Despite bumps on the road, Venture Capital has become an attractive asset class for Investors and operators, promising cherry-on-top returns and access to what will happen next. More VC funds have been raised by so-called "emerging VC fund managers," General Partners who raise their first, second, or third institutional Venture Capital fund, than ever before in the history of VC. Consequently, more experienced Limited Partners have come to the fore to explain what they are looking for to invest. In this article, I lift the veil on the criteria elite LPs use to select the best emerging VC fund managers. After addressing the state of the VC fundraising market, I'll address each selection criteria at play and provide advice for emerging VC fund managers to attract LP investments.

In This Article

Emerging VC Fund Managers: The Data

There is no denying VC has become an attractive asset class in the last fifteen years, as the trauma from the DotCom crash faded in distant memory. "Software is eating the world," and Venture Capitalists provide the cutlery.

VC Funds Raised (2007-2024)

Marc Andreessen, who coined the phrase, wrote in 2011 that software has become a fundamental driver of innovation, disrupting traditional industries and enabling the creation of high-growth, high-margin businesses. He explained how software's scalability, coupled with lower startup costs and the global reach of the internet, has fueled a surge in new tech companies--attracting significant VC investments.

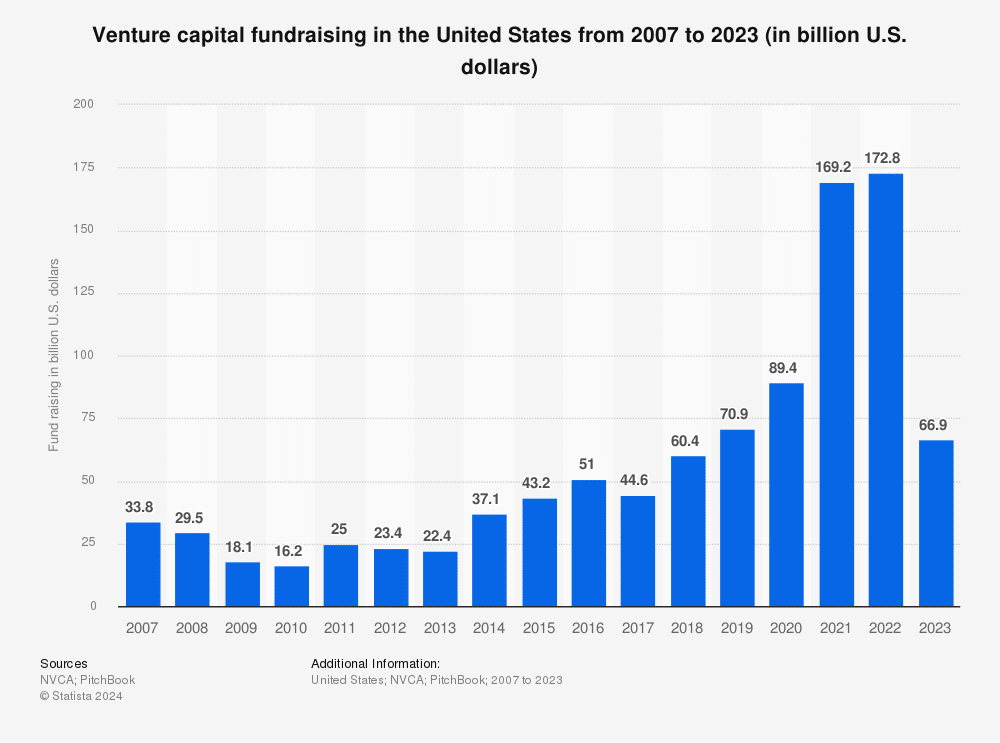

As a result, VC fundraising (funds raised by VC firms) grew almost eightfold between 2013 and 2022. Apart from a minor blip in 2017, it grew without interruption over the period, with a sharp increase during the 2021-2022 boom fueled by the Zero Interest Rate Policy (ZIRP) in the U.S.

There is a similar trend in other geographies, albeit an order of magnitude lower. For example, according to Statista, the value of VC funds in Europe rose from €5 million in 2013 to €24.5 million in 2022—just 15% of the total U.S. amount.

Although the "mini correction," as Benchmark's Bill Gurley called it, has hampered the mood, mid-term perspectives for VC fundraising remain optimistic. Funds raised by U.S. VC firms in 2023, although substantially down compared to the 2021-2022 peak, were still three times the 2013 levels, on par with 2019. 2024 shows similar trends, with $24 billion raised by the end of April.

2024 data from Pitchbook with Downside, Base, and Upside cases

(Note: historical data differs from Statista data presented above).

Focus on Emerging VC Funds Managers

The data provided above includes both established VC firms and emerging ones. While no data is available specifically for emerging VC fund managers, Pitchbook recently shared data for emerging managers across several asset classes, including VC.

The graph below indicates a fluctuating but generally growing trend in fundraising activities among emerging managers over the years, with a spike in 2007 (probably driven by emerging PE funds) and a peak in 2021, most probably due to emerging VC funds.

Pitchbook notes that the growth of private markets over the past decades has resulted in a disequilibrium in demand vs. offer. While more than 25,000 GPs have successfully raised at least one private fund since 1990, there are currently over 10,000 open funds seeking LP commitments.

The multitude of choices and smaller private market budgets due to slower distributions have led to reduced new fund commitments. The share of U.S. fund closings by emerging managers has decreased to 44.7% of total fund count and 15.7% of total capital raised, down from 55.0% and 23.4%, respectively, over 2009-2019.

As private markets mature, LPs increasingly favor established managers to build their portfolios—a "flight-to-quality" typical of post-bubble eras: LPs prioritize VC firms with longer track records, proven performance, and established reputations, considered safer bets over emerging or first-time fund managers. (More below).

