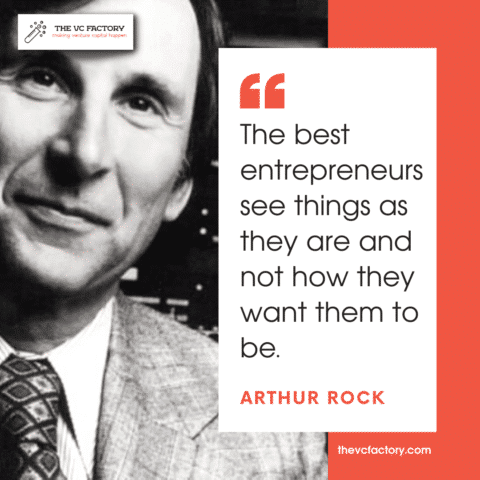

How The Legendary VC Arthur Rock Evaluated Startup Founders

Arthur Rock’s name is tied to early Silicon Valley, that’s why he thrones among our collection of VC quotes. A decade before Don Valentine founded Sequoia Capital and Eugene Kleiner and Tom Perkins founded Kleiner Perkins, there was Davis & Rock, Arthur Rock’s venture capital firm. Back then, pension funds couldn’t invest in VC funds, so Rock had to raise his first few million dollars by convincing a dozen private investors one by one. He put that money to good use, helping build Intel (where he was on the board for over 30 years), and investing in companies like Scientific Data Systems, Teledyne, and Apple. How did this blue-blood Silicon Valley VC pick the Founders he invested in? Like most elite Venture Capitalists, Arthur Rock knew that their mindset was the key to entrepreneurs’ success.

In This Article

Who Was Arthur Rock?

Arthur Rock, a pioneering figure in Venture Capital, played a pivotal role in shaping Silicon Valley’s VC industry. His journey began in New York as an investment banker with Hayden Stone, where he facilitated the formation of Fairchild Semiconductor by uniting discontented scientists from Shockley Semiconductor, famously known as the “Traitorous Eight.” This venture laid the foundation for Silicon Valley’s entrepreneurial ecosystem.

Before the PayPal Mafia, there were the Traitorous Eight. The traitors included Gordon Moore & Robert Noyce (who co-founded Intel) and Eugene Kleiner (who co-founded Kleiner Perkins).

In 1961, Rock co-founded the Venture Capital firm Davis and Rock, which invested $3 million and yielded returns of $100 million between 1961 and 1968. His investment philosophy emphasized backing talented individuals over specific ideas, leading to the success of companies like Intel and Apple. Rock’s approach was characterized by simplicity and trust, often formalizing deals with minimal documentation.

Rock’s contributions extended beyond funding great companies. He was instrumental in establishing the 80-20 profit-sharing model prevalent in Venture Capital partnerships. His insights into the semiconductor industry’s potential and his support for employee stock options fostered a culture of innovation and ownership among tech professionals.

Read to the articles below for more on carry and ESOPs.

How Arthur Rock Evaluated Entrepreneurs

In 2007, when he was already in his 80s, Arthur Rock spoke at the Computer History Museum in Mountain View. Reflecting on his career, Arthur Rock expressed a preference for investing in people over ideas, valuing the capabilities and vision of entrepreneurs.

It may not seem suprising for us today, as we live in a Founder-friendly era where VCs compete for entrepreneurs’ love. But Investors in the 1960s didn’t have the same culture. Arthur Rock didn’t start out thinking like a Venture Capitalist—at first, he acted more like a Wall Street banker.

But when asked how he chose the entrepreneurs he backed, Rock said it all came down to the people. He wanted to see if Founders had what he called “fire in their belly and intelligence.” He asked them the same questions multiple times and watched if their answers stayed honest and consistent.

I’m not enough of a technologist to be able to understand what

Arthur Rock (Source: Computer History Museum)

most of these entrepreneurs are about technically. And the way I went about it was to spend a lot of time with these would-be entrepreneurs.

Arthur Rock looked for people who saw reality as it was—no spin, no inflated promises. He distrusted “promoters” who just wanted to make a deal, and he criticized the hype of the late-1990s Internet Bubble.

That skepticism is still relevant. Many of today’s Founders grew up during a VC bubble and came to believe entrepreneurship was a get-rich-quick-scheme.

Money is never a good entrepreneurial driver, as I explained in this article.

Do Venture Capitalists Today Follow Arthur Rock’s Mantra?

Arthur Rock’s focus on Founders rather than their initial ideas was revolutionary and laid the groundwork for a generation of highly successful Investors. Yet, the reality of modern VC practices tells a different story.

The Old Guard vs. Today’s Money Managers

Arthur Rock epitomized the “old guard” of Venture Capital, a time when Investors prided themselves on deep connections with Founders and a genuine understanding of how businesses are built.

Today, however, many VCs have morphed into little more than “money managers” focused on portfolio diversification and managing large funds. This shift often comes at the expense of understanding the Founder’s vision and the nuances of building a business from scratch.

As Peter Thiel lamented in his famous quote on innovation, VC today is filled with risk-averse managers chasing incremental gains. Rather than seeking bold Founders aiming to “build flying cars,” these Investors gravitate toward safer, trend-driven startups. I detailed my thoughts on this topic in the following essay.

This trend highlights a departure from Rock’s ethos, where the relationship with the Founder took precedence over the technical feasability of their initial idea.

The Perils of Pattern Matching

One of the defining traits of elite VCs is their ability to break free from mental models and avoid over-reliance on pattern matching.

Bill Gurley’s decision not to invest in Google demonstrates the dangers of pattern analysis. At the time, search engines were viewed as a graveyard for Venture Capital due to numerous failed startups in the space. Besides, there was a general belief that PhD’s don’t make suitable CEOs.

Gurley later admitted that his analysis focused too heavily on historical patterns, leading him to miss Google’s extraordinary potential. Read the full account of this multi-billion-dollar “error of omission” in the article below.

This over-reliance on established models contrasts sharply with Rock’s belief in betting on people who could adapt and pivot.

How many VCs today truly emulate this approach? Most remain shackled to rigid frameworks, relying on past successes to guide future investments. While this approach reduces risk, it also blinds them to the outliers on which VC firms relies for top-decile returns.

Founders’ Personality Matters More Than Most VCs Think

Rock’s investment philosophy also emphasized the importance of personality traits—resilience, curiosity, and vision—over technical details or initial market fit.

Modern elite VCs who achieve exceptional results continue to share this focus. They prioritize the intangible qualities that enable Founders to persevere through the chaos of startup life and scale their businesses to unprecedented heights.

As noted in my analysis of how VCs evaluate Founders, technical expertise can always be hired, but resilience, adaptability, and leadership are far rarer and more valuable. These traits form the backbone of Rock’s mantra, and yet, they are often sidelined in today’s data-driven, ROI-obsessed world of Venture Capital.

Conclusion: tl;dr

If modern Venture Capitalists wish to emulate the success of legends like Arthur Rock, they must reconsider their priorities.

Investing in bold Founders, challenging their own assumptions, and focusing on personality traits over market trends, enticing business ideas, and high technicality will help revive the ethos that once defined the industry.

Only then can we bridge the gap between today’s money managers and the visionary Investors of Rock’s era, and his heirs today.