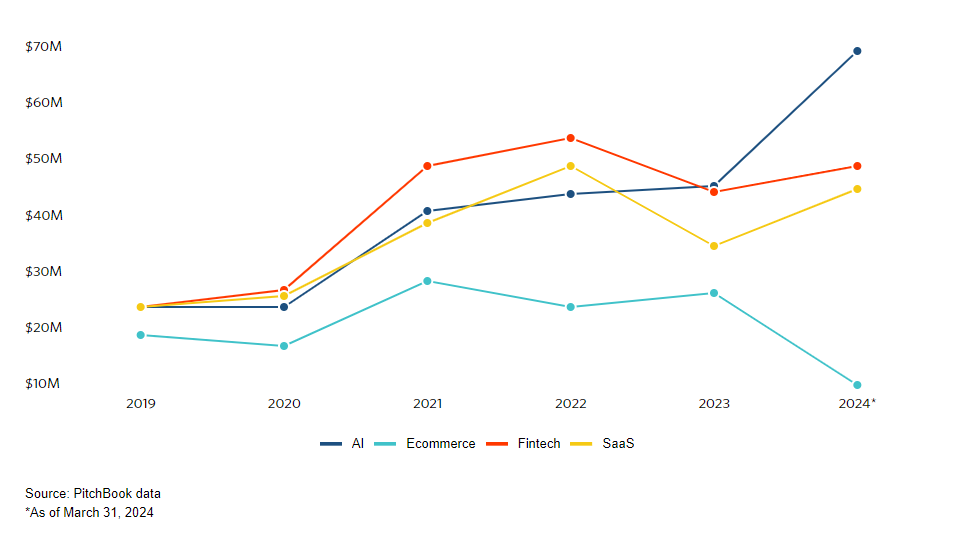

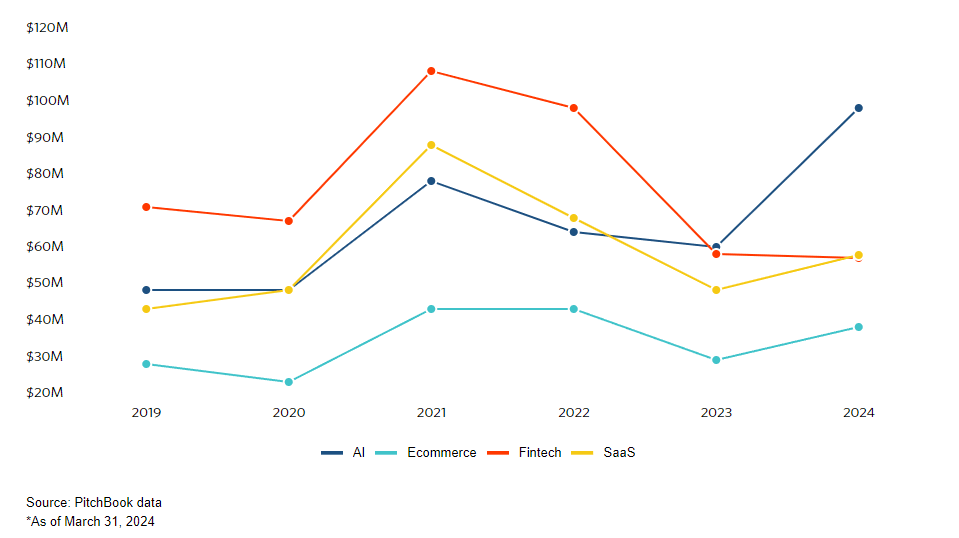

According to Pitchbook, early-stage AI companies have seen median valuations skyrocket to above $70 million by Q1 2024, while other sectors have generally struggled to maintain previous valuation levels. For instance, fintech, which once led in early-stage valuations, now trails behind AI, with the median fintech valuation falling below $50 million. This stark contrast highlights a significant shift in Investor priorities and capital allocation.

We’re in that land grab moment. You have a lot of investors that maybe aren’t thinking in a fundamentally sound matter, willing to pay whatever price it takes to get in.

Giuseppe Stuto - 186 Ventures (Source: Pitchbook)

The late-stage valuation landscape also shows a pronounced disparity between AI and other sectors. Late-stage AI startups continue to command premium valuations, significantly higher than their counterparts in eCommerce, Fintech, and SaaS.

Despite this, some investors urge caution. Tim Guleri of Sierra Ventures advises a diversified approach, arguing that the current high valuations liken the investment frenzy to "high-stakes poker," which may not yield sustainable venture returns. The competitive pressure in AI has led some Investors to explore other verticals, finding more reasonable valuations and less crowded markets.

Now, let's delve into the methods VCs use for startup valuation.

You've reached a Members-only area.

Unlock Full Access

Discover exclusive content curated for Venture Capital professionals and enthusiasts. Join our community and gain unlimited access to in-depth articles, expert guest interviews, MBA-level webinars, and networking opportunities.

Register for our 7-Day Free Trial: Click Here

Already a member? Please Log In Below:

Subscribe to our Newsletter

Join 12,000+ VCs & Founders globally who enjoy our weekly digest on Venture Capital. We keep your information confidential and you can unsubscribe at any time. Sweet!