The Optimal VC Pitch Deck Structure And Why It Matters

Despite the abundance of resources on the startup pitch deck structure and how to create a compelling presentation for Venture Capitalists, many entrepreneurs underestimate its significance. Simple errors, like omitting crucial information, rearranging slide order, or including irrelevant details, can drastically reduce the chances of securing that important follow-up meeting. Over the years, I’ve guided hundreds of entrepreneurs in honing their messages to craft compelling investment opportunities.

In this post, I delve into the intricacies of pitch deck creation, addressing subtle pitfalls many Founders often don’t realize they fall into. Drawing from Picasso’s artistic approach, I highlight the importance of mastering the basics before innovating in format and content. The discussion includes examining pitch deck templates and focusing on effectively structuring and presenting a deck, whether in person or in writing.

In This Post

- Don’t Miss Key Pitch Deck Slides

- Don’t Change The Pitch Deck Slide Order

- #1 – “What Are We Going To Talk/Read About?”

- #2 – “Who Are These People?”

- #3 – “Why Should I Care?”

- #4 – “What Do They Do?”

- #5 – “Does This Solution Exist?”

- #6 – “How Big Is That Opportunity?”

- #7 – “Where Will They Start?”

- #8 – “Why Would Customers Buy This Product?”

- #9 – “How Are They Going To Make Money?”

- #10 – “Am I Going To Make Money?”

- #11 – “How Much Do They Want, To Do What?”

- #12 – “What’s The Point of All This?”

- Use Templates Shared by VC Firms

- What Fundraising Founders May Learn From Pablo Picasso

Don’t Miss Key Pitch Deck Slides

VC pitch decks haven’t changed for decades. I didn’t check the history of Silicon Valley fundraising presentations, but I believe that VC pitch decks have taken their present form since the dawn of PowerPoint. Airbnb’s 2008 pitch deck, the most famous of them all, is 15 years old. Despite Chesky and co.’s design prowess, their pitch deck format was probably invented before them.

However, Founders, brimming with creativity and a penchant for challenging the status quo, sometimes view the conventional structure as a constraint rather than a tool. Why should they refrain from innovating with pitch decks?

There are several reasons why innovating in pitch decks is a bad idea. The first is that VCs rely on a stable pitch deck structure to rapidly decide whether to allocate more time to the investment opportunity presented.

Venture Capitalists Need To Make A Quick Go/No-Go Decision

Venture capitalists are inundated with pitch decks, often having to make quick decisions based on the information presented. The classical pitch deck format is a tool that assists in this rapid decision-making process.

VCs are accustomed to this format; it helps them quickly locate essential information and make efficient go/no-go decisions. By sticking to this familiar structure, Founders can ensure that their pitches are easily navigable and that all critical data is readily accessible.

In the post below, I shared what VCs look for on each slide and how they spend an average of 3 minutes and 44 seconds reading pitch decks.

In essence, this format acts as a common language between Founders and Investors. It’s a framework that organizes thoughts, highlights essential aspects of the business, and allows VCs to evaluate the opportunity against a known benchmark.

This doesn’t mean every pitch should look the same; instead, it suggests the value of adhering to a particular structural integrity while infusing unique elements into the narrative.

A VC Pitch Deck is Not a Commercial Pitch Deck

Why do fundraising entrepreneurs miss key slides in their pitch decks? Many Founders confuse the VC pitch deck and the presentation they use with prospective clients.

They don’t understand that a VC pitch deck sells the company, not a product.

Its primary purpose is to present a comprehensive picture of the business opportunity, not just showcase the product or service. This includes details on market strategy, competitive analysis, financial projections, and the team’s expertise.

On the other hand, a commercial pitch deck is customer-oriented, focusing on the product or service benefits, features, and user engagement.

Mixing up these two can lead to a misalignment of content, leaving potential Investors with unanswered questions about business aspects they deem critical. Entrepreneurs must tailor their pitch decks to their audience, ensuring that the content is relevant, focused, and designed to address the specific concerns and interests of Venture Capitalists.

The other reason innovating in pitch decks is bad is that even something as benign as the order in which slides appear matters.

