7 Startup Funding Mistakes You Should Avoid

Despite what press clips and social media posts may convey, raising Venture Capital funding is a long and arduous process. Startup funding roadshows often derail because Founders make one of the seven mistakes described in this webinar. In some cases, the process is successful, but equity raises occur at sub-optimal terms.

I’ve worked on dozens of startup funding events both as an Investor and an Advisor and bring you best practices from the field.

Note: This post is part of an 8-part series designed to help Founders raise funds with Venture Capitalists. Make sure you read the other posts and watch the corresponding webinars. They tackle all the steps in the fundraising process, from VC-eligibility to contacting potential Investors, pitching VCs, negotiating term sheets and instruments such as SAFEs and Preferred Shares.

Main Take-Aways

Here are the main points I tackled in the video. You can click on the white dots in the player’s bar to access them faster.

- What you need to prepare to keep your startup funding’s momentum going

- How long it takes to raise VC funds and what the steps of the process are

- Best practices on allocating fundraising-related work between Co-Founders

- How to contact the right Investors for your startup

- Why Founders misjudge VCs’ interest in their investment opportunity

- What dilution you should expect at each growth stage

- How much runway is good to have before going on the road for VC funding

If you prefer learning with videos, I encourage you to watch the webinar below. You can skip to each part by clicking on the white dots in the player or the “Chapters” icon in the player bar.

The Fundraising Process

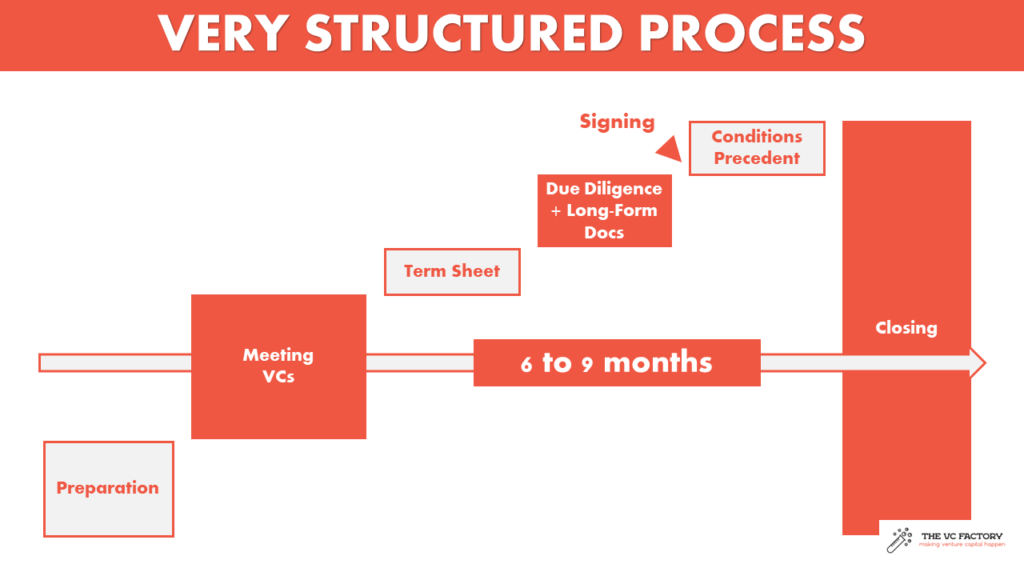

As I mentioned at the beginning of the webinar, I decided to use how the fundraising process rolls out as the backbone for this analysis of fundraising killers. I highlight the most damaging mistake Founders make at each stage of the process:

- Preparation

- Contacting & pitching Investors

- Answering VCs’ questions

- Negotiating Term Sheets

Many Founders believe that the key to their fundraising’s success lies in contacting potential Investors. They often complain that they don’t know any Angel or VC.

They are wrong.

The diagram I show in the webinar addresses not only the fundraising process’s steps, but also how much time Founders should devote to each. As we’ll see later in this post, there are ways to reduce the time associated with each step. Saving on preparation is not one of them.

Killer #1: Lack of Eligibility

It is difficult for outsiders to understand how different parts of the financial world assess opportunities presented to them. Many entrepreneurs, who generally lack the minimum empathy needed to try to understand how others operate, tend to label negative feedback from a potential financing source as “they don’t like risk”.

Financiers like risks, but only proportionate to the potential returns offered.

For instance, a banker will not extend a loan to cover general growth financing needs. Think about it. If all goes well, the bank will make, at best, a few percentage points on the loan. But if things go south, it will lose 100% of the money. This is why, except in crazy bubble periods or unless they have a State-backed guarantee, banks don’t extend financing to startups.

