How Elite VCs Read Startup Pitch Decks In 3 Minutes

- 4.6K views

- 28 minute read

Venture Capital is a high-velocity asset class requiring quick go/no-go decisions multiple times daily. Data reveals that Venture Capitalists typically spend just a few minutes on startup pitch decks, either to prep for a call with a Founder or to decide whether such a call is worth their time. Understanding this, the question becomes: How do elite VCs efficiently sift through the clutter to focus on the potential winners?

In this post, I draw from best practices top VCs use to evaluate startup pitch decks quickly. The article is structured around the critical questions VCs ask themselves while going through startup pitch decks, ultimately answering the question: "Why should I care?" This article primarily aims to assist Venture Capitalists in streamlining their pitch deck evaluation processes. Still, Founders will also benefit immensely by gaining an insider's view into the Venture Capital decision-making process.

I illustrate my points using the famous Airbnb pitch deck as a case study. While not perfect, this deck is often imitated but rarely surpassed, capturing many elements that Venture Capitalists typically look for in early-stage startups.

In This Post

- 1. "What Is This Pitch Deck About?"

- 2. "Does It Fit My Investment Strategy?"

- 3. "Yet Another Product That Nobody Wants?"

- 4. "Is It Compatible with Venture Capital?"

- 5. "Will The Startup Be Profitable One Day?"

- 6. "What Type of Risk Am I Taking?"

- 7. "How Likely Are They To Succeed?"

- Conclusion: tl;dr

1. "What Is This Pitch Deck About?"

First impressions are crucial, more so for Venture Capitalists who receive dozens, if not hundreds, of startup pitch decks yearly. Elite VCs know what they expect from pitch decks, and many VC firms have shared startup pitch deck templates to help Founders make a document in a particular order that is easy to read because they are used to it.

However, it doesn't mean VCs read startup pitch decks page by page. Venture Capitalists will flip back and forth through a deck, ticking off their mental checklist. So not only should the deck immediately answer the question—"What is this about?"—but it must also do so in a way that sets the stage for the rest of the slides to come.

Cover and Tagline: More Than a Formality

The cover slide and tagline aren't merely placeholders—they're an integral part of how a Venture Capitalist assesses a startup at first glance. A well-crafted tagline can instantly convey the essence of what the startup does and why it could be a game-changing venture.

If the tagline resonates with the Venture Capitalist's current focus or personal convictions, it could significantly increase the chances of a deep dive into the deck. Conversely, a vague or overly complicated tagline may signal a lack of clarity in vision or value proposition.

Taglines also serve a crucial role in immediately focusing the Venture Capitalist's attention on the vertical being addressed by the startup. Given the high deal flow, a Venture Capitalist's day often involves reviewing an eclectic mix of startup pitch decks, ranging from B2B SaaS startups to e-commerce operations. A clear, concise tagline enables the Venture Capitalist to instantly contextualize the startup, making assessing fit with their investment strategy easier.

