SBF, Holmes, Madoff: How They Fooled Investors

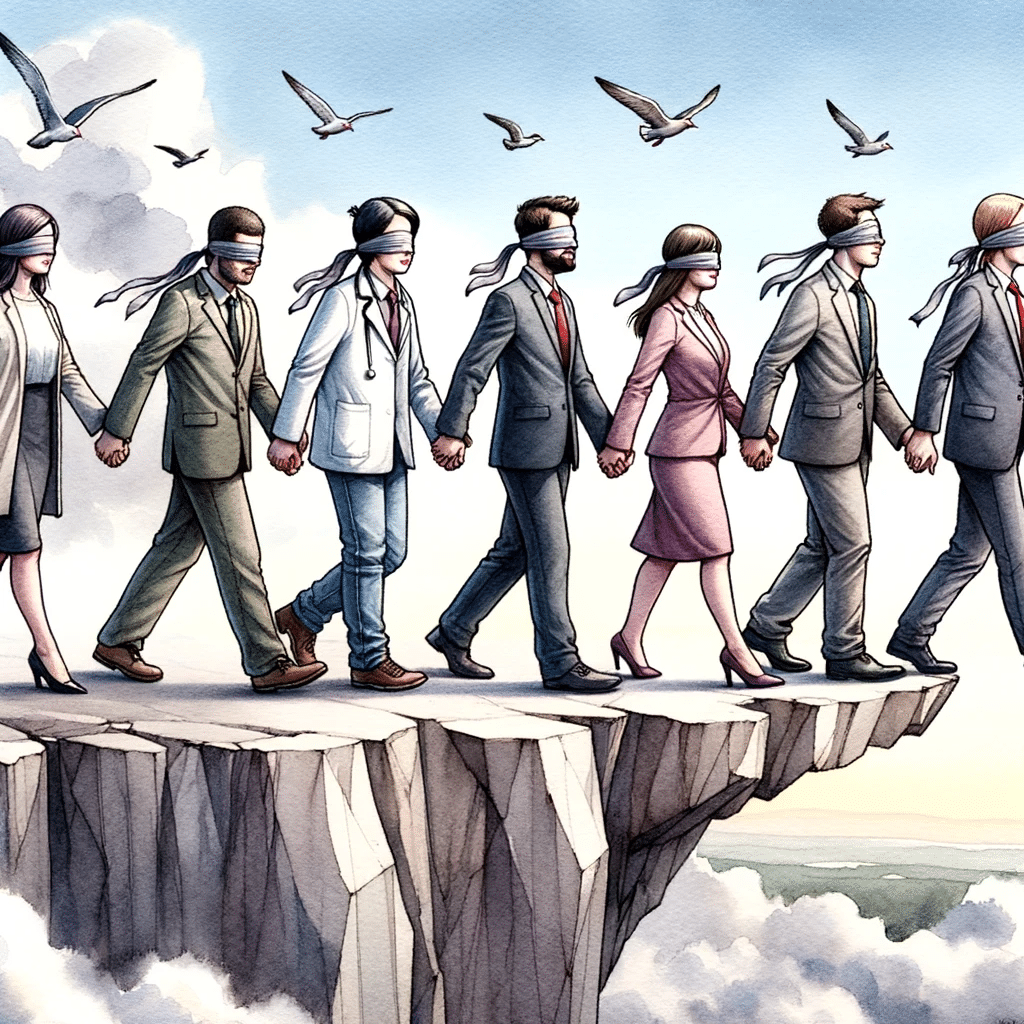

Prosecutors working in the case against Sam Bankman-Fried (SBF), the embattled crypto magnate accused of siphoning billions of dollars from users of his crypto exchange FTX, are intent on demonstrating that SBF misled investors through false representations about his enterprise. Yet, one primary motivation behind Investors’ decision to bet on SBF may be their own doing. In an era where unicorns are not just mythical creatures but billion-dollar startups, Venture Capitalists find themselves grappling with not just economic realities but also psychological biases. One such bias that often masquerades as expert intuition is the “halo effect”—the tendency to make judgments about a person based on unrelated characteristics.

