Why Series A Graduation Is So Hard: Lessons from Paul Graham

Securing a Series A round has always been a major hurdle for startups, but recent data highlights just how difficult this milestone has become. Historically, roughly one in four startups that raised a Seed round managed to secure a Series A. Today, what is called “Series A Graduation” has dropped to nearly 10%, a historical low. While market dynamics—like stricter Investor requirements and an overload of startups raising Series A rounds—play a significant role, there’s something deeper at work. Y Combinator’s Paul Graham captured this challenge perfectly: the problem is that many Founders don’t use the Seed round to answer the most pressing questions about their business, leaving them ill-prepared to clear the Series A bar. In my analysis, beyond overconfidence, the root issue often lies in fear of failure. This fear, fueled by perfectionism, traps Founders in endless product iterations instead of pushing them to confront the market.

Series A Graduation: A Growing Challenge

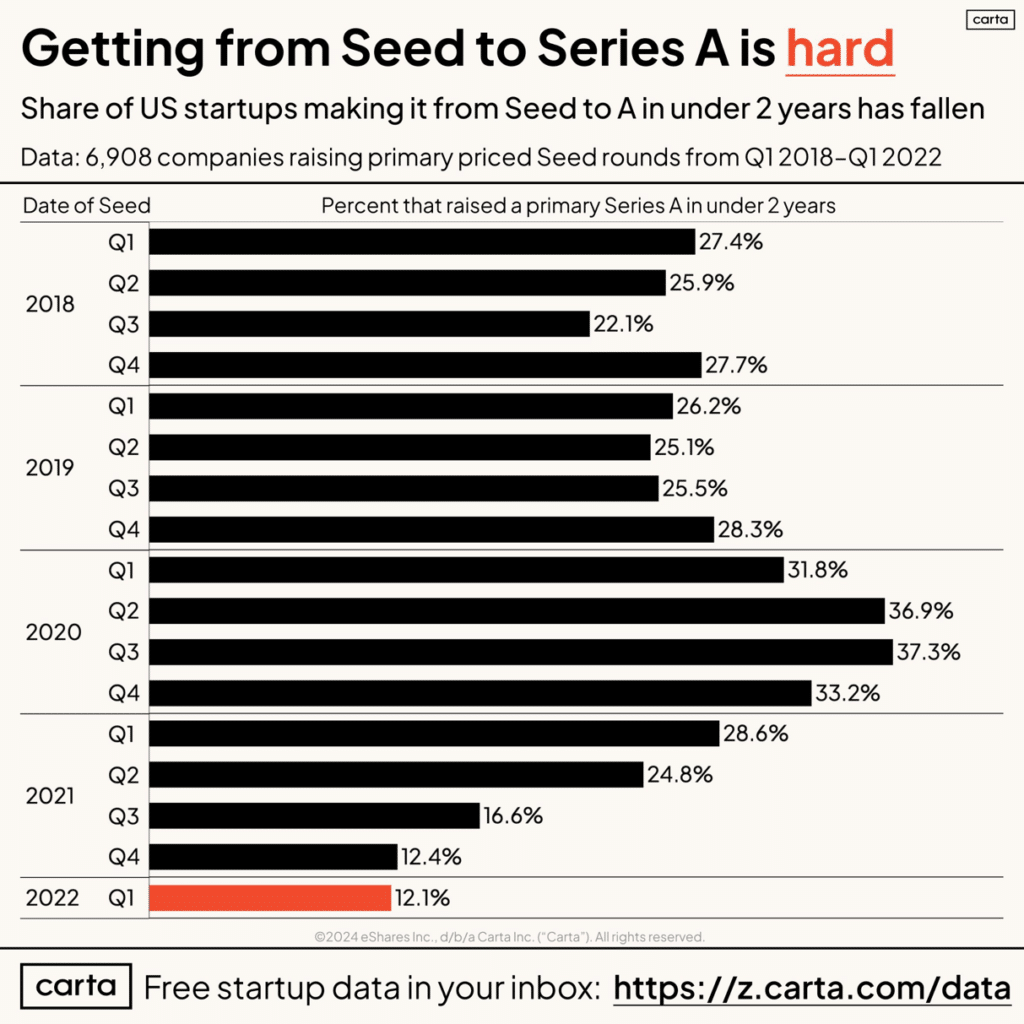

The transition from Seed to Series A funding has become increasingly difficult for startups in recent years.