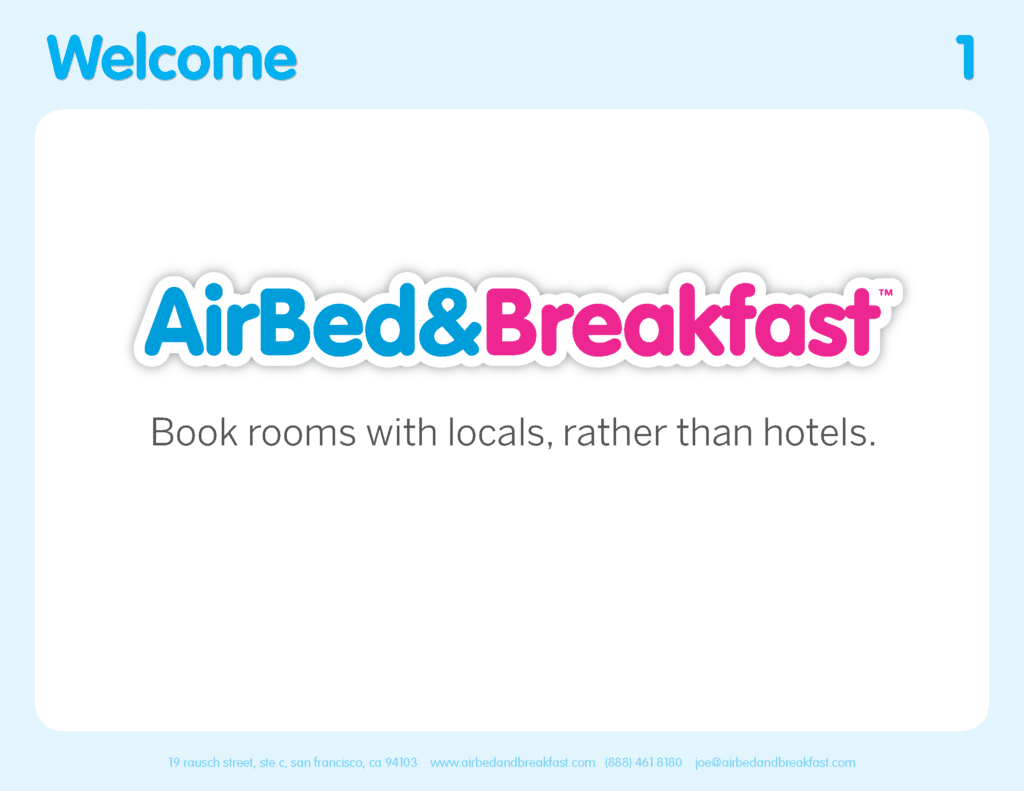

The tagline "Book rooms with locals rather than hotels" employed by Airbnb in their early-stage fundraising pitch deck is an exemplary case of effective messaging. It immediately signals to the Venture Capitalist not only the vertical the startup is operating in—travel and hospitality—but also hints at the disruptive nature of the business model.

The tagline succinctly contrasts Airbnb's offering with traditional hotels, capturing the essence of the startup's unique value proposition. For a Venture Capitalist navigating through multiple startup pitch decks in a single day, such a tagline acts as an efficient mental bookmark, aiding in rapid contextualization and evaluation of the investment opportunity.

Page Design: The Subconscious Weighs In

The design of the pitch deck is often an overlooked element that carries subtle, sometimes unconscious, biases. A clean, professional design not only enhances readability but also signals a well-thought-out pitch and, by extension, a competent team.

Conversely, inconsistencies in font, cluttered layouts, or even the wrong color scheme can introduce a slight but pervasive sense of disorder. While seemingly trivial, these visual factors can subconsciously affect a Venture Capitalist's willingness to invest time in evaluating the opportunity. Design elements can tip the scales in the startup's favor—or against it.

Airbnb's Founders are designers; it is one reason why their fundraising pitch deck stands out.

However, top-tier VCs do not underestimate the psychological dimension of their decision process. They know how to look beyond the surface of well-designed or lackluster startup pitch decks to hone in on the essence of what a startup brings to the table. They recognize that not all Founders are design-savvy, yet they may be visionaries with groundbreaking ideas. By not fixating on design aesthetics, VCs give themselves the latitude to evaluate the core merits of a business idea and the team behind it.

This approach also promotes greater diversity in deal sourcing, allowing VCs to uncover gems that might otherwise be overlooked due to superficial shortcomings. Being open to different styles and formats of presentation can provide a competitive edge, enabling VCs to source deals from a broader, more diverse set of opportunities than those who focus solely on surface-level elements.

2. "Does It Fit My Investment Strategy?"

As outlined in my post "Venture Capital Funds: 5 Questions For Optimal Capital Deployment", a VC firm's investment strategy is a core driver of its investment team's focus. To make efficient use of their time, experienced VCs quickly discern whether a startup aligns with their investment strategy. While they review the deck, they make mental notes to validate whether they should spend more time on a particular investment opportunity.

The typical information they look for includes:

- The vertical in which the startup is active

- Where is the startup located, and what geographical markets it targets

- How much traction it has

- How much money Founders are looking for

These elements are typically scattered throughout the deck and sometimes not mentioned, which sometimes is a drag of VCs' time.

In later stages of investment, particularly in growth equity and leveraged buyouts (LBOs), it's common for Founders to include an executive summary as part of their fundraising pitch deck material, called an information memorandum.

The "exec sum" efficiently informs Investors whether the company aligns with their specific investment strategy, allowing for quick decision-making. Unfortunately, this best practice is rarely emulated in early-stage Venture Capital scenarios. Adopting this approach could significantly streamline the evaluation process for VCs and offer a concise way to convey the startup's value proposition, key metrics, and alignment with a Venture Capitalist's investment criteria.