In this post, I illustrate how the halo effect ruins VC decision-making through three case studies: SBF and the FTX/Alameda fiasco, Elizabeth Holmes with her ill-fated biotech company Theranos, and Bernie Madoff’s infamous Ponzi scheme. Each narrative offers a unique lens to understand how the halo effect can compromise due diligence, cloud judgment, and ultimately lead to poor investment decisions.

The Halo Effect in Venture Capital

The halo effect is a cognitive bias where our overall impression of a person influences how we feel and think about their character. Essentially, our evaluation of one aspect of that person can transfer onto our assessment of the person as a whole. This can work in both positive and negative directions. For example, if an entrepreneur is charismatic and well-spoken, Investors may automatically assume they are also skilled, competent, and trustworthy. The reverse is also true; a single negative trait can lead to undervaluation or misjudgment.

I recently attended a pitch meeting where two entrepreneurs who had successfully built a business generating millions of dollars in sales with minimal funding were criticized for their perceived lack of enthusiasm. One Investor declined to extend an offer, citing that the Founders didn’t “make him dream.” He misconstrued their reserved nature as an indication that the business was underperforming.

In contrast, another Investor recognized that these entrepreneurs were not accustomed to pitching and that their restrained demeanor was an asset in their dealings with clients — large retailers known for their aggressive negotiations. This Investor avoided falling prey to the halo effect.

VC is about extracting enormous signal out of very little data.

Nigel Morris – QED Investors (Source: 20VC)

In Venture Capital, the halo effect can be both a blessing and a curse. On the one hand, it can be a helpful heuristic in the incredibly complex, fast-paced, and uncertain environment of startup investing. With limited time to evaluate a company’s potential, VCs may rely on the perceived competence, past success, or social proof around a Founder or founding team as indicators of future performance. In some cases, this can be beneficial.

However, the halo effect can also lead to critical errors in judgment. Investors might overlook red flags like a shaky business model, poor customer acquisition metrics, or questionable ethics simply because they are captivated by a Founder’s charisma or previous success. This may result in poor investment decisions and missed opportunities to back more deserving startups.

As I demonstrated in a comprehensive post on Venture Capital diversity, the halo effect can also propagate inequality within the VC community. Investors might be more likely to back entrepreneurs from prestigious schools or previous successful ventures, perpetuating cycles of inequality and missing out on diverse talent.

Understanding the halo effect’s role can help VCs make more informed, unbiased decisions. As with any cognitive bias, awareness is the first step toward mitigation, paving the way for more accurate assessments and, ultimately, better investment outcomes.

SBF and FTX: What Could Sequoia Have Done Better?

A disturbing narrative has emerged as the curtain is pulled back on SBF’s operations. Allegations of embezzlement and unscrupulous tactics started to overshadow the Wunderkind’s previously pristine image. The situation raised a pressing question: How could someone deeply embedded in an ethical and knowledgeable environment stray so far? And perhaps even more critically, how did astute Venture Capitalists miss the warning signs?

Sequoia Capital was one of the principal backers of FTX, investing $214 million in total. Contrary to what many critics said at the time of FTX’s bankruptcy in late 2022, Sequoia’s misstep wasn’t only a lack of thorough due diligence into SBF’s operations, but a failure to advocate for stringent governance measures.

At the time of our investment in FTX, we ran a rigorous diligence process.

SEquoia capital (source: twitter)

In a note sent to their LPs and published on their Twitter account, Sequoia indicated they had run audits customary in VC investments. Reports also emerged confirming that Tiger Global, another Investor in FTX, had commissioned the consulting firm Bain & Co. to conduct due diligence before their $38 million investment.

Why did all this work fail to uncover the ties between SBF’s companies, whose entanglement ultimately led to their demise?

Missing The Alameda Link

The exact cause of the alleged FTX fraud is still a matter of legal debate and investigation. However, many believe that the close relationship between FTX and Alameda Research, a cryptocurrency trading firm co-founded by SBF, is the leading cause. The second count of the US. vs. SBF indictment indicates that:

“Bankman-Fried, along with others, engaged in a scheme to defraud customers of FTX.com by misappropriating those customers’ deposits, and using those deposits to pay expenses and debts of Alameda Research, Bankman-Fried’s proprietary crypto hedge fund, and to make investments.”

