Venture Capital Investment Committees: Best Practices From Elite VC Firms

- 10.3K views

- 16 minute read

Investment committees are the VC partners' meetings that make or break deal opportunities. They remain largely secretive in an industry that has opened considerably in the last few years. Like all human interactions, ICs are fraught with secret agendas and (sometimes unconscious) cognitive biases, the largest of which is confirmation bias. IC rules and dynamics make or break VC firms' performance. In this article and the companion webinar, I uncover hidden truths of VC investment committees and share best practices, including how to create winning investment committee memos, the rules used in the best VC firms to make IC decisions, the psychological barriers you should be aware of, and how to defuse them.

In This Article

- Investment Committees: The Basics

- How To Write World-Class Memos For Investment Committees

- VC Investment Committees: Internal Dynamics

- Recipe for Success or Disaster: Voting Rules in Investment Committees

- Alternative Models: Equal Partnerships And Solo GPs

- How To Break Confirmation Bias Grippling VC Investment Committees

- Conclusion: tl;dr

Accelerate Your Learning: Watch Our Webinar!

Don’t just read about it, immerse yourself in the content through our companion webinar for this post! Engage with a multimedia presentation, discover all the referenced sources, and have your questions answered live! Click the “Watch Now” button to access the webinar. (Members: click here).

Investment Committees: The Basics

VC firms' investment committees are one of the last bastions of secrecy in an industry that has opened considerably since the veil started lifting at the end of the 1990s. When Harvard professors Paul Gompers and Josh Lerner published their book The Venture Capital Cycle in 1999, little was known about the asset class. We now live in the opposite situation: so much content is produced by industry players, including VCs themselves, that it's become necessary to curate the best of the crop.

Yet, for reasons I detail in this post and the companion webinar, VCs are usually shy about providing details about their internal decision-making processes—with the notable exception of Bessemer Ventures, who shared internal documents I analyze below. Worth noting, Sequoia has started sharing extracts of their IC memos too, which is why I updated this article to include them.

The primary reason behind the secrecy is that investment committees are the VC firm's battlefield, where egos fight for more power and money.

The great challenge at venture partnerships is that the principals must refrain from killing each other.

Michael Moritz - Sequoia Capital (Source: The power law)

Michael Moritz’s quip captures the intense dynamics within VC firms, where partners often balance collaboration with competition. As a longtime leader at Sequoia Capital, Moritz experienced firsthand the pressures of aligning strong-willed, high-stakes decision-makers where personal ambition sometimes conflicts with collective success. I'll return to these dynamics later in this article.

But first things first. Let's start our analysis with the very existence of IC meetings and their main objectives.

Why Do IC Meetings Exist?

Among the other transaction-related investment practices, Venture Capital is unique in that it requires an abundance of deal flow analysis. When I started my private equity career in LBO financings in the mid-2000s, we typically studied a few dozen opportunities yearly. Those we spent more resources on would take weeks, and often months, to diligence. It was expected that six to nine months, almost full-time, would be spent structuring and implementing an operation.

In contrast, early-stage VC firms receive thousands of opportunities yearly, with less manpower to sift the deal flow. VC firms typically have a top-heavy structure, which is why landing a job in Venture Capital is so challenging. The VC deal funnel I mentioned in the webinar shows all the steps in the process and the associated probability of success for startups raising VC funds.

Studies show that a fraction of investment opportunities (9%) reach the IC level, and only one in ten of these are realized. Even top-of-the-crop startups, such as those accelerated at Y Combinator, have a low probability of getting funding. Read the article below for more details on the deal flow screening process in Venture Capital.

The investment committee is the gateway opportunities must go through before a VC firm commits more time and money. IC members are the Cerberuses of Venture Capital.

Many actions of Venture Capitalists become clear once you understand the role the IC plays in the deal funnel, starting at the top:

- Warm introductions and referral networks help VCs get qualified deal flow, which means more time allocated to promising opportunities

- Pitch decks allow experienced investment professionals to make a go/no-go decision in a few minutes

- Management meetings, where Founders pitch to VCs, are designed for VCs to gather data but also interpret signals on the quality of the Founding team—the most significant investment decision criterion at the early stage

- Due diligence, first exploratory and then confirmatory, once the IC sanctioned the spend, serves the purpose of preparing the IC memo and confirming that the "house is in order"

- Term sheets make sure that the VC firm will not spend too much time and resources if the partners can't agree on basic terms with the Founders

While the 2020-2021 VC bubble compressed the time to make decisions, as new entrants and aggressive players started to deploy capital frantically in the wake of the ZIRP policy, the market's current state allows for more serene decision-making processes.

Investment Committees Matter

Despite the bickering and occasional murderous thoughts, well-run ICs help VCs attain multiple objectives.

Most Venture Capital firms are partnerships with more or less equal voting rights among GPs (a point I dive into below). While deal opportunities are routinely discussed in more informal gatherings—such as the Monday morning meeting—the IC meeting is the forum for deciding resource allocation. Given the elevated volume of deal flow they receive and the many tasks they juggle daily, it is paramount for GPs to dedicate time to studying the most promising investment opportunities.