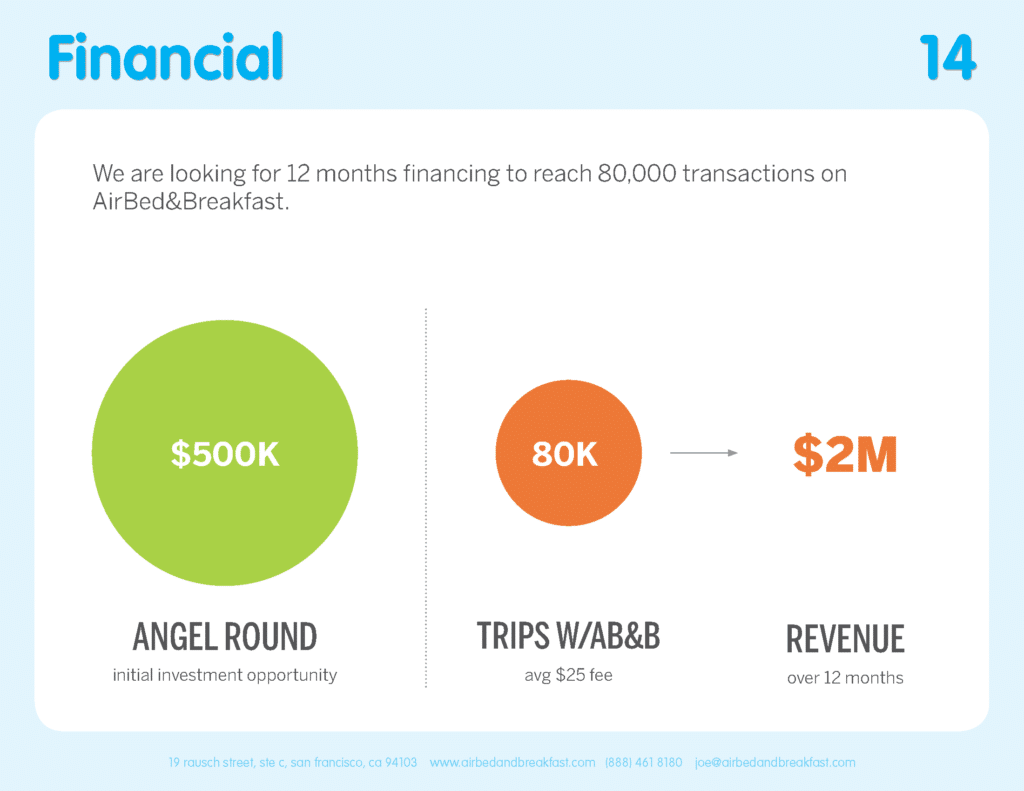

Airbnb's fundraising pitch deck slide titled "Financial" encapsulates some pivotal elements that align with what Venture Capitalists typically look for regarding investment strategy. The slide succinctly states that they are seeking financing for 12 months to achieve 80,000 transactions, underlining both the short-term objective and an explicit key performance indicator (KPI). The visual representation of their $500K Angel round juxtaposed against the expected 80K trips and anticipated $2M revenue makes for quick and efficient comprehension.

I also like that this slide focuses on milestones, not costs.

I often ask Founders: "What do you want the money for?" to test them. When a Founder responds with a generic list like "hire a sales team, spend on advertising, and hire more developers," a mental orange flag appears in my head. Such answers lean towards describing inputs and may indicate a prevention-focused mindset. VCs are primarily interested in the expected outcomes these inputs will drive.

By emphasizing milestones, Founders can better align with a Venture Capitalist's perspective. A growth-oriented metric offers a tangible and quantifiable goal, enabling Investors to measure progress, predict potential returns, and assess the company's ability to execute its strategy.

However, one noteworthy observation is the placement of this crucial slide. It is positioned at the end of the fundraising pitch deck. Given its importance in communicating alignment with a Venture Capitalist's investment strategy, leading with this slide or placing it more prominently might have helped Airbnb more immediately establish the nature of the opportunity and its strategic goals. This is especially salient considering that VCs, due to high deal flow, may not always progress through every slide in the deck.

3. "Yet Another Product That Nobody Wants?"

We now get into the crux of the analysis VCs conduct on startup pitch decks. Contrary to what many Founders believe, Investors are not primarily interested in their product. After validating that the startup indeed fits their investment strategy, experienced Venture Capitalists obsess about the reality of the problem the startup decided to tackle.

They know the pitfalls of investing in startups that might appear innovative but lack a genuine problem to solve. They've witnessed, time and again, bright ideas that did not resonate with a sizable or urgent market need and ultimately joined what I call the "startup cemetery." The ability to discern between a startup genuinely addressing a pressing issue versus one that is merely an answer without a question becomes paramount.

Most startups are great at creating, over time and over budget, a product that nobody wants.

Eric Ries - LEan Startup

VCs learned the hard way that the primary cause of startup failure is not securing a loyal and expanding customer base. It's not enough for a startup to showcase an impressive product or solution; it has to resonate with an actual pain point or unmet market needs. Elite VCs have cultivated an instinct for this, often seeking tangible proof, like early traction or deep market research, to validate a startup's proposition. This is why product-market fit is such an essential concept for financial Investors.

Reading these early signals is the focus of my VC Career Accelerator's practice sessions. We review real-life startup pitch decks and "build the muscle" of quickly evaluating their potential. I encourage Investors to get into the end user's shoes when considering a startup's value proposition. They must learn to discern if the product or service offered helps their customers fill at least one of the following needs:

- Increasing Revenue: Is the solution capable of boosting the customer's top line by attracting more clients, favoring cross-selling and upselling, or entering new markets? Products helping customers sell more fare better, especially in dire economic times. For example, food delivery services such as Deliveroo help restaurants increase sales by addressing a new category of customers.