Do Emerging VC Fund Managers Perform Better Than Established VC Firms?

Despite the risks of backing first-time fund managers, the promise of better returns attracts many LPs to emerging GPs. Does the data back these claims, and how can the overperformance be explained?

Established vs. Emerging VC Fund Managers Rankings

One piece of analysis often used to demonstrate the superior returns delivered by emerging VC fund managers is Cambridge Associates' 2019 ranking of top 10 performers.

The table below illustrates the performance of US VC funds by vintage year from 2004 to 2016, ranking them based on Net TVPI (Total Value to Paid In). It highlights that new (I&II) and developing (III&IV) funds are consistently among the top 10 performers across these years.

New funds, represented by the dark blue squares, often occupy the top rankings, indicating their strong performance relative to their peers.

Developing funds, shown in light blue, also frequently appear in the top ranks.

In contrast, established funds, depicted in purple, are less consistently ranked among the top performers. This suggests that newer and developing funds achieve higher returns more regularly than their established counterparts.

A few caveats are necessary. First, the data reflects only the funds that survived and performed well, ignoring those that failed (survivorship bias). Second, it is based on Net TVPI and may change over time, as DPI comes in; paper returns by emerging funds are more volatile since they tend to invest earlier. Read the article below for more explanations on how VCs value their portfolios and why their methodologies are often problematic.

Go Further: Venture Capital Returns: True Lies?

Betters Returns But More Volatility

As the graph below shows, emerging VC fund managers have historically outperformed established peers. Their median Internal Rate of Return (IRR) has been higher since the late 1990s, especially during market recovery periods such as the post-global financial crisis (GFC) years.

However, returns from emerging VC fund managers tend to be more volatile. While they offer significant upside potential, the range of outcomes is broader, with a greater likelihood of both top-decile and bottom-decile performance. This volatility underscores the challenge for Limited Partners (LPs) in achieving predictable, needle-moving exposure from these managers.

Let's take an example. A $30 million emerging seed VC fund returning 5x is exceptional performance, yet it does not significantly impact the returns of an LP with billions of dollars in assets under management (AUM). Besides, building a portfolio of such emerging VC fund managers is challenging due to the low consistency across their performance.

Here's how to read the graph:

- Top and bottom decile: This is represented by the upper and lower end of the bars, indicating the IRR of the top-performing and bottom-performing 10% of the funds within each category (established and emerging).

- Top-and-Bottom quartile range: The interquartile range (IQR) represents the middle 50% of the data, excluding the lowest 25% (bottom quartile) and the highest 25% (top quartile) of values.

Pitchbook's graph above shows that both the range and the interquartile range of returns are higher for emerging VC fund managers, indicating volatility across investment firms. There are many emerging managers, but selecting the best ones is more challenging.

Why Do Emerging Managers Outperform Established Ones?

One reason often heard in VC circles is that they are "hungrier," hustle more, and make more efforts to meet as many Founders as possible and get on the most promising deals. Emerging managers have more at stake personally and professionally, driving them to work harder for success.

Unlike established VC firms, which tend to deploy larger funds, emerging VC fund managers cannot rely on management fees to make a living. They must strive for carried interest, a profit-sharing scheme rewarding high performance.

Another (anecdotal) explanation is that they more readily invest in non-obvious ideas and Founders. Being able to be "contrarian but right" is a critical trait in high-performing VCs, as I detailed in the article below.

Another cause is that emerging VC fund managers often specialize in niche sectors or geographies, which can provide unique alpha opportunities not easily replicated by larger, more diversified funds. This specialization allows them to leverage on-the-ground expertise and exploit networks intensively to get early deal flow.

After my first "fintech" (it wasn't called that yet) investment in 2011, I started meeting with more people in the industry and going to fintech events to better understand the dynamics. As the main actors got to know me better, they sent me opportunities more readily. Another consequence was a better understanding of the diversity of technologies and value chain players in the vertical.

Pitchbook data confirms that specialized emerging VC fund managers ("emerging specialists") outperform established generalists, emerging generalists, and even established specialists.

Although there is no data for median IRRs generated by emerging specialists, the top decile and top quartile information is more relevant given the VC power law.

Pitchbook notes that specialists outperform generalists in both categories (emerging and established), citing that specialization provides a sourcing perspective. Startup Founders are more likely to pick a specialist VC firm as their networks and value-add appear more relevant.

Other arguments explaining superior returns by emerging managers include:

- Smaller check sizes: Smaller funds can generate higher returns more easily due to more favorable math.

- More attention to fewer investments: Emerging managers can provide more focused attention to their portfolio companies.

- Alignment with Founders: Many emerging managers have experience as Angels or operators, giving them a unique perspective to understand and support founders.

- Agility and flexibility: Emerging managers can often move quickly on opportunities and adapt to market changes.

- "GP-Thesis Fit": Allocate CEO Samir Kaji points to emerging VC fund managers' focus and leaning into their strengths being strongest when they raise their first fund(s)

Going into each of these points would exceed this article's objective. In the next section, I analyze what elite LPs say about emerging VC fund managers.

Why Emerging VC Fund Managers Struggle To Raise Money

Raising capital for a first-time VC fund is a formidable challenge, as emerging managers often face skepticism from potential Investors due to a lack of proven track record. The journey of Fika Ventures, as shared by co-founder TX Zhuo, vividly illustrates the obstacles new fund managers must overcome to secure commitments from LPs.

You've reached a Members-only area.

Unlock Full Access

Discover exclusive content curated for Venture Capital professionals and enthusiasts. Join our community and gain unlimited access to in-depth articles, expert guest interviews, MBA-level webinars, and networking opportunities.

Register for our 7-Day Free Trial: Click Here

Already a member? Please Log In Below: