I Quit My Venture Capital Job. Here’s What I Learned.

Venture Capital job “exit interviews” are rare, so I jumped on the opportunity when Moksha announced she left the elite VC firm Bessemer Venture Partners to launch an entrepreneurial venture. We openly discussed the intricacies and behind-the-scene workings of VC, how firm culture influences what you’ll do on the job, and what VCs really look for in the investment opportunities they receive. We also talked about Bessemer’s famous anti-portfolio and investment committee memos. Moksha impressed me with her smartness, maturity, and cautious humility. I wish her all the best in her new venture.

In This Post

- What were you expecting when you took a Venture Capital job? Did you find it?

- What was an unexpected learning from your Venture Capital job experience?

- You have worked at three VC firms over the past five years. How did each firm's culture influence your development as a VC professional?

- Does that early ownership translate into being invited to Board meetings and having a voice on the Investment Committee—or does that happen later?

- What is the most challenging aspect of the Venture Capital job?

- Talking about missed opportunities: Bessemer is famous for its anti-portfolio. Any startups you regretted passing on?

- Bessemer open-sourced many of their Investment Committee memos, which contain a table with the probability of success for each investment opportunity. How do you determine the different scenarios?

- What was your decision process to leave your Venture Capital job and become an entrepreneur?

- Fire Round: Short Question, Short Answer.

What were you expecting when you took a Venture Capital job? Did you find it?

Mokhsa: “Reflecting on the past five years in Venture Capital, I was initially drawn to the proximity of entrepreneurship. In college, I found my tribe through YouTube and coding hackathons, which made me feel at home. Venture Capital offered me a front-row seat to the entrepreneurial ecosystem, enabling me to make connections and think horizontally. The flexibility of being on the investing side allowed me to explore various paths before starting my own venture. This experience provided me with clarity and conviction in my decisions.”

While Venture Capital jobs offer a unique front-row seat to observe entrepreneurs’ successes and failures, few positions are available. Exceptionally talented individuals like Moksha typically get in by preparing for months ahead of going through interviews. Read our Venture Capital job guide to do the same.

What was an unexpected learning from your Venture Capital job experience?

Moksha: “I didn’t expect the industry to be so fast-paced. Even the smartest Investors are continuously learning. For instance, upon the release of new technologies like ChatGPT or cryptocurrencies, investors quickly immerse themselves deeply in these areas. They may not know much when it happens, but within three or six months, they’ve had all the important conversations, read the books, the blogs, whatever is necessary to understand the field deeply.”

“This constant need for reinvention applies across all levels, not only at the analyst or associate position but all the way up to partners and managing partners. It emphasizes the importance of curiosity and humility in the learning process.”

VCs need to reinvent themselves every six months.

Moksha – Former VC at Bessemer Venture Partners

“The pace makes it crucial to balance meeting time with reflection. Many Investors are caught up in meetings and fail to allocate downtime to digest information and strategize. A roadmap-based approach, which explores various business models within a sector, is essential. You meet fifteen or twenty founders a week, sometimes in sectors you don’t know much about, so downtime is vital to pause and reflect on the key learnings. This approach and staying informed about multiple sectors enhance decision-making.”

Moksha spent five years in Venture Capital, most recently as an investment professional at Bessemer Venture Partners in India. She left VC in February 2024 to work on an entrepreneurial venture.

You have worked at three VC firms over the past five years. How did each firm’s culture influence your development as a VC professional?

Moksha: “Where you work significantly influences your sense of ownership and developing judgment skills. In investment firms with highly centralized decisions, higher-ups or partners in different geographies make the calls. This dynamic can reduce the role of junior and mid-level managers to mere facilitators of opportunities rather than key decision-makers. One thing Bessemer does really well is empowering its junior investors. This autonomy also ensures that decisions for any country are made locally. This decentralization of decision-making across geographical and hierarchical levels is crucial for fostering a productive culture within a Venture Capital firm.”