Don’t Change The Pitch Deck Slide Order

The classical pitch deck structure, with its linear progression from problem to solution, market size, and competition, mirrors the natural way our brains process information. It guides the listener through a logical narrative, answering critical questions in a natural and compelling sequence.

We’ve evolved to hear a story in a particular order over thousands of years. I did some anthropological research on that topic in the post below, and illustrated how to pitch a compelling story with the Calendly example.

The temptation to deviate from the traditional pitch deck format is understandable. After all, isn’t entrepreneurship about breaking rules and setting new trends? However, before one can effectively rewrite the rules, it’s crucial to understand why they exist and how they work. This is where the analogy of Pablo Picasso becomes particularly poignant.

But first, let’s review the order in which VCs understand the stories startups tell them.

#1 – “What Are We Going To Talk/Read About?”

Slide concerned: Cover.

Airbnb’s tagline clearly announces to VCs that they will read about the hospitality industry.

The Cover Tagline in a pitch deck is crucial in orienting Venture Capitalists. They often navigate through a plethora of decks, varying from consumer-focused applications to complex industrial solutions. The tagline on the opening slide serves as a critical focal point, delineating the specific sector or niche the startup operates within. This element is akin to a palate cleanser, akin to ginger in a sushi meal, preparing the Venture Capitalist for a distinct flavor or, in this case, a unique business proposition. A common error occurs when Founders opt for overly broad or excessively promotional taglines. The objective here is not to promise value or evoke inspiration per se, but rather to briefly state the startup’s function or core offering.

#2 – “Who Are These People?”

Slide concerned: The Team.

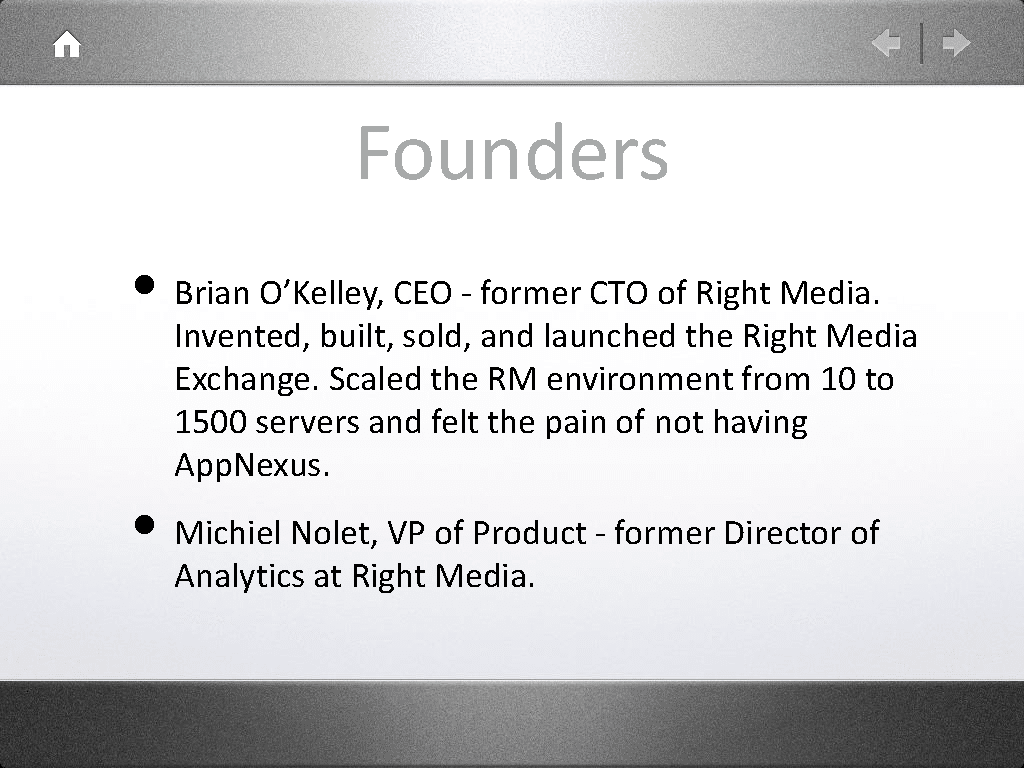

AppNexus’s team page is the first in the deck (after the cover and content pages). It establishes the Founders’ credibility early.