Things are different for Venture Capitalists. They, too, may lose 100% of their investment–and they often do. But if things go well, they may make a 100x return on the money they put in. High risk, high returns. I dive int VC returns in the post referenced below.

Go Further: Venture Capital Returns: True Lies?

What Are Venture Capitalists’ Eligibility Criteria?

Venture Capitalists are the link between startups and institutions willing to invest in them but who lack internal capabilities. They are usually called Limited Partners (LPs) to account for their passive role and recourse.

VC firms pitch a very precise investment strategy to potential LPs in their funds. The parallel with Founders pitching VCs is striking. An entrepreneur telling Investors: “We may use the funds you invest in developing this product or in launching another one”, will considerably reduce their chances of raising money. Likewise, VCs tell LPs which verticals they invest in, at which stage, how much on average, in which geography, and so on.

VCs connect entrepreneurs with good ideas (but no money) with investors who have money (but no ideas).

Paul Gompers & Josh Lerner (Source: The Money of invention)

It becomes clear that every VC firm has its own sets of eligibility criteria, which Founders need to understand ahead of launching their funding process. In the webinar, I play an extract of Brad Feld’s interview making this point clear on the 20VC podcast.

How To Check VC-Bankability: The “Coffee Meetings”

There are many ways for Founders to verify whether they have what it takes to attract Investors. I list them below. However, by far the most efficient one is to take informal “coffee meetings” with them well ahead of launching the fundraising roadshow.

The interaction is a golden opportunity to collect precious information about a VC’s investment strategy, provided entrepreneurs spend more time listening than talking. They should ask about the kinds of companies the VC is looking for, what metrics they need to consider an investment, how far they are in their fund’s deployment, or whether the current fund is closed and ready to deploy.

Angels and VCs ask a flurry of questions when they evaluate potential opportunities, as they need to decide quickly whether to spend more time on them or pass. The informal setting of the coffee meeting allows Founders to get straightforward and genuine answers, as there is no pressure to gauge interest.

All the signals as to the quality of the entrepreneurial team really, really matter.

Bill Reichert – Garage Ventures, Pegasus (Source: STanford GSB)

One of my favorite VC-related videos of all time is a class Bill Reichert taught at Stanford in 2009. In his first item on the list of “top 10 lies VCs tell entrepreneurs”, he does a phenomenal job of explaining why these coffee meetings matter. (Note: follow our YouTube list of great VC videos for more of these nuggets).

Verifying eligibility is the first step in the fundraising process. Too many Founders skip this essential phase and end up on the roadside five minutes into a meeting with a potential Investor—when they get a meeting at all.

I often tell the story of my worst meetings with Founders while working as a young professional Investor. After just a few sentences into the conversation, I knew that I couldn’t even look at the potential opportunity because it didn’t fit my investment criteria. It also signaled me that the entrepreneur had not bothered to do a minimum check on my firm’s website. On the entrepreneur’s side, they had wasted considerable time trying to set the meeting (potentially asking for a warm introduction, see below) and making the effort to come to my office to meet me.

Killer #2: Asking For Too Much, Too Soon

In entrepreneurship, each development stage is akin to an experiment, one that requires just the right amount of fuel—capital—to propel it to the next phase. Many Founders, however, fall into the trap of seeking a windfall investment early on, aiming to supersize their runway and minimize the frequency of fundraising rounds. This mindset overlooks the fundamental nature of business growth, which is iterative and experimental, particularly in the startup world.

The inclination to ask for substantial funds to avoid the need for near-term fundraising can lead Founders to spend their money unwisely, pouring resources into unproven strategies or non-essential features without validating the core business assumptions that would warrant further investment.

Hiring is the single best way to kill your company.

Aaron Harris – Y Combinator (Source: Startup SChool)

Raising money too soon often leads to a misallocation of resources, as startups flush with cash might prioritize the wrong areas of the business. Founders are tempted to scale operations prematurely, investing in aggressive marketing, expansive sales teams, or lavish offices.

This overspending can create a dangerous burn rate that outpaces the company’s ability to generate revenue and learn from customer feedback. The abundance of capital can also mask underlying problems in the business model, delaying crucial pivots and adaptations. As a result, the startup may find itself in a perilous position once the funds run out, with too little progress made and too much stakeholder expectation to manage.

[This post is being continuously updated, check back later to read more or watch the video at the top of the page now.]