“Ownership over daily responsibilities is also vital. As an analyst or associate, you engage in numerous activities. Navigating through the cycle of sourcing, analyzing, and defending investment opportunities is essential to form independent judgments about which meetings to take or which sectors to explore. You have to go through the grind; you can’t expect to write a check in your first month or even your first year on the job. VC firms that provide the space to grow are invaluable. I’d steer away from firms with a top-heavy approach to decision-making, as developing your own judgment is critical for long-term success in Venture Capital.”

Research shows that investment committees’ voting rules impact a VC firm’s performance. I described the various modes—simple majority, supermajority, no vote—in this article: Venture Capital Investment Committees: Best Practices From Elite VC Firms.

Does that early ownership translate into being invited to Board meetings and having a voice on the Investment Committee—or does that happen later?

Moksha: “Participation in board meetings and having a voice at the investment committee typically come with time. However, you can always take the initiative to raise your hand, be involved, and actively contribute. It can pave the way for deeper involvement in decision-making processes. It is crucial to engage in constructive discussions with the partner leading the investment and to dive into detailed discussions with the founders and their executive team. It can position you as a valuable asset to both your firm and the entrepreneurs you support, serving as a sounding board for them before engaging with the VC partner. This approach requires a proactive mindset and finding a firm that values and encourages this kind of involvement.”

What is the most challenging aspect of the Venture Capital job?

Moksha: “Being a VC means you’re largely on your own. You source your own deals and create your own roadmaps for potential investments. This responsibility is somewhat unexpected. In my time as a VC, I noticed that my interactions were more frequent with founders and external stakeholders like lawyers and accountants than with colleagues within my own firm. This aspect of the Venture Capital job underscores a somewhat solitary workflow that isn’t initially apparent to everyone.”

VCs are lone wolves, they eat what they kill.

Moksha – Former VC at Bessemer Venture Partners

“Another challenge, particularly if you’re new to the field, is determining where to allocate your efforts. Most VC teams are very lean, you have to learn to prioritize the most promising opportunities. Every investor I know has engaged in endeavors that, in hindsight, were not the best use of their resources. No one is there to tell you whether it’s the right thing to do. This trial and error process is integral to the Venture Capital job.”

Venture Capital is unique among transaction finance in the sheer volume of opportunities presented to the investment team. VCs must learn to screen deal flow effectively and rapidly. As they don’t have time to train junior team members, hiring VCs look for plug-and-play professionals with prior knowledge of tech, startups, and how VC works.

Talking about missed opportunities: Bessemer is famous for its anti-portfolio. Any startups you regretted passing on?

Moksha: “Sure. Every investor knows the sting of missed opportunities; for every successful investment they made, they missed many more. Bessemer is open about its anti-portfolio, showcasing missed chances and holding themselves to a rigorous standard of reflection and accountability.”

As an investor, you have to make peace with the fact that you’ll probably have more regrets than wins in your career.

Moksha – Former VC at Bessemer Venture Partners

“My own experience mirrors this. We looked at a consumer internet company a while ago. We really liked what they were doing, but their LTV/CAC ratio was not where we wanted it to be. We also estimated too much dilution for our position from future funding rounds. So, even if it were a mega success, it would not be a great financial outcome for our fund. Such decisions, tough as they are, underscore the importance of IRR as a guiding metric in our evaluations.”

Moksha’s story highlights a fundamental but lesser-known investment criterion in VC: “Does the investment move the needle for the fund?” Even if the fundamentals are sound, VCs will pass on opportunities they expect to return less than 1x the size of their fund. It’s one of the seven secret criteria I described in this article.