The Team slide is fundamental in showcasing the people driving the venture. This slide should illuminate the team members’ skills, experience, and unique qualifications. In Venture Capital, the team’s composition and capabilities are often seen as critical factors in a startup’s success. Founders must effectively convey why their team is uniquely positioned to execute the venture’s vision and strategy.

Some readers will express surprise at seeing the Team page arriving so soon in the pitch deck. The conventional templates often relegate it to the end, a practice that seems counterintuitive when the team possesses relevant expertise and experience. The standard template, perhaps better suited for younger, less experienced Founders, overlooks the immense value seasoned professionals bring to the table. For ventures led by individuals with substantial industry experience and expertise, capturing the attention of Venture Capitalists early in the presentation is paramount.

Establishing the team’s legitimacy and credibility from the outset is a powerful way to frame the entire pitch narrative, ensuring that every subsequent slide is viewed through the lens of proven competence and authority. This approach firmly positions the team as a critical asset in the venture’s potential for success.

#3 – “Why Should I Care?”

Slide concerned: Problem.

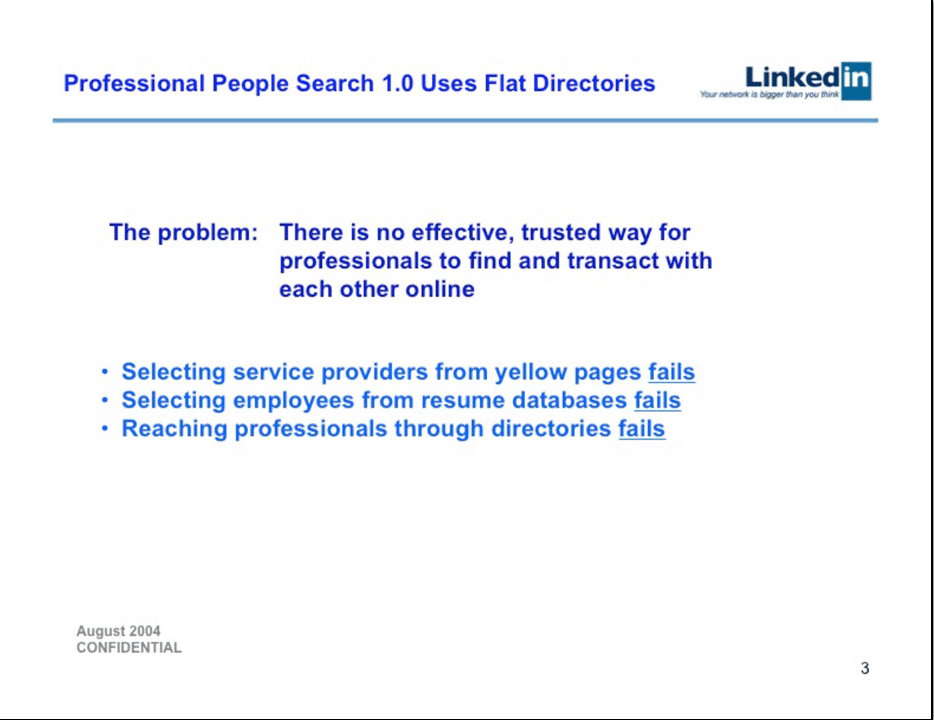

LinkedIn’s problem page outlines a large problem that all professionals worldwide have.

In the Problem slide, the emphasis is on articulating the issue the startup aims to resolve. This is a pivotal point in the pitch deck, as it is essential to underscore the problem’s relevance to the audience. In Venture Capital, understanding the problem is foundational to gauging a venture’s potential. This slide should resonate personally with Venture Capitalists, as it sets the context for the solution offered. The challenge for Founders lies in balancing the presentation of the problem’s scale with its applicability and urgency for the intended market.

#4 – “What Do They Do?”

Slide concerned: Solution.

Intercom’s solution page identifies how it helps its clients solve the problem: “There’s no one tool to do customer relationship management.”