- Decreasing Costs: Any solution that can reduce operational, administrative, or production-related expenses is invaluable for customers. In competitive markets, businesses continually look for ways to improve their bottom lines. Startups that can offer innovative solutions to cut costs, improve efficiency, or eliminate wastage have a significant edge. Canva perfectly illustrates that concept by considerably decreasing creation-related expenses for small businesses.

- Addressing Pressing Issues: Beyond the direct financial implications, solutions that tackle urgent challenges are more likely to attract customers. This includes navigating complex legal landscapes, adhering to evolving regulations, or mitigating risks. Startups that can provide clarity, ensure compliance, or simplify intricate processes can be considered indispensable partners for their target audience.

Above all, experienced Venture Capitalists prize a distinct insight that sets the Founding team apart—an understanding or vision that eludes others in the market. Such insights often form the bedrock of disruptive innovations.

Let's take Airbnb as an illustrative example. Bryan Chesky's unique insight is to have recognized that while hotels had streamlined the unpredictability of bed and breakfast stays with standardization, there was an untapped opportunity. He envisioned a model that combined the consistency and predictability guests cherished in hotels with the warmth and authenticity inherent to bed and breakfasts. His unique perspective on blending the best of both worlds was central to Airbnb's novel approach to lodging.

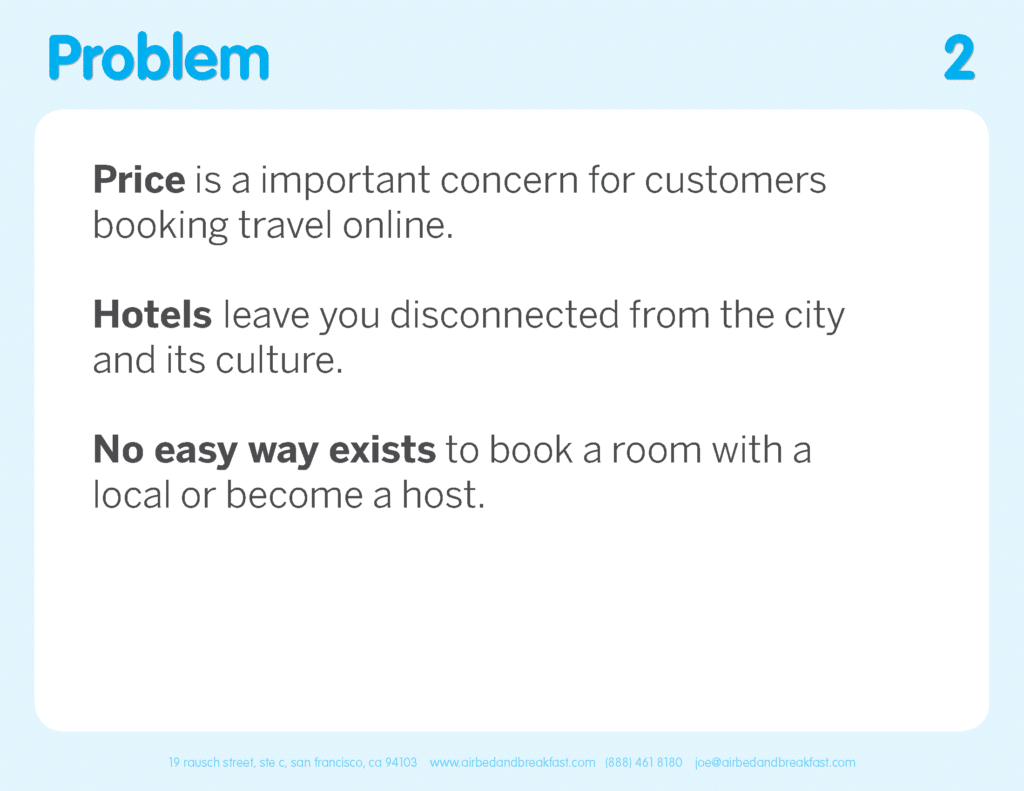

Airbnb's problem slide succinctly highlights the main pain points faced by travelers: the cost of online bookings, the impersonal nature of hotels, and the lack of easy local hosting options. While these are valid concerns, from a Venture Capitalist perspective, it's essential to see data backing these claims, demonstrating a genuine market need. (See the next slide).

The slide might also benefit from a clearer presentation of how widespread these problems are and who specifically faces them. Airbnb is a platform catering to hosts and guests, which makes the message a tad complex. The Founders should have shown both parties' problems. One of the startup's critical success factors is that, after the 2008 Great Financial Crisis, more people were open to renting out their properties to make an extra buck.