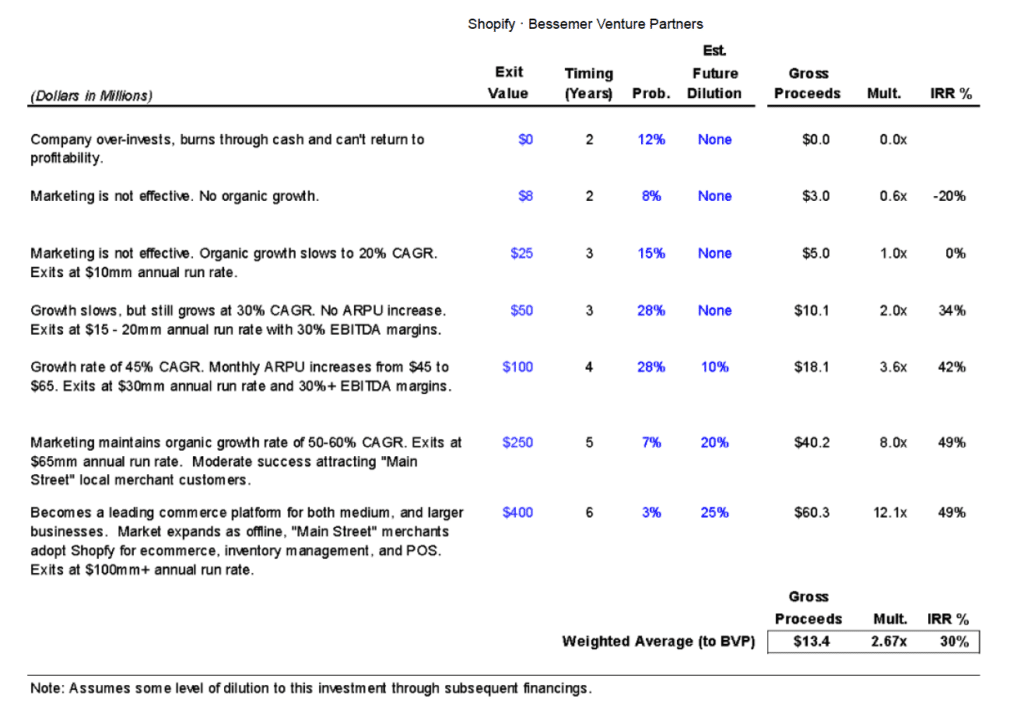

Bessemer open-sourced many of their Investment Committee memos, which contain a table with the probability of success for each investment opportunity. How do you determine the different scenarios?

Moksha: “In every investment memo we write, the scenario analysis sheet is present. We think deeply about how the markets could shape up and how the company could evolve alongside them. We try to map out the different possible scenarios, and identify the factors that would impact the company the most in each scenario. For example, what are the top three things that need to work—whether it’s about the market or the company—to reach the “hitting out of the park” scenario? If all three work out, do you have a unicorn on your hands? Does the company reach 100 million in ARR? Are there a million customers paying you every day?“

“But the reality check here is that we usually peg these best-case scenarios at a 1% to 5% probability. Most of the time, we’re underwriting more moderate outcomes, with a 30% to 60% chance of getting our money back and change. It’s a sobering part of the job, honestly, to present such odds to the partnership. You’re there trying to pick winners, but you’ve also got to be real about the probability of success, which often suggests a venture might not pay off as hoped. This balancing act between optimism and realism, recognizing the inherent risks and the potential for huge wins, makes Venture Capital such a unique field to work in.”

What was your decision process to leave your Venture Capital job and become an entrepreneur?

Moksha: “Leaving Venture Capital after five years wasn’t easy. It meant starting from scratch in a new direction after spending five years learning the ropes of the VC industry. The journey demanded a lot of hard work. What helped me through my decision was imagining my future and thinking about what would matter to me in ten years. The possibility of feeling dissatisfied if I continued on my current path was something I wasn’t willing to accept, despite my love for Venture Capital. I considered what gave my life meaning and how to pursue it.”

“The idea of entrepreneurship always lingered in my mind, not as an immediate step but as a potential future endeavor. It wasn’t about money or success. I asked myself what the minimum I needed for a good life was to support myself and my family financially. I imagined what my base lifestyle would look like. As I embark on this entrepreneurial journey, I’m aware of the uncertainties lying ahead.”