The Solution slide is where Founders showcase their product or service as the antidote to the previously outlined problem. This slide is the heart of the pitch, where clarity meets uniqueness. In Venture Capital, the focus is on the startup’s unique value proposition. The solution should be clear and distinct, setting the startup apart in the marketplace. Founders should effectively communicate how their solution fills the existing gap or addresses the need in a superior way to existing alternatives. It needs to be “good enough”.

#5 – “Does This Solution Exist?”

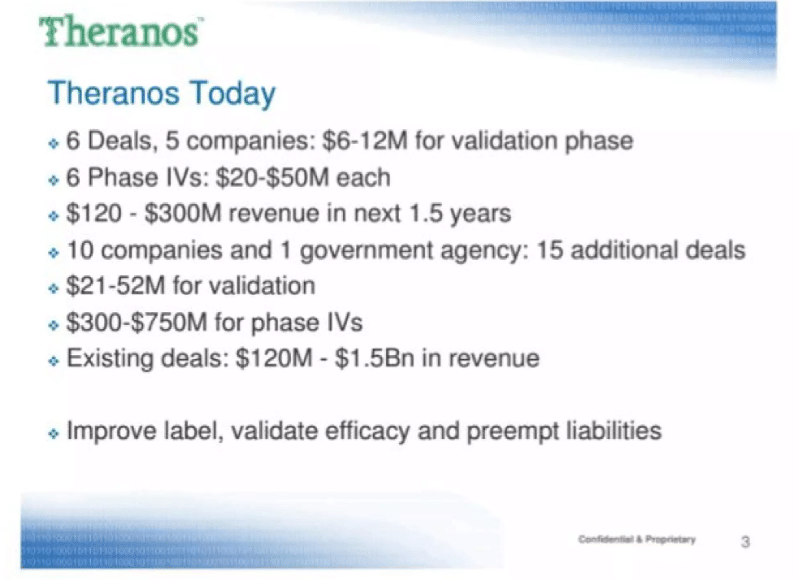

Slide concerned: Traction.

Needless to say: Don’t lie about traction.

The Traction slide is instrumental in affirming Investors’ interest. In Venture Capital, proof of traction is a key indicator of a venture’s viability and growth potential. This slide should include tangible evidence, such as sales figures, partnership details, or user growth metrics. These elements collectively validate the startup’s market presence and operational effectiveness. Founders must ensure that this slide is a narrative that convincingly illustrates the business’s upward trajectory and market acceptance.