SBF is also accused of wire fraud on Alameda’s lenders.

As I highlighted in my dedicated post on VC due diligence, the process has two phases: exploratory (led by the VC team) and confirmatory (led by external service professionals). In FTX’s case, the Sequoia team consisted of senior partner Alfred Lin, a Sequoia veteran behind many of the firm’s successes, and junior partner Michelle Bailhe, who had arrived recently with a banking background.

But here lies a fundamental challenge: due diligence in Venture Capital often has time constraints. VC partners juggle between analyzing deal flow, negotiating agreements, monitoring portfolio companies, raising funds, and a string of other high-pressure tasks. They have limited time to delve into technical matters. The VC market dynamics compounded the issue, as 2021, when Sequoia led FTX’s Series B round, was the hottest year in the upcycle that ended in early 2022.

We asked, ‘Are these two companies independent?’ and we were told that they were. We were misled.

Alfred Lin – Sequoia (source: pymnts)

Alfred Lin’s statement at a conference in January 2023 highlights another limitation of VC due diligence. The process relies mainly on self-reported legal and financial aspects by Founders. While checks with references and interviews with industry experts form part of the analysis, these can sometimes fail to uncover deep-rooted structural issues.

Besides, the first $150 million investment in FTX represented only 3% of the fund making it. I’m guessing that Lin and Bailhe had a lot on their plate and did not want or have time to pursue the matter further. It is also possible that there was no wrongdoing at the time, as Alameda’s problems seem to have surfaced after Sequoia’s investment.

Go Further: Why Venture Capital Due Diligence Fails

However, the oversight by Sequoia doesn’t lie in due diligence alone. It’s a broader governance concern.

The Real Issue: Weak Governance

With FTX’s rapid rise and influx of capital, the expectation would be that robust governance mechanisms, especially at the Board level, would be in place to review the operations of both Alameda and FTX regularly. Astonishingly, the presence of such mechanisms seems lacking. FTX had only a nominal Board of Directors.

FTX had no board of directors. Every single investor that opted into that construct earned their $0 outcome. You can’t blame Sam. Or Binance. Just yourself. You made a bad decision.

Bill gurley – benchmark (Source: twitter)

Moreover, the rudimentary accounting methods, supposedly done on tools like Excel for a firm that raised significant capital and was valued at tens of billions of dollars, are nothing short of baffling.

In its trusted position, Sequoia should have championed more robust governance, ensuring a clear separation of operations and financial flows between FTX and Alameda. The lack of this not only raises questions on due diligence but also on the fundamental role of Venture Capitalists in safeguarding and guiding their investments.

It underscores the importance of clear delineations between different business entities and the need for robust governance and transparency, especially in rapidly evolving industries subject to significant speculation.

SBF: A Cascading Halo Effect

The story of Sam Bankman-Fried and his cryptocurrency empire, FTX, exemplifies a cascading halo effect. In this phenomenon, an initial positive assessment or reputation spreads outwards, layer by layer, influencing various stakeholders’ perceptions.

For FTX, this cascading effect moved from its internal ecosystem of employees, branched out to Venture Capitalists, swayed entertainment figures, and finally, magnetized the general public. Each layer of influence was based on different facets of SBF’s life and achievements, reinforcing the overarching positive narrative.

Step 1. Effective Altruism and the “Good Guy Aura”

At its core, Effective Altruism (EA) is about utilizing resources most effectively to benefit others. SBF’s association with this philosophy earned him an aura of moral righteousness. By committing large sums of his wealth towards causes vetted for their effectiveness, he presented himself as someone using his newfound crypto affluence for the greater good. This commitment painted a portrait of a billionaire who was not just about profits but also deeply concerned for global well-being.

SBF was introduced to EA during his time in college at MIT, which led many to believe his engagement with EA was not a PR move; it was deeply rooted in his past, reflecting his longstanding values.