Money is another parameter. VC firms bear the cost of post-term sheet audits if the transaction is not consumed. The fees they charge LPs barely cover pay and rent, let alone diligence costs for multiple deals falling through. Before they commit to such potential expenses, partners want to ensure they minimize the risk of eventually footing the bill. The IC meeting's role is to evaluate the chances of success and the opportunity costs associated with the deal team's request.

I explain these dynamics in the article below.

Go Further: Why VC Due Diligence Fails

There are two more reasons to hold IC meetings despite the time they mobilize—several opportunities are typically presented during each meeting, and partners must go through all of the material in advance.

The first reason is that ICs allow for sharing expertise, networks, and points of view on the opportunity presented. Since Venture Capital is mostly about interpreting signals, having several people around the table with different perspectives helps. As I showed in another article, diverse VC teams perform better.

The other reason why ICs matter is more subtle yet significant. They are an effective tool to fight off confirmation bias. A pernicious effect of working on an investment opportunity is that Investors bond with the startup's Founders. While building trust is helpful because VCs will sit on the startup's Board for years to come, there is a risk of losing objectivity and becoming biased supporters of the startup, disregarding obvious perils or putting them aside by focusing only on positive aspects.

It takes time to build the trust to listen to your partners, without taking it personally, and get better.

David Frankel - Founder Collective (Source: 20VC)

Basing the discussion on data—insofar as possible in VC—forces the deal team to question their judgment. In the webinar, I play an extract of a 20VC episode with Founder Collective's David Frankel, who eloquently makes this point.

Investment Committees debate the merits of every opportunity based on the Investment Committee Memo or IC Memo. In the next section, I dive into the best practices to write effective IC memos.

How To Write World-Class Memos For Investment Committees

Although VC firms' IC memos have circulated online for a few years, they remain difficult for the untrained eye to understand and emulate. In the webinar, I review a couple of memos from top firms such as Bessemer Venture Partners (BVP) and Sequoia.

I aim to help professionals relatively new to VC avoid a typical mistake. Most recent VCs focus too much on the risks instead of imagining mitigants, i.e., reasons to feel comfortable about the risks identified—which will be tested in the next growth phase.

The IC Memo's objective is not to underplay the risks in a bid to push for the deal during the IC; or, on the contrary, overplay them to cover your butt if the venture goes south. The art of the IC memo lies in the section called Risks & Mitigants. Experienced VCs know how to provide data demonstrating why they are comfortable with the potential risks they identified.

They do so in a variety of ways, highlighted in the webinar:

- Ask experts for their opinions

- Use analogies from other industries

- Build sensitivity scenarios

For instance, Sequoia gets comfortable about the lack of visibility on YouTube's exit by taking analogies from photo-sharing apps. For their part, BVP gets behind a pricey round for LinkedIn by demonstrating that the structure protects their downside risk.

On top of the examples you can watch in the webinar, I recorded short videos showcasing some IC memos from elite VC firms.

#1 - Twitch

I focus on how the deal team reports deal dynamics, how they fight intuition with data, their take on the team, and how they get comfortable with the main risk: market size.

#2 - YouTube

I focus on how elite VC firms think about value-add before the investment is made, how they try to reduce uncertainties around the company's growth (here: monetization), and how the staging investment technique works.

#3 - Shopify (Part 1)

I illustrate two of the seven secret evaluation criteria VCs use to evaluate investment opportunities: internal standing and mental models. I also discuss the growth vs. profits trends in Venture Capital, which are detailed in my article: How Venture Capitalists Evaluate Unit Economics. While the VC market has put profitability forward since the 2022 market correction, the temptation is always present in upcycles to focus on growth.

#4 - Shopify (Part 2)

I talk about VCs' methods to interpret signals during the exploratory due diligence phase. I also further analyze the deal structure, discuss the problem with cost asymmetry in Venture Capital, and explain how Investors try to reduce it using liquidation preference.

VC Investment Committees: Internal Dynamics

I always illustrate the internal workings of investment committees with the intense jury deliberations portrayed in the 1957 Sidney Lumet classic, "Twelve Angry Men." In the film, twelve jurors are tasked with deciding a verdict, with each member bringing their perspectives, biases, and convictions to the table.

Similarly, the VC IC is a crucible where diverse viewpoints and investment theses are debated fervently. Each member serves as a juror of sorts, weighing the venture's potential. IC members discuss personal convictions, collective reasoning, and the pressures of looming cognitive biases to arrive at a decision that could shape their firm's success or failure.

Consensus vs. Conviction-Driven Firms

The decision-making ethos of Venture Capital firms can be broadly categorized into two paradigms: consensus-driven and conviction-driven.

Consensus-driven firms seek unanimity or near-unanimity in their decisions, aspiring toward collective agreement in every deal they pursue. While fostering a sense of mutual responsibility, this approach may also dilute individual accountability and lead to more conservative investment choices.

Conviction-driven partnerships want to know that the deal "sponsor" is willing to have his or her head on the chopping block advocating for this opportunity.