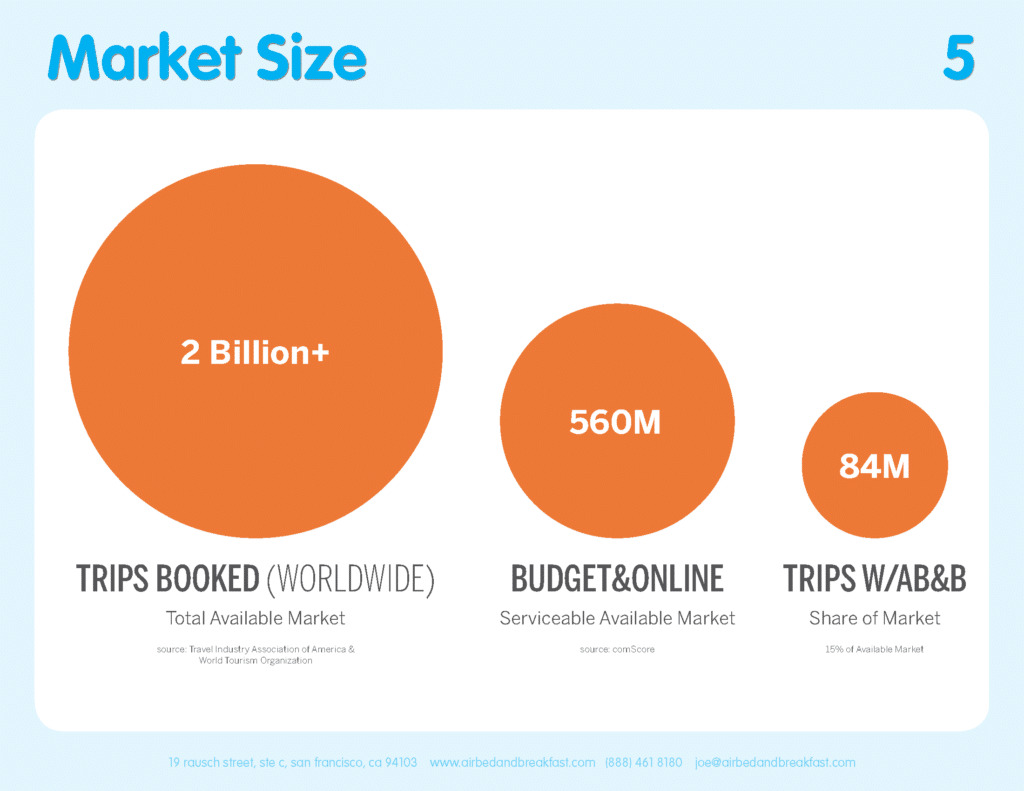

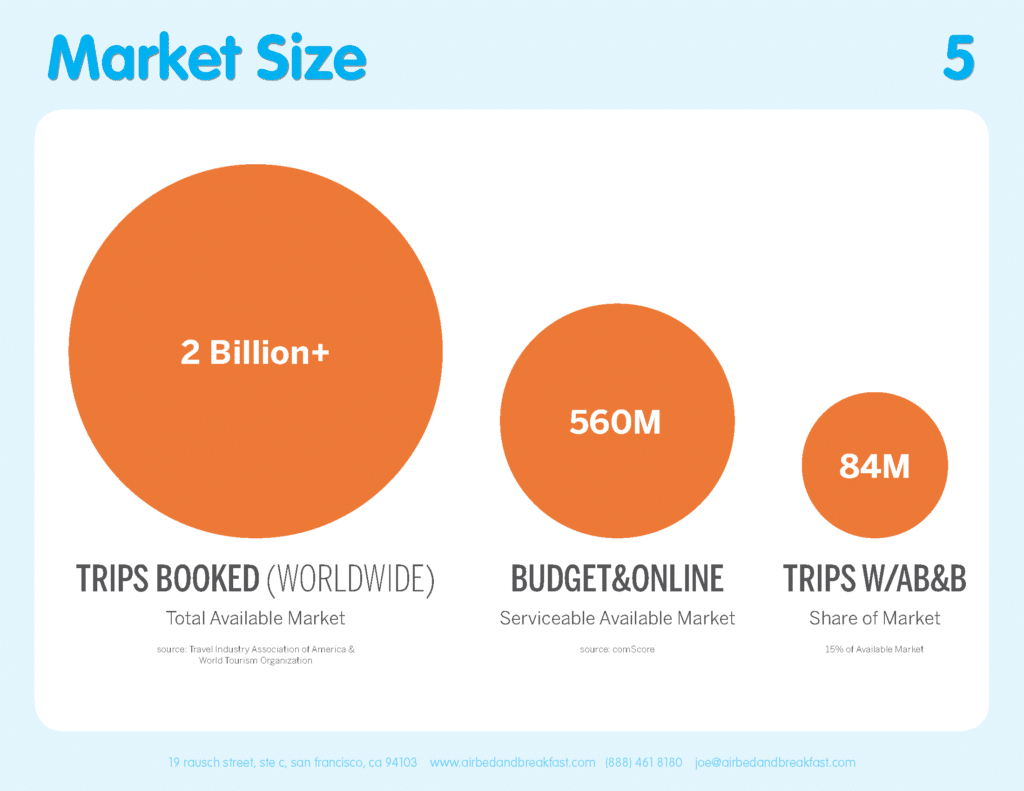

#6 – “How Big Is That Opportunity?”

Slide concerned: Market Size.

Often imitated, never surpassed. Read this post on TAM SAM SOM to learn how to nail this complex but crucial slide.

Comprehending the venture’s potential scale and scope is crucial to VCs’ decision process. This slide transcends mere numerical grandeur, demanding a precise and relevant market definition. It falls to Founders to map out the market’s dimensions and elucidate its expansion opportunities.