Besides, Effective Altruism squared well with crypto’s ideals. Cryptocurrency, especially in its early days, was often touted as a tool for societal change. Its decentralized nature promised to dismantle traditional financial power structures. SBF’s fusion of crypto’s transformative potential with EA’s principles showcases a unique blend: the promise of technology as a force for good combined with a rigorous, evidence-based approach to philanthropy.

We let people believe he was a saint, when in reality he lived like a pretty standard workaholic billionaire.

SEnior EA community member (Source: The NEw Yorker)

However, further scrutiny showed that SBF did not live according to EA’s standards. Effective Altruism champions unwavering moral rigor, proposing that every discretionary penny spent beyond basic survival could be better used for those in dire need. It’s a philosophy that requires living frugally and continuously being sensitive to the suffering of others—to make the most significant positive impact possible.

Sam Bankman-Fried’s narrative, however, throws a wrench into this ideal. Public tales once spoke of his modesty—driving an older Toyota Corolla, sleeping on bean bags in the office, sharing a flat with multiple roommates to save living costs, seemingly embodying the very spirit of EA. But scratch beneath the surface and a different story emerges. Revelations about his luxurious property holdings, notably the opulent $40 million penthouse in the Bahamas, present a glaring misalignment with EA’s spirit of austerity.

Such dissonance should have been a red flag. Employees, the broader EA community, and anyone interacting with Bankman-Fried, especially Investors, should have recognized this gap between proclaimed values and actual lifestyle. After all, if the most prominent advocates of a philosophy don’t walk the talk, it’s only natural to question the integrity of their other endeavors.

Yet, SBF’s aura of a philanthropic billionaire weighed prominently in VC firms’ decision to invest in FTX. It is the next step in the halo effect cascade.

Step 2. Venture Capitalists and the Stanford Law Lineage

In the Wild West of crypto, credibility can be scarce. Rampant issues such as money laundering, elaborate scams, and pump-and-dump schemes have tarnished its reputation. Compounding these challenges is the absence of a unified global regulatory framework, allowing malicious actors to exploit the system’s decentralization and anonymity. As such, the crypto landscape became a double-edged sword: a space of innovation, but also a haven for unscrupulous dealings.

SBF had an edge here: his lineage. With parents who were esteemed scholars at Stanford, one of the world’s leading academic institutions, an inherent trust was instilled in him. The reasoning, though perhaps subconscious for some, was straightforward: someone from such an illustrious background, with a family entrenched in intellectual and ethical pursuits, would be less likely to engage in fraudulent activities.

Joseph Bankman, revered for his initiatives on making the US tax code more equitable for the less affluent, and Barbara Fried, a leading voice on legal ethics in progressive political realms, were not merely academic titans but also deeply embedded in a culture of ethical conscientiousness. Their home often buzzed with intellectual debates, hosting a myriad of academics from diverse fields, discussing everything from philosophy to politics. Both were recognized for their profound moral compass, notably exemplified by their decision not to marry because they felt it unjust that same-sex couples couldn’t do the same.

The exchange that Sam had started to build was Goldilocks-perfect. There was no concerted effort to skirt the law.

Michel Bailhe – sequoia (source: sequoia)

An account of Sequoia’s involvement with FTX highlights the halo effect at play in their decision process. Published in September 2022 on Sequoia’s website, the article was embarrassingly removed a few weeks later, as the battled crypto exchange’s troubles became apparent.

“Young gun” Michelle Bailhe and veteran partner Alfred Lin, part of the Sequoia deal team on FTX, embarked on a rigorous expedition to map the crypto landscape. Bailhe singled out Sam and FTX as standing out from the crowd. In the since-removed profile on Sequoia’s website, they lauded SBF as seemingly “bred for the role of crypto exchange founder and CEO.”

SBF’s brief stint at a prestigious Wall Street trading firm was among the justifications for this endorsement. But more intriguingly, significant emphasis was placed on his lineage—being the offspring of Stanford law professors. It is worth noting that Alfred Lin is a Stanford graduate. This pedigree seemingly provided Sequoia with assurance, suggesting an inherent aptitude and commitment in SBF to navigate the crypto universe’s complex legal and regulatory intricacies.