In the U.S., the “graduation rate”—the percentage of startups that successfully raise a Series A within two years of their Seed round—has plummeted. While 37% of startups that raised Seed rounds in early 2020 achieved Series A within two years, this rate dropped sharply to just 12% for those that raised Seed funding in Q1 2022. It’s a sharp decline compared to the historical averages.

Only 12% of startups that raised their Seed round in late 2021 and early 2022 raised the following Series A round within two years

What’s driving the decline? There are several reasons for this drop:

- Higher Bar for Series A: With the 2022 market reset, Investors now demand startups demonstrate stronger traction, product-market fit, and revenue growth before investing

- Bridge Rounds Overload: An increasing number of startups are resorting to bridge rounds, creating a bottleneck for Series A Investors who face a surplus of options.

- Investor Selectivity: With more Seed-stage startups competing, Series A investors are exercising greater caution and raising the stakes for “must-have” opportunities.

“Nice” traction no longer turns heads – it’s gotta be stellar traction. Or a repeat founder with successful exits.

Peter Walker – Carta (source: Linkedin)

Another, more optimistic reason is that startups don’t need to raise more money because they are performing well (unlikely given the economic environment) or bootstrapping to weather the storm.

As Series A becomes harder to achieve, Founders must rethink how they allocate their Seed money. The emphasis has shifted from expanding aggressively to de-risking their core value proposition and showing measurable progress toward sustainable growth.

The growth-at-all-cost model has given way to a focus for being profitable quickly. The shift is not new, as I explained in the article below.

Go Further: How Venture Capitalists Evaluate Unit Economics

While the current VC market may be at fault for the glut in Seed startups not raising the next round, there are fundamental dynamics at play here. Most first-time Founders raising a Seed round fall into the same traps.

The Main Traps Seeded Founders Fall Into

The first trap Founders raising their second funding round make is believing it will go like the first one: Share a vision in a shiny pitch deck, vaguely talk about the go-to-market strategy, briefly mention unit economics, and only focus on the team and the problem.

However, raising a Series A round is about much more than that. VCs want to see how far Founders got with the money they raised, especially in terms of de-risking the initial market assumptions.

Venture Capitalists fund a “series of experiments,” as Flybridge Ventures’ Jeff Bussgang elegantly put it. They determine the Seed round’s amount to give enough resources to the startup to reach the next step in its growth trajectory, a technique I detailed in the article and webinar below.

Series A Venture Capitalists are also looking for key growth metrics and at least some confirmation of product-market fit. It’s not about the idea anymore, but how real the market is.

While the Seed round’s goal is to test a team and an idea, the main objective of Series A rounds is to confirm customer adoption and do more of what worked to find customers.

In an episode of the hilarious HBO TV show Silicon Valley, Angel investor Russ Hannemann explains to Richard and his team that “if [they] show revenue, people ask how much, and it’s never enough.” As is often the case with this brilliantly written show, there is some truth beneath the caricature. Seed rounds are about promises, but Series As are about traction—the answers Paul Graham, Y Combinator’s famous co-Founder, mentioned in his quote.

You can raise a seed round by pleasing investors, but to raise series A you have to please customers.

Paul Graham – Y Combinator (Source: X)

Graham advised and funded countless early-stage startups at Y Combinator. He’s seen first-hand companies that don’t ask promising questions (and don’t get funded), but also startups that don’t provide answers to the initial questions despite spending all their Seed round’s money.

The main obstacles Founders meet on their way to Series A typically include:

- Spending the money too fast

- Not focusing on value-creating tasks

- Realizing they need to pivot but not having enough funds to do so

- Failing to confirm the market’s existence

- Not finding unit economics that work

There is no single cause to these obstacles; they may result from poor planning, lack of discipline and focus, not raising enough money (or raising too much, which get sucked into the wrong places), making hiring mistakes, and bad luck.

But the biggest trap by far is the lack of focus. Founders struggle to devote their time and attention to the only metric—or set of metrics—VCs care about. I listed them in the article below, with practical case studies.

I often tell entrepreneurs that financial Investors don’t make the strategy. But if they want to take the Venture Capital route, Founders must abide by the rules in effect: gain enough momentum to get to the subsequent funding round.