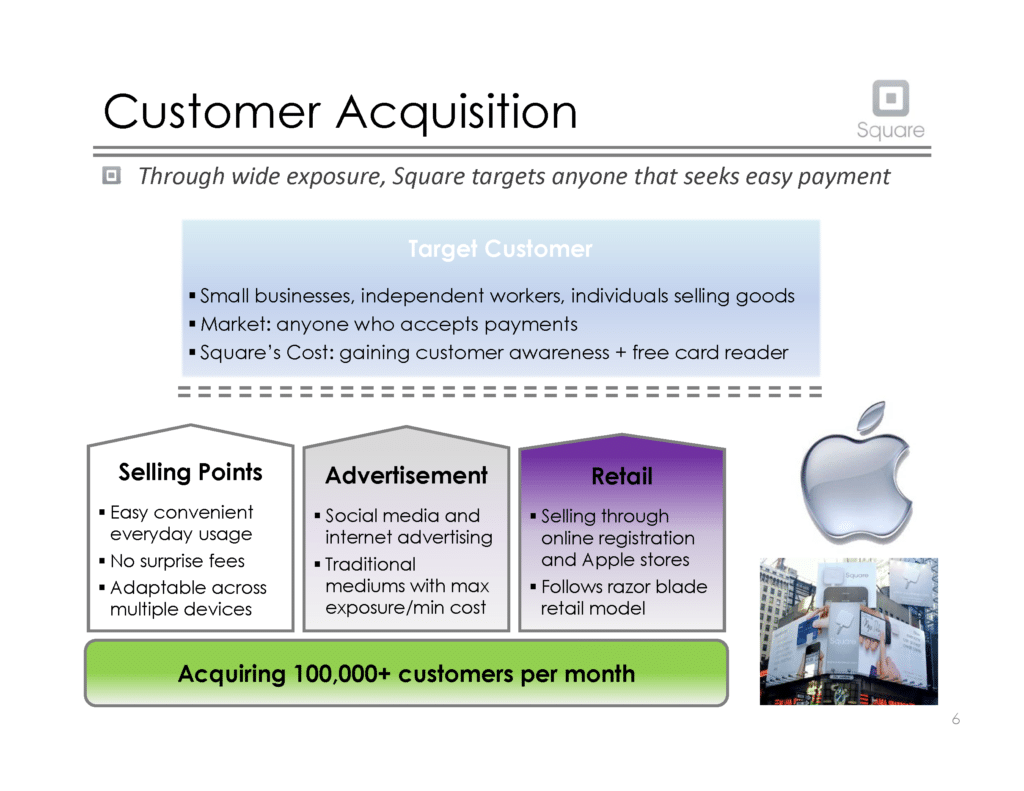

#7 – “Where Will They Start?”

Slide concerned: Go-to-Market Strategy.

Square mentions they address small businesses and independent workers. Learn more about beachhead customers here.

The Go-to-Market Strategy slide outlines the startup’s market entry and expansion roadmap. This is where Founders detail their marketing and sales strategies and their overall growth plan. In Venture Capital, this slide demonstrates the tactical approach the startup intends to take to capture and expand its market share.

#8 – “Why Would Customers Buy This Product?”

Slide concerned: Competition.

Nothing beats the four-blocker, provided it is done right. Learn more about best practices here

The Competition slide is about understanding and positioning within the competitive landscape. Founders must analyze and present how their solution stands out in the market. This slide should identify key competitors and highlight the startup’s unique selling points or differentiators. Understanding the competitive edge is crucial for assessing a venture’s potential to capture and retain market share.

#9 – “How Are They Going To Make Money?”

Slide concerned: Business Model.

I recommend adding pricing on the slide, but it can be discussed during the follow-up meeting.

This slide illustrates the venture’s approach to generating revenue. Founders must present a clear and viable model outlining how the company will make money. This includes detailing the revenue streams, pricing strategy, and underlying economic logic. A robust and well-thought-out business model is often a vital determinant of a venture’s attractiveness, as it provides insight into the startup’s potential for sustainable profitability and long-term success. Founders should ensure this slide succinctly communicates the financial underpinnings of their business idea.