This investment decision underscores how deeply rooted academic and familial backgrounds can influence even the most analytical and discerning Investors in their judgments, demonstrating the potent halo effect in action.

After VCs made SBF a paper billionaire and lent him a suit of respectability, the next step in the cascade was celebrity endorsements, which trickled to the public at large.

Steps 3 & 4. The Magnetic Pull of Big Names

Celebrities often have an outsized influence on public perception. Their association with a brand or person can elevate or degrade its public image. In the case of FTX, several celebrities, probably swayed by SBF’s billionaire status and the aura of invincibility around him, lent their names to the platform. Their endorsement was less about the technical merits of FTX and more about the growing allure of being associated with a successful figure in the booming crypto domain.

For the general public, when stars like Tom Brady and Larry David became associated with FTX, it wasn’t just an advertisement; it was a tacit stamp of approval. Many likely reasoned that if these trusted figures believed in FTX, it must be legitimate. This trust, built upon the cascading halo effect originating from SBF, drew numerous clients into the FTX fold, further amplifying its success and reach.

I’m in on crypto because I want to make the biggest global impact for good.

Gisele Bündchen (Source: Bloomberg)

In the wake of the FTX crypto exchange collapse, celebrity endorsements have come under intense legal scrutiny. Alongside Brady and David, other celebrities—including Gisele Bündchen (who was then married to Brady), basketball star Stephen Curry, tennis champion Naomi Osaka, and Shark Tank’s Kevin O’Leary—have been pulled into the legal quagmire, although not to the extent of facing criminal charges.

The class-action lawsuit against them asserts that they lent their significant credibility to FTX, thereby bearing responsibility for the substantial financial damages ensuing from the platform’s downfall. The underlying legal argument centers on the claim that transactions on FTX involved “unregistered securities” regulated by the SEC. Thus, these celebrity endorsers had an obligation to disclose the specifics of their financial agreements with FTX.

The lawsuit alleges they neglected this duty and bypassed necessary due diligence before endorsing FTX. They are now facing repercussions for their promotional involvement. Brady and Bündchen purportedly “lost” $30 million and $18 million in the FTX debacle, respectively.

We all look like idiots. We relied on each other’s due diligence, but also another theme. […] Sam Bankman-Fried’s parents are American compliance lawyers.

Kevin O’Leary (Source: CNBC)

A CNBC report highlighted O’Leary’s candid admission of a staggering $15 million payout from FTX, of which $9.7 million was reinvested in crypto, $1 million was paid in FTX equity, and slightly over $4 million was reportedly consumed by taxes and agent fees.

The irony lies in O’Leary’s initial confidence in FTX, especially its compliance systems. This belief was later shattered when FTX’s risk, audit, and compliance measures were termed “a complete failure of corporate controls” in Delaware bankruptcy protection filings. O’Leary’s regretful acknowledgment: “It was not a good investment,” underscores the risk of relying on external themes lending a halo effect to a person’s main character.

Liz, Bernie, and the Halo Effect

A complex tapestry of external factors and psychological influences play intricate roles in the financial debacles that riddle business history. While the Theranos and Madoff scandals were undoubtedly multifaceted events, with myriad causes and players, a discernible common thread weaves through both: the powerful sway of the halo effect. In these cases and many others, this subtle cognitive distortion can amplify trust, overshadowing due diligence and blinding even the most astute Investors to glaring red flags.

Elizabeth Holmes: From Dropout To Deception

The meteoric rise and dramatic fall of Theranos can be significantly attributed to the halo effect surrounding its young and charismatic founder, Elizabeth Holmes.

With (again) Stanford University as her backdrop, the narrative of a dropout challenging the status quo further amplified her appeal. Silicon Valley lore is full of charismatic Founders who left school to pursue their dreams and changed our way of life: Apple’s Steves, Michael Dell, Bill Gates, Mark Zuckerberg, and Jack Dorsey are just a few names in a long list.

While other cognitive biases are involved, the halo effect is evident. For VCs relying on mental shortcuts to make decisions, dropping out of a prestigious university signals a willingness to take risks and the likelihood of being right in doing so. After she portrayed herself as Steve Jobs’ successor in tech and constantly appeared in the press, Elizabeth Holmes became an unstoppable force.