There is another issue with Airbnb's problem slide. A cardinal rule is the singularity of focus. Often, startups fall into the trap of presenting an assortment of problems, each necessitating its own unique product, go-to-market strategy, and distinct marketing endeavors. This scattershot approach not only dilutes the core message but also raises red flags for potential Investors about the startup's ability to execute efficiently.

Consider, for instance, a startup aiming to revolutionize the health industry. If their Problem slide highlights issues ranging from inefficient hospital administration to the need for better mental health apps and the lack of effective fitness trackers, it immediately begs the question: Which problem are they truly equipped to tackle? A scattered approach hints at a lack of clear direction and strategy, which is precisely what Investors are wary of.

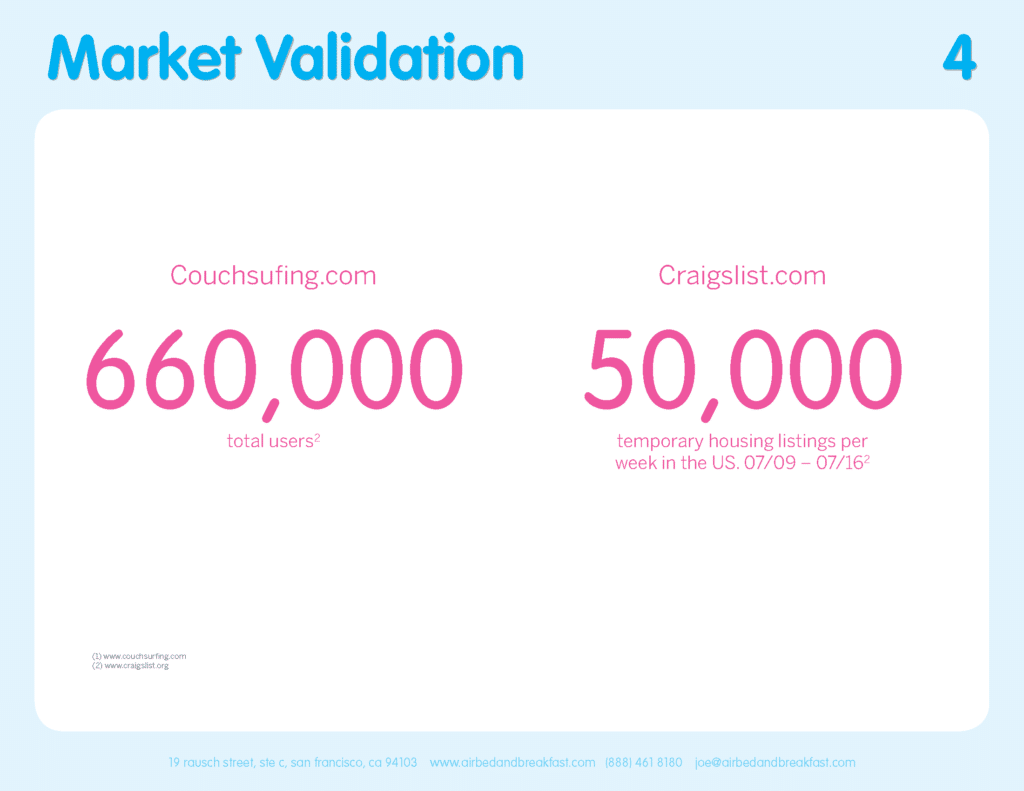

To me, this slide is the master stroke in Airbnb's pitch deck. It illustrates perfectly what Harvard Business School's Bill Sahlman preached to entrepreneurs for decades: they need to produce data to shift discussions from a debate of opinions—that they are bound to lose, being on the wrong side of the checkbook—to a dialogue rooted in facts. Startups often face skepticism, and without hard data, they are left in subjective debates where they are at a disadvantage.

Startups are in the business of gathering data. Investors are in the business of analyzing data.

Bill Sahlman - Harvard Business School

Perhaps no other successful startup in history met as much skepticism from Investors as Airbnb (with the exception of Tesla and SpaceX). VCs were convinced that guests would be sexually assaulted or murdered. They had trouble understanding how anyone in their right mind would host a complete stranger on an airbed.

The "Market Validation" slide, which is uncommon in startup pitch decks, was a critical part of Airbnb's demonstration that there was indeed a market for their product.

The fact that Couchsurfing, a platform connecting travelers with locals willing to offer a free place to stay, had 660,000 total users demonstrated that there was already a sizable number of people comfortable with the idea of staying with strangers. This helped dispel the commonly held belief that people wouldn't be open to such arrangements due to safety concerns or the perceived oddity of hosting strangers. (Fun fact: Very few people identified the typo "Couchsufing" in the slide).

Additionally, the 50,000 temporary housing listings per week on Craigslist in the U.S. showed that there was a significant demand for short-term housing solutions outside the conventional hotel sphere.