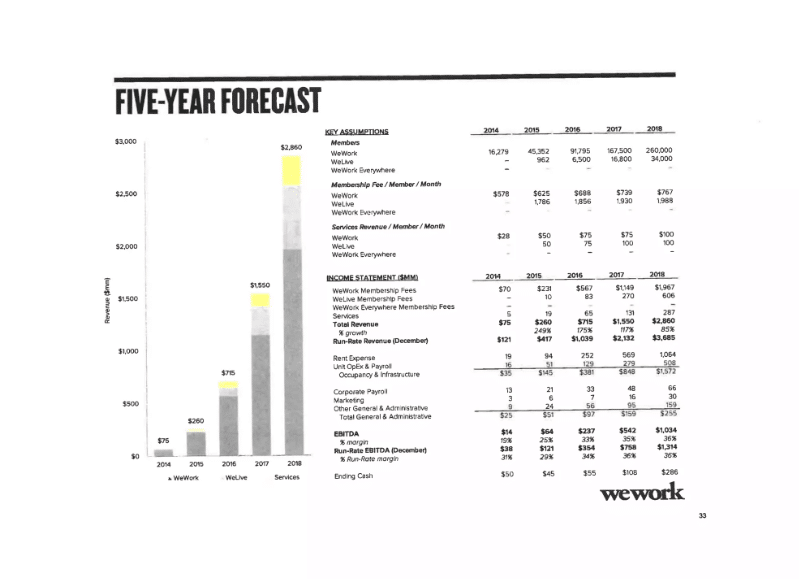

#10 – “Am I Going To Make Money?”

Slide concerned: Financial Projections.

The format of this slide depends on how much momentum the startup has. Early-stage startups are asked for less detailed information. Also: provide realistic projections.

Nobody expects startups to make their numbers. However, the Financial Projections slide is critical to any pitch deck presented to Venture Capitalists. This slide offers a quantitative glimpse into the venture’s future financial health. Founders’ detailed revenue, expenses, and profitability forecasts over a specified period should be rooted in realistic assumptions and market analysis. They provide a basis for conversation and help VCs assess their ability to make sufficient returns in a realistic exit scenario.

#11 – “How Much Do They Want, To Do What?”

Slide concerned: Ask / Transaction / Uses & Sources of Funds.

Focusing on growth-oriented milestones rather than costs reassures VCs that Founders will reach the next funding stage.

Founders must clearly state their funding requirements and how these funds will be utilized to scale the business. Transparency and clarity in this section are paramount. Founders need to articulate a well-thought-out plan for allocating funds, demonstrating how the investment will drive growth and enhance the value of the business.

#12 – “What’s The Point of All This?”

Slide deck concerned: Vision.

Making the world a better place is often a guaranteed seller in VC. Learn how they fell for it in the FTX case.

The Vision slide is a forward-looking statement of the startup’s aspirations and goals. It answers the question: “If all goes well, what does this company look like in ten years?”. It includes long-term objectives and a depiction of what success entails for the venture. The vision often helps VCs get behind a project as they adhere to the startup’s values.

Many Venture Capital firms offer templates for Founders to use in their pitch decks. These VC firms hope to streamline their deal flow process, ensuring that the information they receive is structured in a consistent and familiar format. This uniformity allows Venture Capitalists to efficiently evaluate the potential of various ventures, as they can quickly locate and compare essential information across different presentations.

Founders using these templates strongly signal to Investors that they have a solid understanding of how Venture Capital funding operates. It demonstrates their readiness to engage with the industry’s norms and expectations. This alignment facilitates the due diligence process and reassures Investors of the Founders’ professionalism and preparedness, critical traits in securing Venture Capital funding.

Sequoia’s Pitch Deck Template

The main objective of the Sequoia Pitch Deck Template is to help startups create a compelling and comprehensive presentation for their investing team. It guides entrepreneurs to effectively communicate their business ideas, market opportunities, and strategies for success. The focus is on clear, concise, and persuasive storytelling covering all the business’s critical aspects.

The main differences with the order I presented above are:

- Company Purpose: The company mission is often close to the Vision slide I mentioned earlier. Including it early in the deck sets the tone for the entire presentation.

- Why Now: This slide contextualizes the opportunity, explaining why the current market conditions, technological advancements, or changes in consumer behavior make this the opportune moment for the company’s solution. This slide should highlight trends, shifts in the market, or emerging needs that create a unique window of opportunity for the company. The aim is to show Investors that the business is timely, capitalizing on current or imminent market dynamics.