“I’m not saying that I didn’t love my venture capital job. Being an early-stage investor is the most exhilarating job there is. But it wasn’t fulfilling me at a level that I thought I deserved a shot at. That was my reason.”

I realized that not becoming an entrepreneur would just produce dissatisfaction at a level I’m not prepared to handle ten years from now.

Moksha – Stealth entrepreneur

“Another aspect I considered was how I would perform as an operator vs. a VC. I had a role similar to what we’d now call a Chief of Staff in an earlier avatar, working closely with the founder on every aspect of the business, from hiring and strategy to go-to-market plans, and I just loved it. We were working for 12 to 16 hours a day. I’m not saying it’s what everybody should do, but it worked out amazingly well for me. It was one of my happiest times as a working professional. And I thought going back to that would satisfy me a lot. I’d like to think that I’d be a great operator. I guess we’ll find out when the rubber meets the road.“

Fire Round: Short Question, Short Answer.

Inspired by Harry Stebbing’s 20VC podcast (and others before him), the fire round is an efficient way to learn much about an Investor quickly.

One question you always ask fundraising Founders

Moksha: “When I meet with entrepreneurs, I focus on understanding their motivation behind the business. Not just about what got them started, but seeing how that drive will sustain them and their company over time. This insight is crucial because a founder’s initial motivation often influences the longevity and resilience of the company.”

I couldn’t agree more. After over fifteen years of working with entrepreneurs as an Investor and advisor, I now primarily focus on their internal drivers. Entrepreneurship is so hard, and Founders have so many more work opportunities that a strong motivation will keep them grinding when the going gets tough. I discussed this point in many articles throughout the blog and developed a framework called the “promotion/prevention focus,” allowing Investors to quickly understand Founders’ inner motivation. This webinar is the most detailed on the topic.

The first metric you look for in a pitch deck or a first meeting

Moksha: “For me, evaluating growth is key. It’s a clear indicator of the business plan’s viability and the founder’s determination. The growth metrics reveal whether Founders effectively tested and found strategies that work. This experimentation and persistence are what I’m keenly interested in. It tells a story of trial, adaptation, and progress.”

Again, I 100% agree. Promotion-focused Founders try to win and don’t mind getting rejected by clients, Investors, and potential recruits. They’ll try relentlessly until they achieve their goals. In contrast, prevention-focused Founders try not to lose and are typically the ones adding more features to a product whose market need they didn’t validate.

The most important pitch deck slide

Moksha: “The most critical slide in a pitch deck is ‘Why Now?’. The market slide is important, but entrepreneurs generally target large markets. The main difference between the best and worst business ideas is often the timing of their venture.”

One tip to find superior deal flow as a VC

Moksha: “Outreach. You can’t wait for founders to come to you. You have to be very persistent. You have to meet them where they are—on social media, at tech events, etc.”

Moksha’s comment reminded me of this interview with Peter Fenton, one of the greats at Benchmark. Fenton advises successful VCs to check their ego and keep reaching out to Founders. “The next great company is likely to be started by somebody that’s totally unknown. And they don’t know that you did these things ten years ago. The probability that they’re going to reach out is really low.” Hustling remains a significant part of the Venture Capital job, even as a partner.

The top quality of successful VCs

Moksha: “Diving deep into the numbers is incredibly underrated in Venture Capital. VCs often focus on trends and market dynamics, but truly understanding the financial intricacies of a company is where some set themselves apart. VCs must have a firm grasp on how to see through an investment from entry to exit. It enables conversations with Founders and better decision-making.”

One tip you received that changed your approach to investing

Moksha: “Expanding my focus across various sectors rather than delving too deeply into specific ones made a significant difference in my approach. For example, by looking at marketplaces across multiple sectors, such as automotive, agriculture, electronics, and professional services, I gained a more holistic understanding of what sets the best marketplaces apart.”