By presenting this data, Airbnb effectively convinced Investors that there was a pre-existing market and demand for their proposed service. Instead of relying on mere conjectures or beliefs about the potential dangers of hosting strangers, Airbnb grounded its market validation in tangible numbers.

4. "Is It Compatible with Venture Capital?"

Contrary to what constant social media posts led many to believe in the last market upcycle, Venture Capital is not a one-size-fits-all solution for every startup. After validating that the startup fits their investment strategy, top VCs avidly look for signs of scalability and the potential to address a large market.

Market Size or Market Opportunity?

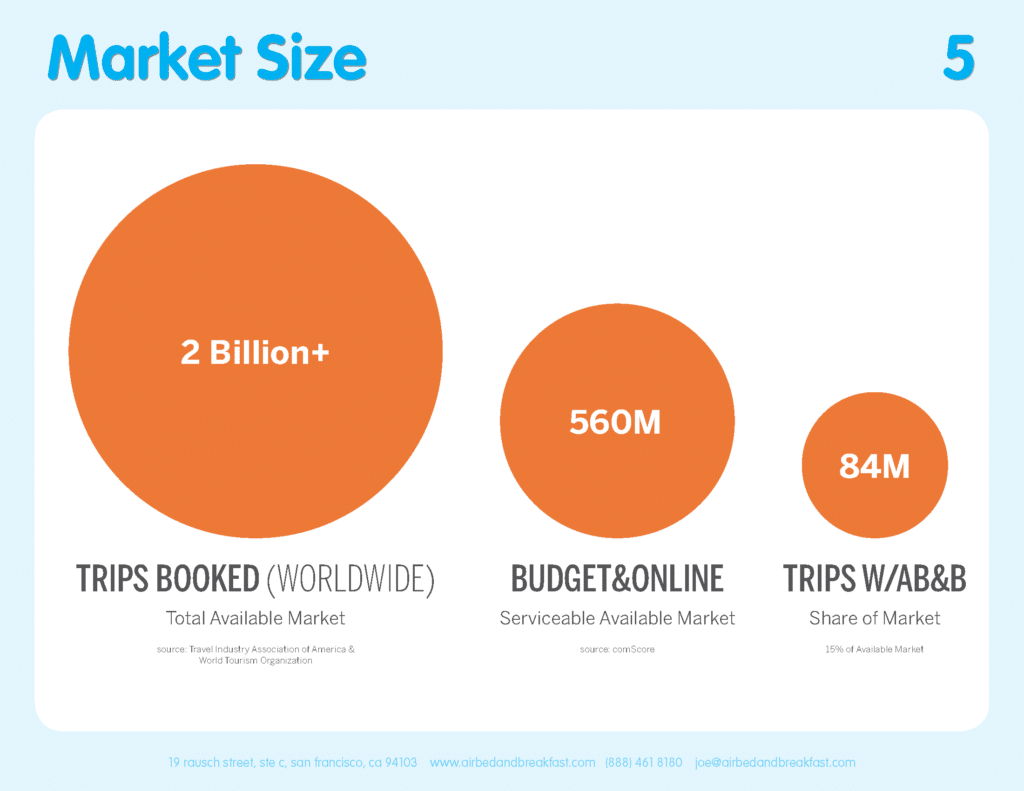

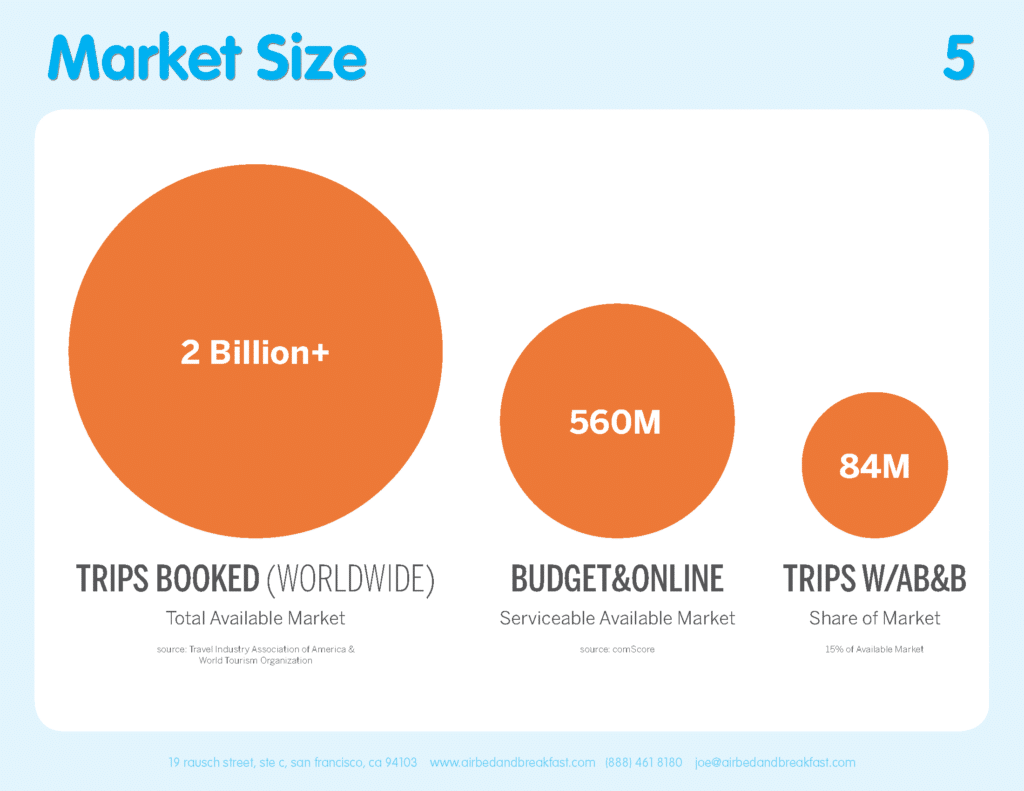

How do elite VCs evaluate market size? I wrote two lengthy and detailed posts on the topic, mostly to help Founders create helpful market slides. VCs use the TAM SAM SOM to evaluate market size, and the beachhead approach to assess market opportunity.

Elite Venture Capitalists understand that mere market size isn't an indicator of a startup's potential success. They don't fall into the "TAM trap," where founders highlight an immense market and argue that by capturing just "1%", they'd be on their way to creating a unicorn. This overly simplistic approach often fails to convince experienced Investors.

Rather, seasoned Venture Capitalists gravitate towards the SAM (Serviceable Available Market). SAM doesn’t just represent a number; it showcases the unique insight the Founding team possesses about their market. It reflects the granularity of their understanding, suggesting that they've engaged with potential customers to discern who feels the most acute pain from the problem the startup aims to solve.

When Founders present vast market sizes without clear identification of segments or pinpointing their beachhead customers, they inadvertently send a signal to Investors. It suggests they're more inward-focused, rather than genuinely understanding the external market and its intricacies. Worse, it may indicate a tendency to fear failure, which is not a precursor to success in entrepreneurs.

For a startup to truly resonate with elite Venture Capitalists, it's not just about showing opportunity – it's about demonstrating a deep, nuanced understanding of that opportunity.

Airbnb's presentation is a good example. The Founders didn't fall into the TAM trap; they started with TAM but quickly moved to more refined and actionable segments. The TAM gave a sense of the magnitude of the entire market, especially as the share of the budget and online segments grows in the total travel market.