Mark Suster - Upfront Ventures (Source: INC.COM)

Conviction-driven firms, in contrast, are spearheaded by Venture Capitalists willing to push for a deal they firmly believe in, even in the face of skepticism. This model allows the partners to champion non-obvious opportunities, potentially capturing transformative ideas that consensus might overlook.

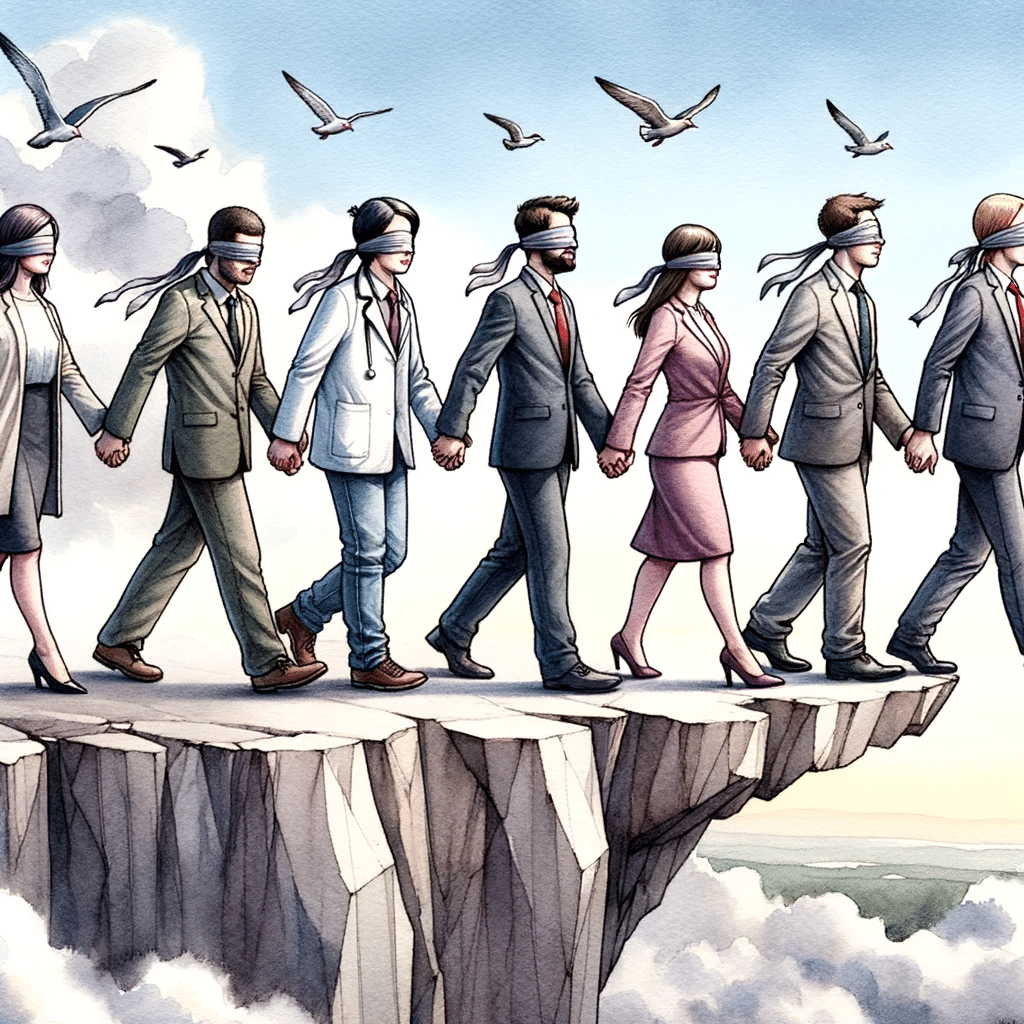

Cognitive Biases Harm Decisions in Investment Committees

Venture Capital operates at the "margin," as Nobel Prize laureate Daniel Kahneman would say, where disruptive ideas naturally meet skepticism. Investment Committees often rely on interpreting signals, making Venture Capital a hotbed for cognitive biases such as Fear Of Missing Out (FOMO), Fear Of Looking Stupid (FOLS), and confirmation bias.

I wrote over two dozen articles on VC biases. The article below, which focuses on the main ones in the startup evaluation process, is a good place to start.

These biases can cloud judgment, influencing decisions in subtle yet profound ways and leading to errors of omission, which I call "VC's capital sin."

The IC's task is to recognize these biases and mitigate their influence, ensuring that skepticism does not stifle potentially groundbreaking ideas and excitement does not lead to overzealous investments.

You've reached a Members-only area.

Unlock Full Access

Discover exclusive content curated for Venture Capital professionals and enthusiasts. Join our community and gain unlimited access to in-depth articles, expert guest interviews, MBA-level webinars, and networking opportunities.

Register for our 7-Day Free Trial: Click Here

Already a member? Please Log In Below:

Subscribe to our Newsletter

Join 12,000+ VCs & Founders globally who enjoy our weekly digest on Venture Capital. We keep your information confidential and you can unsubscribe at any time. Sweet!