- Product: I’m all for including this slide when it helps Investors better understand the startup’s offering, such as with apps or software. Founders should avoid adding too many of these pages, which can be put in the appendix section.

Accel’s Pitch Deck Template

The Accel template has a slightly different structure and flow than Sequoia’s. This template emphasizes the team (the page comes first), detailed product analysis, customer focus, and the current operational status of the product or service.

Point Nine’s Pitch Deck Template

Berlin-based Point Nine, one of Europe’s highest-performing VC firms, shared their internal deal memo a while back. This is the document VCs use to discuss investment opportunities during the investment committees. It also indirectly informs us about what the team’s Investors are looking for in pitch decks.

The Point Nine open memo showcases the firm’s data-driven approach. It begins with an in-depth focus on the product, delving into features, problem-solving capabilities, and future development plans. This emphasis on the product is followed by a rigorous analysis of the market and competition, requiring startups to present detailed market segmentation and a comprehensive competitive landscape.

Point Nine also published a simple pitch deck template similar to Sequoia’s and Accel’s.

What Fundraising Founders May Learn From Pablo Picasso

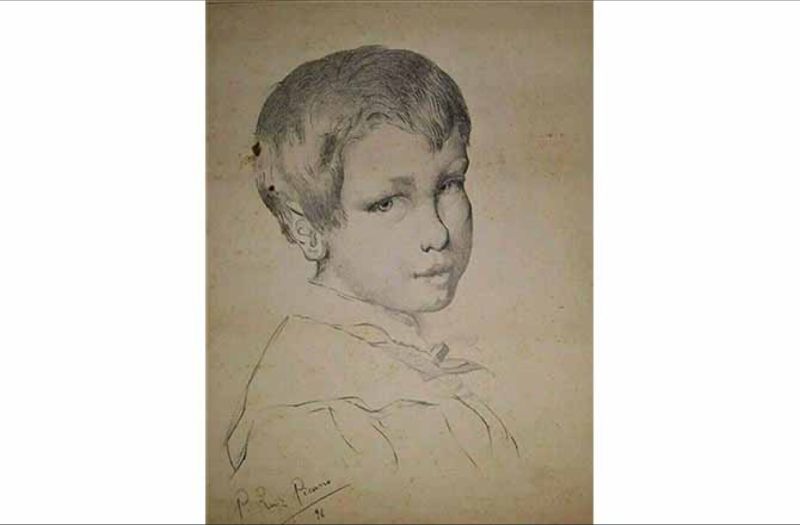

The approach to creating a successful pitch deck in Venture Capital can be likened to the artistic journey of Pablo Picasso, one of the most celebrated artists of the 20th century.

Picasso was an exceptionally skilled draftsman. His journey in the arts began with mastering classical drawing techniques, achieving an elite level of proficiency at a young age. This foundational expertise in traditional art forms served as a springboard for his revolutionary contributions to the world of painting.

Pencil drawing of a boy, attributed to Pablo Picasso, 1896. Sold for AUD700 via WA Art Auctions (April 2020).

Picasso’s foray into Cubism marked a transformative phase in art history, where he deconstructed conventional perspectives and reimagined them in abstract, geometric forms. This radical shift built upon his initial skills, showcasing how a deep understanding of traditional methods can be the precursor to groundbreaking innovation. Picasso’s journey reflects the symbiosis between mastery of the basics and the creative reimagination of one’s craft, reshaping the boundaries of artistic expression.

Just as Picasso mastered traditional drawing and painting techniques before revolutionizing the art world with his unique style, Founders must first understand and adeptly apply the conventional structures of pitch decks provided by Venture Capital firms. Mastery of these fundamentals ensures that the essential elements of their venture are communicated effectively to Investors.

Once this foundational understanding is established, Founders, akin to Picasso, can innovate and personalize their presentations, adding unique elements that distinguish their pitch while still adhering to the expectations of the Venture Capital community. This balance of adherence to established norms and creative individual expression is critical to effectively communicating a venture’s potential and aligning with Investor expectations.