LPs Beware: The “Super Power Law” in Venture Capital

- 314 views

- 6 minute read

Every few months, a debate resurfaces on social media: Is the Venture Capital power law a bug or a feature of the asset class? This question often overlooks a deeper truth I call the “superpower law.” While it’s widely accepted that a few investments drive most returns, what’s less discussed is that a very small number of VC funds—and few GPs behind them—generate outlier outcomes. For LPs, understanding this superpower law is critical: success depends on identifying and partnering with these exceptional performers.

Apply now to the Emerging VC Accelerator to receive advanced VC knowledge and mentoring, and a potential $25,000 to $100,000 investment to cover your funds’ initial marketing efforts.

In This Article

The Power Law is a Feature, Not a Bug

The VC power law is not an anomaly but a foundational characteristic of the asset class. It's not a "law" like Moore's law of predicting chip component cost, or something you'd have to believe in. It's a statistically proven phenomenon.

In statistics, a power law is a type of heavy-tailed probability distribution where a small number of occurrences have a disproportionately large impact. This means that as the size of an event increases, its frequency decreases at a predictable rate, leading to a few exceptionally large events driving the majority of the outcome.

Data consistently shows that most VC portfolios' performance comes from a very small subset of investments—often just a few “home runs” that vastly outperform the rest. This skewed distribution reflects the high-risk, high-reward nature of early-stage investing and helps explain why so many investments fail while a handful yield exponential returns.

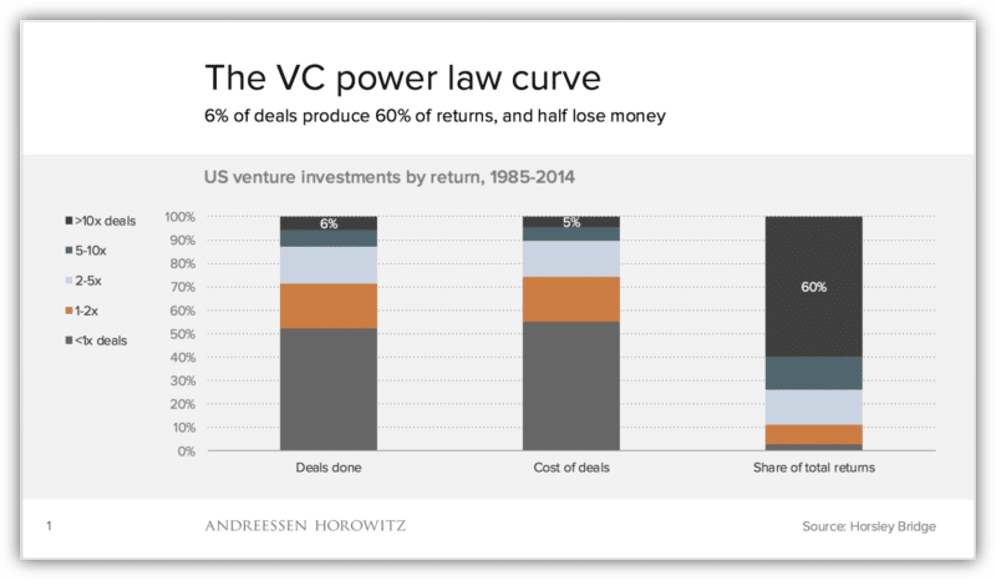

Horsley Bridge reported that 6% of US VC deals made between 1985-2014 returned 60% of the asset class's returns

I wrote a detailed article analyzing six datasets explaining the dynamics of VC returns over long periods. Here are the key learnings:

1. High Concentration of Returns: Across multiple datasets, a small fraction of investments typically generates the majority of financial returns. For example, the AngelList data highlighted that less than 0.5% of their 1,800 investments yielded 100x returns, with most investments delivering far more modest outcomes.

2. Skewed Distribution in Fund Performance: The British Business Bank found that only about 16% of UK VC funds with vintages from 2002-2020 generated returns above 3x. Meanwhile, nearly half generated 1x-2x, underscoring the stark imbalance between a few highly successful funds and the rest.

3. Impact on Fund Strategy: The evidence suggests that elite VCs, rather than aiming to minimize losses, focus on potential upsides. Another Horsley Bridge analysis mentioned in my previous article on the VC power law shows that great VCs (3x+ returns) make more losses than good VCs (2x-3x returns).

Power Law Consequence: Don't Miss The Outliers

David Clark, a respected LP in Venture Capital at VenCap, one of the oldest VC fund of funds, recently confirmed that VC returns rely on a tiny fraction of deals made each year.

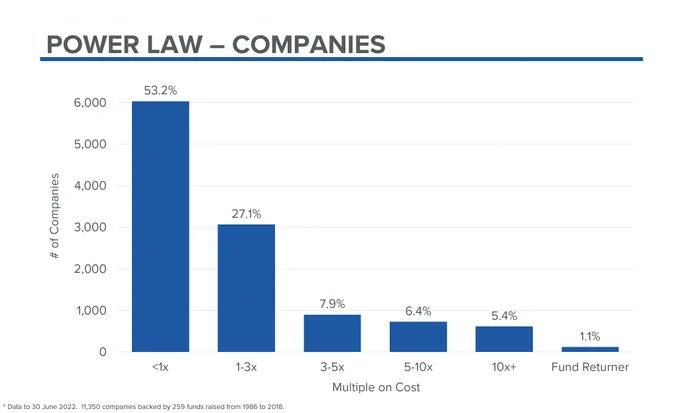

Analyzing 11,350 startups backed by 259 funds from 1986 to 2018, VenCap found that about half lost money, but 121 (1.1%) returned the entire amount of the fund that invested in them.

He further mentioned that 90% of the funds making at least 3x back to VenCap had a fund returner, highlighting that it's quasi-impossible in VC to outperform without at least one stellar investment.

The immediate consequence for GPs is that missing the startups that will make these returns seven to ten years down the line may lead to their demise. Given how skewed the distribution of returns in early-stage VC is, a vintage that doesn't secure at least one of these, out of hundreds of opportunities analyzed, may not perform well enough to help the firm raise its next fund.

It explains why some VC firms, especially the large ones, are prepared to pay whatever price is necessary to secure unicorn real estate. I called them the "land grabbers" in my article on startup valuation.

25 to 30 companies each year are responsible for over half of the total exit value that is generated by the VC industry globally.

David Clark - Vencap (Source: Origins Podcast)

The Super Power Law in VC: Only Top-Decile GPs Matter

The "super power law" concept extends these findings beyond the startup level and posits that the same phenomenon is true at the superior level: a handful of VC funds generate most of the asset class's returns.

You've reached a Members-only area.

Unlock Full Access

Discover exclusive content curated for Venture Capital professionals and enthusiasts. Join our community and gain unlimited access to in-depth articles, expert guest interviews, MBA-level webinars, and networking opportunities.

Register for our 7-Day Free Trial: Click Here

Already a member? Please Log In Below:

Subscribe to our Newsletter

Join 12,000+ VCs & Founders globally who enjoy our weekly digest on Venture Capital. We keep your information confidential and you can unsubscribe at any time. Sweet!