Entrepreneurs often don’t realize that the funds bestowed upon them are more about answering the next wave of questions than executing on the strategy they presented during the Seed round.

Investors want that money to produce traction (typically, in the form of revenues) while many Founders focus on costs: how to build a better product, hire a larger team, and acquire traffic. Paying for customer acquisition too early is a common pitfall inexperienced Founders fall into.

Case Study: Yuri Sagalov and “The Hope Strategy”

In a candid Twitter thread a few years ago, Yuri Sagalov, a former YC partner who’s now a VC at Wayfinder Ventures, recounted a misstep many Seed-stage Founders face in transitioning to Series A.

In 2010, Sagalov and his team at AeroFS, a startup he co-founded, experienced what many early-stage Founders dream of—a breezy Seed round. Their technical expertise and youthful confidence led to an oversubscribed raise.

However, this early success bred complacency.

We confidently handwaved away questions like “how will you get customers?” and spent most of our time building product.

Yuri Sagalov – Wayfinder ventures (source: X)

When it was time to raise their Series A round, Sagalov approached Sand Hill Road VCs expecting the same red carpet treatment as for their Seed round. But it was a whole other story this time around.

The team had built an enterprise product with some free users but lacked paying customers. When faced with the critical “how will you get customers?” question during a partner meeting, Sagalov found himself unprepared.

One partner bluntly interrupted him, saying: “Yuri, hope isn’t a strategy.” The meeting ended disastrously, leaving Sagalov shell-shocked and reflective.

Sagalov admits that he spent time angry at the partner’s behavior but later recognized the harsh truth: “We didn’t have a plan on how to get customers at that point, and we weren’t ready to raise our next round.”

Sagalov’s story illustrates that strong technical skills and a compelling product vision are not enough. Founders must demonstrate customer traction and a clear path to revenue to reach Series A graduation.

It is a mistake many entrepreneurs make. Instead of prioritizing sales, talking to prospective customers and learning from the market, they remain in the safe zone of endless product iterations.

For years, I’ve grappled with this question, intrigued by how often this pattern repeats itself. Through my doctoral research, I’ve come to believe that the answer lies in the psychology of Founders and the subtle forces that shape their decision-making.

Why Do So Many Founders Focus On The Product Not The Customers?

I recently wrote about the most damaging mistake of Founders: believing there is a market for their product. In that post, I put forward that the underlying personality trait explaining that attitude is overconfidence.

The same trait could apply here. However, my doctoral thesis on entrepreneurs’ psychology has led me to a different path. Let’s unpack it.

The necessity for startups to prioritize their customers’ needs is one of the most covered topics in startup land. It’s rooted at the heart of the Lean Startup methodology and was further popularized by the concept of product market fit (PMF).

The principles have proven their efficacy. Founders need to market products that are testing simple features, learn from customer feedback, and iterate the build-measure-learn loop till they reach PMF.

At this stage, any entrepreneur who has not heard about the methodology must have been living under a rock. Founders are generally smart, so what is preventing them from applying it?

I used to think the main reason was finding oneself outside of the comfort zone. Technical Founders in particular, so runs the cliché, don’t like to sell.

Founders often struggle with the possibility of being unconsciously motivated by the fear of failing. The image they project, including to themselves, is that of a rugged risk-taker. It’s in tune with the media’s representation of entrepreneurs, also conveyed by the startup ecosystem.

Over the last fifty years, the picture of the entrepreneur has gradually moved to one of a maverick defying all odds to make a vision come true—even when nobody believed in them.

Steve Jobs and Elon Musk are examples often cited in this regard.

How The Fear of Failure Gripples Entrepreneurs

Another common attribute given to Jobs and Musk is their obsessive pursuit of the perfect product. Stories about Steve Jobs incessantly pushing his teams to develop a better version abound. Or, in some cases, his competitors’ teams. A Google VP once told the story of Jobs calling him on a Sunday to ask him to fix the yellow gradient of Google’s logo on the iPhone’s home screen.

How do these common beliefs on entrepreneurs stand to closer examination?

I wrote elsewhere that entrepreneurs are more risk-averse than most people think. They often don’t view a situation as risky due to their confidence in their abilities.