By narrowing down their SAM, Airbnb's Founders demonstrated a clear understanding of their target clients. They've identified their niche (budget and online travelers) and have set clear short-term goals.

This slide would likely indicate to an experienced Venture Capitalist that Airbnb's Founding team is looking outward and has a clear comprehension of their place in the larger travel market. They've identified their core client base and are not just chasing after the allure of a vast, but generic, market.

Assessing Scalability in Startup Pitch Decks

A startup may have a great product and address a large market, but if the business model is not scalable or the market size is limited, it could be a quick "no" for most Venture Capitalists. It is essential to take a moment to gauge these factors because they can be the ultimate litmus test for the company's compatibility with VC investment.

Surprisingly, scalability's core essence is often misinterpreted by many, including some Venture Capitalists and, even more frequently, Founders. At its heart, scalability isn't just about rapid expansion or skyrocketing user numbers; it's deeply ingrained in the very fabric of a startup's business model and growth strategy.

Simply put, scalability describes a startup's ability to grow without being hampered by its structure or unavailable resources when facing increased production. It's about achieving higher revenue growth without a corresponding linear increase in costs. This property makes a scalable business particularly attractive, as it means potentially exponential profit growth. Virality and network effects (which are two different concepts) help scalability, but they don't equate with it.

I don’t know how to write a business plan, but I know how to read them. You start at the back, and if the numbers are big, we look at the front.

Tom Perkins - Kleiner Perkins (Read more about this quote in this article)

Consider Dropbox, whose business model exemplifies scalability. Once the infrastructure was set up, adding an additional user incurred minimal costs–mostly storage costs, which continued to decrease over time due to technological advancements. Their revenue, however, increased with each premium user addition, creating a situation where revenues grew at a much steeper rate than costs.

What makes Dropbox's example even more compelling is that even their user acquisition strategy was scalable. By offering additional free storage to users who referred others, they turned their user base into promoters. This referral strategy meant that their user acquisition costs didn't spike significantly as they grew, maintaining a scalable model not just in product delivery but also in marketing.