Another feature of the Theranos story played a strong halo effect. A board of directors with prominent figures, such as retired generals, Defense Secretaries, and even a legendary Secretary of State, created a sense of infallibility. Alongside social proof and FOMO, the halo effect set the stage for a disruptive medical technology that promised to revolutionize blood tests.

Investors and media alike were enamored, but beneath the sheen, the technology was flawed and the promises hollow.

Bernie Madoff’s Halo of Respectability

The Bernie Madoff saga offers a striking example of the halo effect in finance. As I realized when I watched the Netflix series “Madoff, the Monster of Wall Street“, Madoff was no novice in the world of investments; in fact, he was a highly competent money manager with a track record that shone particularly in the 1970s and 1980s, securing his reputation as a financial luminary.

The halo surrounding Madoff extended far beyond his financial expertise. He had once been the Chairman of the Nasdaq stock exchange, a role that conferred prestige and respectability in the financial world. This association with a major financial institution only strengthened his aura of trustworthiness.

Another layer of the halo can be found in the SEC clearing Madoff’s operations several times, indirectly endorsing his financial activities. This regulatory validation further solidified his standing in the eyes of investors.

Madoff’s philanthropic efforts in his community also contributed to the image of a benevolent figure. His charitable donations and community involvement created a positive public perception that worked to his advantage.

Madoff’s returns of 8% to 14% were impossibly consistent.

Daniel Simons – University of illinois (Source: Hidden Brain)

In the end, this multifaceted halo effect made Bernie Madoff’s grand deception possible, luring investors into a fraudulent scheme built on a foundation of trust and credibility. It made it easier for people to trust him with their money, often without doing the kind of due diligence that might have uncovered his Ponzi scheme.

Psychologist Dan Simons from the University of Illinois has extensively studied the concept of inattentional blindness, which relates to the human tendency to miss things in plain sight simply because they aren’t expected or relevant to our current focus of attention. This phenomenon can certainly be applied to the Madoff case.

Madoff had cultivated such a strong halo effect, built on his reputation as a competent money manager, his role as the Chairman of Nasdaq, and the SEC’s multiple clearances of his operations, that people largely failed to consider the possibility of deception.

As I conclude this article, I want to go back to SBF’s case to highlight the nefarious impact of the halo effect.

Conclusion: tl;dr

The halo effect is a common psychological bias repeatedly starring in high-profile financial frauds such as those perpetrated by Sam Bankman-Fried (allegedly, as I write these lines), Elizabeth Holmes, and Bernard Madoff. It is a cognitive shortcut where we tend to assign a favorable judgment of a person based on a specific trait or accomplishment.

In the context of investment, the halo effect can lead to nefarious consequences. It can turn Founders and financial gurus into untouchable figures, obscuring their flaws and casting a blinding light on potential red flags. Venture Capital is particularly prone to the halo effect, with its tendency to put entrepreneurs, seen as Schumpeterian heroes bent on changing the world, on a pedestal.

Throughout this exploration of the halo effect, I have explored the stories of individuals who were seemingly endowed with halos but ended up casting long shadows over Investors and stakeholders. Whether it was the seemingly noble motivations of Effective Altruism champion Sam Bankman-Fried, the charisma and conviction of Elizabeth Holmes at Theranos, or the financial prowess of Bernie Madoff, the halo effect led many to look the other way when caution was warranted.

The danger is that the halo effect closes our eyes to the full spectrum of an individual’s character and actions. In the case of Sam Bankman-Fried, the glare of his lineage and altruistic ventures overshadowed his unbridled risk appetite and troubling history at Alameda. His penchant for playing video games during crucial discussions could have been perceived as a baffling distraction, but his halo distorted it into the myth of a genius at work.

For SBF and others who have harnessed the halo effect to further their ambitions, there’s a lesson here: reputation and charisma can be powerful, but they should never overshadow due diligence and a critical evaluation of actions and intentions. Investors must be willing to look beyond the halo to see the whole picture.