The second characteristic of entrepreneurs I mentioned above, perfectionism, plays a more subtle role in their incapacity to focus on traction instead of the product. The main reason is that perfectionism is a multidimensional construct.

If you’re trying to avoid failure, having prospective buyers tell you all that is wrong about your product may not be the best strategy. Spending hours refining it, on the contrary, gives satisfaction and shields from the realization that you may walk in the wrong direction.

The overconcern for mistakes leads perfectionists to strive for their goals by a fear of failure rather than a need for achievement.

Frost et al. (1990). Source: Cognitive Therapy and Research

The notions embedded in this definition of perfectionism merit further examination, which are not within the scope of this post. I would conclude by saying that they often find their sources in childhood and upbringing, a topic of focus for many researchers.

Can You Tell If Perfectionism Is Holding You Back?

The more entrepreneurs I train and mentor, the more I realize how this deeper mechanism is at play. However, it’s difficult to spot and even harder to place in plain sight of the Founder. Many of them will not recognize that their endeavors on the product are fruitless before it is too late. (Unfortunately, it often leads to the end of the venture, as the company’s resources have been spent.)

To make things even harder, many Founders honestly believe they are building a rough version of a product, compared to their grand vision. They don’t see that their prototype is already too complex to test a simple hypothesis about the customers’ real needs.

One way to identify the “perfectionism bug” is by answering this simple question: how many issues is the product addressing?

One Product, One Problem

I recently talked with a Founder building an app to help people suffering from an eating disorder remain engaged in the new habits they were trying to develop.

He demoed the product, showing me various features, including a section containing content on how to prevent the illness. When I expressed surprise—target users had already been diagnosed, so they would not consult that section—, the Founder replied that this feature was aimed at another group of potential users. People who didn’t yet have the condition but were at risk.

In short: he had not built an MVP, whose main objective is to answer a limited number of questions about its potential customer adoption (in this case: “does our methodology help sick users stick to their new habits?”). The first version of the product was already answering multiple mutually-exclusive problems.

This mistake is typical of entrepreneurs who don’t talk to potential clients or users enough. Being opportunistic is a critical quality of Founders. But casting the net too wide makes it difficult for the product to exist. You don’t position and market an app to help cure a disease like one educating about it.

The pitch deck’s problem page is a good entry point into this challenging but unavoidable discussion. A mistake often made is to list thoroughly all the problems the imagined customer has. Founders with a background in consulting or marketing are adept at it, in my experience.

If your product is trying to solve more than one problem, chances are you are not talking to your potential customers enough.

Only one question matters: which feature of the product will make them buy it?

Core vs. Peripheral Features

Most Founders confuse the core issue that leads people to buy their products and peripheral features that may help but are not significant enough to trigger a purchase.

Kima Ventures, one of the most active early-stage funds globally, uses what they call the NPE Canvas.

I learned that lesson hard when I first launched my e-mentoring platform in 2018. (Before it was a non-profit initiative, what is now The VC Factory was called the TytchMe Academy and had a commercial component to it.)

My initial vision was that the platform “would make money while I slept”, I joked. I spent a lot of time and resources designing and building the online programs to be self-sustaining. The idea was that, contrary to my previous consulting practice, the platform could make money with minimal involvement on my part.

The first lesson I learned from startups enrolled in the online programs was that the Founders loved the ability to learn at their pace, having additional curated content, and the overall pedagogy. But the only thing they were ready to pay for was… my mentoring hours.

In other terms, the core feature was opposed to my vision of spending minimal face time in this activity. Had I talked to prospects before embarking on the adventure, I would probably have designed a very different product. (Silver lining: the programs today are well adapted to this reality. But it took longer to get there.)

If you’re not embarrassed by the first version of your product, you’ve launched too late.

Reid Hoffman

Most Founders misinterpret what Reid Hoffman was trying to convey with this aphorism. As he clarified in a LinkedIn post a decade after coining it, the point is not to launch a product that you are “deeply ashamed” of. Hoffman wanted to encourage entrepreneurs to iterate with customers as early as possible. What will embarrass you is “how many wrong assumptions you made”.

Fear of failure can be a strong motivator for some, but for the average Founder, it’s a crippling feeling they need to keep in check. A road that starts by being aware of it.