The 3 Investment Criteria Venture Capitalists Use to Screen Deal Flow

- 6.8K views

- 12 minute read

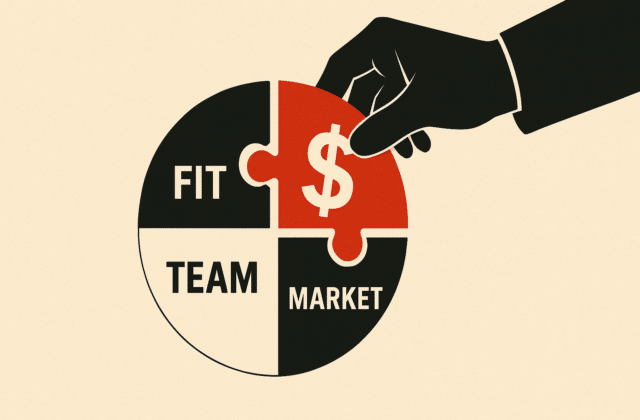

Venture Capitalists must use decisive investment criteria when they evaluate deal flow to determine which opportunities to pursue. Making swift go/no-go decisions allows VCs to allocate more time to the most promising prospects. In this post and the companion webinar, I describe the top criteria experienced VCs use to screen deal flow: alignment with their investment strategy, the Founding team's fit with the execution challenges ahead of them, and the market's size and opportunity. This guide helps Venture Capital Investors sharpen their decision-making process, streamline deal flow evaluation, and optimize their investment choices. It also allows fundraising Founders to better assess their odds of getting funded.

In This Article

Accelerate Your Learning: Watch Our Webinar!

Don’t just read about it, immerse yourself in the content through our companion webinar for this post! Engage with a multimedia presentation, discover all the referenced sources, and have your questions answered live! Click the “Watch Now” button to access the webinar. (Members: click here).

Why VCs Need To Go Through Deal Flow Quickly

Venture Capital is inherently a flow business, with VCs receiving hundreds of potential investment opportunities from a myriad of sources. These sources can range from personal networks, warm introductions, cold pitches, Angel investors, referrals from other VC firms, startups, incubators, accelerators, and demo days.

According to a research paper I detailed in the webinar, only a tiny portion of potential opportunities a Venture Capitalist receives every year get to the finish line. Even the hottest startups struggle to get funding. My estimate is that 1% of startups created every year eventually get funded.

In a blog post that made waves in the otherwise quiet VC industry, Del Johnson, a vocal advocate for inclusive practices in VC, discusses how even Y Combinator startups struggle to get funding. The prestigious startup accelerator developed an Investor portal to track their batches' Series A fundraises. Data collected by YC highlighted that even companies from elite accelerators face significant hurdles in raising Series A funds.

On average, successful fundraising took 30 coffee meetings with individual investors, leading to partner pitches in only 50% of cases. Out of these partner pitches, only 30% led to full partnership pitches, with only one in five partnership meetings resulting in a term sheet. The process, which typically takes 8-12 weeks for seed-stage fundraising, is time-consuming even for strong companies. Del Johnson emphasizes that this inefficiency is further exacerbated for non-networked, early-stage founders.

VCs need to sift through their deal flow quickly and efficiently to pinpoint the diamonds in the rough.

#1. Fit With The Fund's Investment Strategy

Venture Capital firms play a pivotal role in the startup ecosystem by providing the necessary capital and guidance for emerging companies to thrive. However, the Venture Capital landscape can be complex and challenging to navigate for both startups and budding Investors. In this section of the webinar, I show how VC firms’ investment strategies, as well as their philosophies and cultures, influence their decision-making processes, starting with deal flow.

How Limited Partners Indirectly Influence VC Investment Criteria

The structure of Venture Capital explains in large part how VCs make deal flow-related decisions. VC firms act as intermediaries between startups and the investors in their funds, Limited Partners (LPs). LPs are typically institutions, such as pension funds, endowments, family offices, and high-net-worth individuals. LPs have a more passive role in the Venture Capital process, as they are not directly involved in making investment decisions. Instead, they trust the GPs to manage their funds effectively and generate returns on their investments.

One of the primary reasons LPs invest in Venture Capital funds is to diversify their investment portfolios and mitigate risk. By spreading their capital across various VC funds, they can reduce their exposure to any single investment, which may experience losses. Consequently, GPs need to present a well-defined and focused investment strategy to LPs in order to secure funding.

This strategy typically includes factors such as:

- The startup's development stage: pre- or post-product-market fit, scale-up, maturity

- The investment's stage, e.g., early-stage or growth-stage rounds

- Target industry or sector

- Range of the investment size

- Geographic focus

LPs expect GPs to adhere to their stated investment strategies, as it helps ensure that their capital is invested in line with their risk tolerance and return expectations. A tight and coherent investment strategy also serves as a competitive advantage for GPs, as it demonstrates their expertise and competence in managing the funds entrusted to them. I covered this dynamic in depth in the article below.

Most VCs probe for the fit of all startups they consider with their investment strategy as quickly as possible. A few minutes of reading a pitch deck is enough to pass on opportunities. When they do take a call or a meeting, they politely suggest that the Founders “come back later” (a remark entrepreneurs, who often don’t understand the context, often complain about). Most startups ask Investors for too much money, too soon. Many VCs, even at the early stage, need more proof of traction before they can commit.