Experienced Venture Capitalists pay keen attention to the business model slide in startup pitch decks, as it provides pivotal clues about a venture's scalability potential. For instance, platform-based models, like Facebook and Uber, inherently possess scalability. These models allow for the addition of new users at marginal costs, who are then monetized through advertising or commissions on rides, respectively.

Conversely, models that rely heavily on manual processes might not scale as efficiently. Think of tech firms that might need to install hardware for each new client or provide intensive, one-on-one customer service. It's a trap that even SaaS startups, which are supposedly the epitome of scalability, often fall prey to.

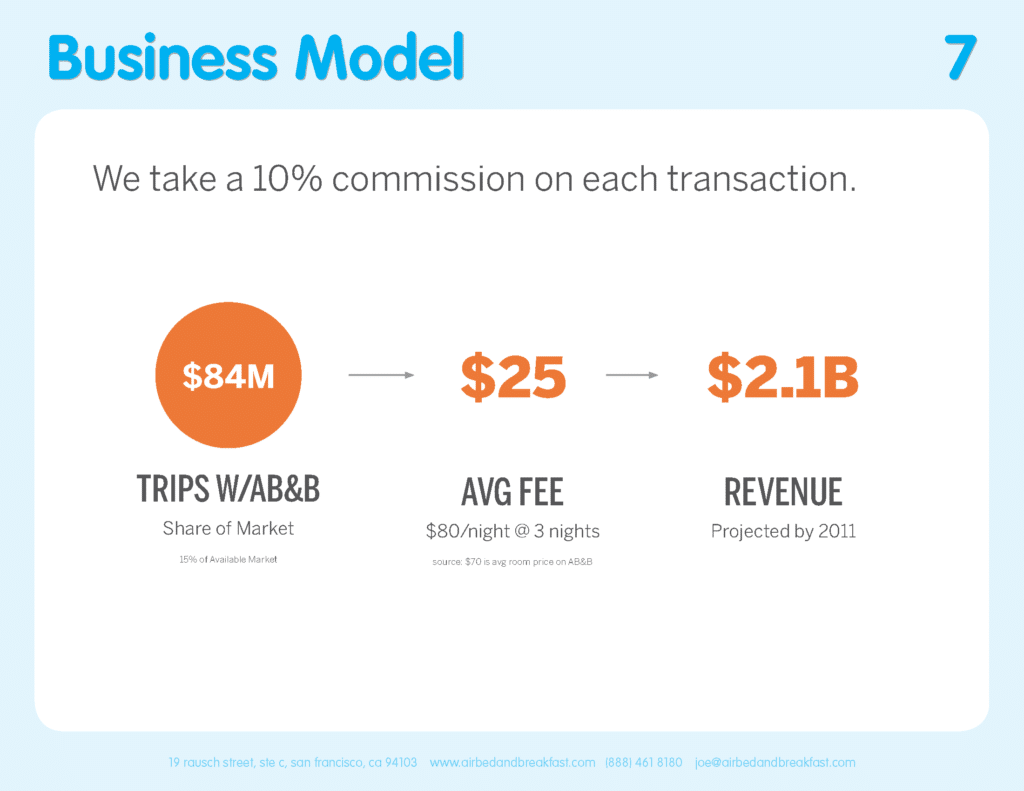

Airbnb's "Business Model" slide provides a comprehensive insight into the company's potential for growth and its inherent scalability. The slide commences with the statement, "We take a 10% commission on each transaction." This commission-based model underscores Airbnb's strength. Since Airbnb operates as a platform without owning the properties, it means that each new booking brings in a significant profit margin once the minimal variable costs and fixed costs, such as platform maintenance, are accounted for.

While analyzing business models offers a good first step, the litmus test of scalability often lies in the financial projections. A detailed examination of how revenues are projected to grow in comparison to costs can give a more concrete picture of scalability. During the exploratory due diligence process, top-tier VCs sensitize the startup's financial model. By adjusting key variables to see how they affect outcomes, they can further probe and validate a startup's scalability claims, ensuring they're not just on paper but viable in the real world.

Airbnb's fundraising pitch deck does not include detailed financials, which are rarely shared publicly, but no doubt early Investors such as Sequoia carefully analyzed the company's scalability.

5. "Will The Startup Be Profitable One Day?"

You've reached a Members-only area.

Unlock Full Access

Discover exclusive content curated for Venture Capital professionals and enthusiasts. Join our community and gain unlimited access to in-depth articles, expert guest interviews, MBA-level webinars, and networking opportunities.

Register for our 7-Day Free Trial: Click Here

Already a member? Please Log In Below:

Subscribe to our Newsletter

Join 12,000+ VCs & Founders globally who enjoy our weekly digest on Venture Capital. We keep your information confidential and you can unsubscribe at any time. Sweet!