However, these objective criteria are not the only ones that matter. The firm’s philosophy must also be taken into account.

A VC Firm’s Culture Shapes Their Investment Criteria

Recognizing that investment philosophies differ across VC firms is crucial. While some investors, like Jason Lemkin, focus on specific industries, others, like Fred Destin, avoid certain sectors due to market saturation or unclear winners. Startups must be aware of these differing philosophies when seeking investment

We use a filter based on themes we invest in, ticket size, and geography. If the startup goes through the filter, we look for three more attributes.

Brad feld - Foundry Group (source: 20VC)

In the webinar, I present additional examples from Brad Feld, a prolific Investor and one of the best in the industry, and Vinod Khosla, a co-founder of Sun Microsystems and Khosla Ventures. Khosla emphasizes working on high-impact projects. His firm's mission includes making a positive change alongside aiming for a high internal rate of return (IRR).

While this post is primarily intended for Investors making their way into VC, it also highlights why startup Founders should do their homework before contacting potential Investors: browse VC firms' websites, examine portfolios, read their blog posts, follow investors on Twitter or LinkedIn, and leverage resources like my newsletter and Crunchbase. However, they need to be mindful of potential discrepancies between what Investors say and their actual investments, making it even more critical to carefully evaluate their portfolios.

In the webinar, I also discuss examples of investment strategies for a16z, Initialized Capital, and Cowboy Ventures.

#2. Team Fit With The Execution Challenges

The second critical investment criterion experienced VCs use to screen deal flow is the team’s quality. Some VCs only look at that, especially in the early stages of a startup's development. In this section of the webinar, I present in detail the precise qualities VCs are looking for and nuance them by comparing them to the execution challenges the startup requires to overcome to succeed.

What Are The Qualities VCs Look For In Startup Founders?

A comprehensive academic study led by top researchers in the field a few years ago revealed the most important qualities for a strong Founding team: ability, industry experience, passion, teamwork, and entrepreneurial experience. I provide more details about each in the webinar.

The criterion that most surprises VCs and Founders I train to Venture Capital is industry experience. It plays a crucial role in venture success, as Founders with substantial knowledge in their domain not only understand the problems and value chain better but also possess valuable networks. This often gives Investors confidence in the entrepreneurs’ ability to navigate their business landscape.

I have never seen a venture success for which one person deserves all the credit. The winners always seem to be the founders who can build a kick-ass team.

Brian Jacobs - Emergence Capital (Source: Harvard Business Review)

Teamwork, by contrast, is an expected feature in the ranking of VC’s criteria. More precisely, Investors try to evaluate if there is any major skill gap on the team (including employees). The composition of a strong team varies depending on the nature of the startup. For instance, a more technical or high-tech startup would likely benefit from having a CTO as a co-founder, while all an e-commerce website running Shopify may need is a mid-level developer. The key functions and expertise needed within a team depend on the startup's focus.

In the webinar, I illustrate this point with the Airbnb case study, based on the famous email exchange between Paul Graham and Fred Wilson. You can also dive into the qualities VCs look for in Founders--and the framework they should use instead--, in my webinar How Venture Capitalists Evaluate Successful Startup Founders — And What They Should Do Instead.

The next section addresses a question I often get asked by fundraising Founders: how likely is it to get funded as a solo Founder?

Founding Team vs. Solo Founder

How does the absence of a well-rounded team influence a Venture Capitalist's decision to invest? While solo Founders might have a clear vision and drive, it can be challenging for them to handle all aspects of building a startup. A complementary team, bringing diverse skills and experiences, often garners more interest from Venture Capitalists, who are keen on mitigating risks.

We're generally reluctant to fund single founders. And yet the most successful startup we've funded had a single founder at the time he applied.

Paul Graham - Y Combinator (Source: FORBES)

The Dropbox case study provides a counter-illustration of sorts. While it's true that Drew Houston brought on Arash Ferdowsi as a co-Founder, creating a Founding team for Dropbox—allowing them to get into Y Combinator—it is important to recognize that Houston is often credited for much of the company's success. In this sense, the Dropbox case can be viewed as a nuanced example that highlights the impact a driven, visionary Founder can have on a startup's trajectory. Nonetheless, the importance of having a strong Founding team in place remains a crucial factor in Venture Capital decision-making.

In the article below, I explore the qualities VCs look for in Founders, a crucial element of their investment criteria.

The last of the three key investment criteria VCs apply to their deal flow is often not well understood by fundraising Founders. Venture Capitalists invest in startups attacking a large market.

You've reached a Members-only area.

Unlock Full Access

Discover exclusive content curated for Venture Capital professionals and enthusiasts. Join our community and gain unlimited access to in-depth articles, expert guest interviews, MBA-level webinars, and networking opportunities.

Register for our 7-Day Free Trial: Click Here

Already a member? Please Log In Below:

Subscribe to our Newsletter

Join 12,000+ VCs & Founders globally who enjoy our weekly digest on Venture Capital. We keep your information confidential and you can unsubscribe at any time. Sweet!